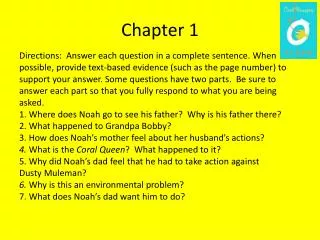

CHAPTER 1

330 likes | 494 Vues

CHAPTER 1. Investments: Background and issues. Investments & Financial Assets. Essential nature of investment Reduced current consumption Planned later consumption How to invest Real Assets: Assets used to produce goods and services produce income to economy Financial Assets

CHAPTER 1

E N D

Presentation Transcript

CHAPTER 1 Investments: Background and issues

Investments & Financial Assets • Essential nature of investment • Reduced current consumption • Planned later consumption • How to invest • Real Assets: Assets used to produce goods and services • produce income to economy • Financial Assets • Claims on real assets or income generated by them • Allocation of income, real assets among investors, individuals in the economy

Financial Assets Money Market (Short-term) Bond Market (Long-term) Common Stocks Preferred Stocks Options Futures

Role of Financial asset and financial markets in the Economy • Consumption Timing • Allocation of Risk • Separation of Ownership and Management

Consumption Timing Financial assets: stocks, bonds, deposits, etc. Savers (earn more than spend) Borrowers (spend more than earn) How do you transfer money from when you do not need to when you need?

Allocation of risk Example: GM wants to build a new auto plant, it raised money by issuing stocks and bonds Stock investors (high risk) Stock Auto plant High risk and low risk GM Bond Bond investors (low risk)

Separation of ownership and management • Example: GE, total asset is $640 bil • Cannot be single owner, must have many owners • Selling stocks to market • Currently, GE has 500,000 owners • These owners choose managers • Can easily transfer ownership without any impact on management

The Investment Process • Asset allocation • Security selection • Risk-return trade-off • Market efficiency • Active vs. passive management

Investment process Small stock Big stock Stocks Bonds Real estate Commodity corporate bond T-bond, T-bill Broad assets House Land coffee, tea gold, oil, etc (1) Asset allocation (2) Security analysis

Example of Asset Allocation Common AgeStocksBonds 30s 70% 30% 40s 60 40 50s 50 50 60s 40 60

Example of Security Selection Wal-Mart Nordstroms Sears Bank of America Berkshire Hathaway Citibank

Market Efficiency • Security prices accurately reflect all relevant information. • The price in the market is the true price • Earn return just enough to compensate for risk, no abnormal return

Active vs. Passive Management Active Management • Finding undervalued securities • Timing the market Passive Management • No attempt to find undervalued securities • No attempt to time • Holding an efficient portfolio

Players in the Financial Markets • Business Firms – net borrowers • Households – net savers • Governments – can be both borrowers and savers • Investment Bankers

Players in the Financial Markets securities Savers borrowers fund securities securities savers financial intermediaries borrowers borrowing rate lending rate securities securities savers borrowers investment bank fund fund get commission fees

Recent Trends • Globalization • Securitization • Financial Engineering • Computer Networks

Globalization • In 1970, US equity market accounted for about 70 percent of equity in the world • Currently, only 20-30 percent • How to invest globally • Purchase ADRs • Invest directly into international market • Buy mutual fund shares that invest in international market • derivative securities with payoff depends on prices of foreign market

Securitization • Benefits of securitization • more funds available to borrowers • Transfer risk of loans to corresponding investors in the market Banks pool all loans Mortgage loans auto loans credit card student loans other loans loans are securitized securities Investors High risk loan High risk securities High risk investors Low risk loan low risk securities low risk investors

Financial engineering • refer to creation of new securities • Bundling: combine more than one security into a composite security • Unbundling: breaking up and allocating the cash flows from one security to create several new securities

Collateralized Debt Obligation (CDO) • A CDO is an asset backed security (ABS) whose underlying collateral is typically a portfolio of bonds (corporate or sovereign) or bank loan • A CDO cash flow structure allocates interest income and principal repayments from a collateral pool of different debt instruments to a prioritized collection (tranches) of CDO securities.

Cash CDO Structure Illustration Tranche 1 (AAA) Yield = 5% ($25mil) Mortgage 1 Mortgage 2 Mortgage 3 Mortgage n Average Yield 12.5% ($100 mil) Investor: banks, pension funds, college saving funds, universities, cities, etc. An investment bank creates a set of securities (tranches) backed by a mortgage pool (CDO) Tranche 2 (A) Yield = 10% ($25mil) Tranche 3 (BBB) Yield = 15% ($25mil) Tranche 4 (junk bond) Yield = 20% ($25mil)

Collateralized Debt Obligation (CDO) • In normal time, mortgage borrowers are able to make the mortgage payments, so the investors will get the interest payments, the values of slices of CDOs increase • When housing bubble busts, mortgage borrowers, especially subprime mortgage borrowers are not able to make payments, investors don’t get their money, values of CDOs decrease substantially. The value decrease is write-down and counted as loss in the income statement. • For example, investment bank A, equity: $10 mil, borrow $90 mil. Invest all $100 mil in CDOs. When mortgage crisis happens, the market value of these mortgage backed securities drops substantially say to $80 mil, that means the income will go down by $80 mil, and at this point, technically the bank is insolvent.

Subprime Mortgage Crisis: Winners and Losers • Big losers: http://ml-implode.com/ • Bear Stearns: two hedge funds (>$1 billion) • Australia: Basis Capital ($1 billion?); Absolute Capital ($200 million?); IKB Deutsche Industriebank … • May take two more years to completely resolve! • Big losers: • Citigroup ($18B+) • Merrill Lynch ($11.5B+) • UBS ($17.8B+) • Morgan Stanley ($9.4B+) … • Bank of China (initial estimate $223 million, now could be $4-5B)

Recent Trends—Computer Networks • Online information dissemination • Information is made cheaply and widely available to the public • Automated trade crossing • Direct trading among investors

Decision Making • Perceive the situation • Possible actions • Evaluate the outcomes • Choose the action with the best outcome

Summary • Financial assets • Risk return tradeoff • Next class: Financial Securities