From Information Scarcity to Abundance: IT Strategies Unleashed

280 likes | 311 Vues

Explore the evolution of information from scarcity to abundance and unleash IT strategies in the digital era. Learn about data, insights, and the power of predictive analytics for competitive advantage. Decode the jargon and discover opportunities in big data for business growth.

From Information Scarcity to Abundance: IT Strategies Unleashed

E N D

Presentation Transcript

In•for•ma•tion Gordon Gecko's Revenge Chapter 2 AJ Raven

Agenda Information scarcity to abundance Three lenses for IT strategy Two way to disrupt value chains Is competitive advantage ~ Tooth Fairy?

Jargon Decoded • Data, information, insight: Raw factscontextualized & aggregated; actionable • Data points vs. “big data”streams • Analytics Using data to predict the future • Margins= (what customers pay - what it costs you) • Disintermediation Using IT to bypass other firms • Value chain vs. stream

"The most valuable commodity I know of is information" Gordon Gekko in the 1987 movie Wall Street

Human Obsession with Prediction A 2,000 year history • 8BC: Ancient Greeks thronged to hear predictions from the Oracle of Delphi • Since then: Commonsense, nonsense, and wishful thinking • Prediction turned scientific with statistics in England around 1700AD • Hyper-progress around World War II (1939-1945) • Business analytics: Using data to predict outcomes your firm cares about Predictive models are the bread-and-butter of analytics • Assumption: Past behavior reasonably predicts the future • Rely on historical data • Good predictions need: (a) sound data and (b) sound models • Predicting a baseball superstar, rain, a box-office hit, pricing insurance, catching spam • Firms got better at collecting more data • Spreadsheetsdata warehouses data centers Led to a flurry of innovative practices in all functional area • Segment markets • Tier customers on lifetime value • Forecast demand for a product any hour

Ingredient #2: Sound Reasoning • Business apps transform data information knowledge • Apps are “models” translated into software code • Predictions only as good as managerial insight in underlying models • Function-specific e.g., marketing, operations, accounting, or finance • Non-IT managers are the only sources of: • Things competitively worth predicting (the DV in stats-speak) • Models in their functional domain

“Big” Data is More than Just Volume Lake Niagra Falls Data points being replaced by ephemeral big data streams IT’s historical focus Lasts momentarily Exceeds capacity to store Use it or lose it Continuously flowing series of data points • Digitization-infusion-ubiquity trifecta perpetuates these data streams • Coming from interconnected supply chains, mobile devices, IoT, social media • e.g., Walmart produces over 200x entire Library of Congress every hour • Boeing 787 jet generates 2,500 iPhones worth every hour • Most firms fail to capitalize on data in hand • Abundance, not scarcity is the problem today • Strategy must now be crafted assuming information abundance scarcity • Raises the bar for valuable insightRed Queen problem

Ingredient #1: Sound Data • Data: Raw facts • e.g., 24, 32, and 28 • Information: Sorted, condensed, and contextualized data • e.g., temps in your ZIP code • Insight: Actionable information • e.g., need a coat tomorrow • Unreliable data -> untrustworthy insight • Collecting and managing data is the IT unit’s job • But not all data is worth managing • Not all information it produces is competitively valuable • What’s competitively valuable requires non-IT managers’ judgments • Without it, IT excels at collecting more without a clear business purpose • Troves of irrelevant data bog down business decisions • Proverbial needle in the wrong haystack

Dust to Gold • Historically wasted byproduct ~ sawdust • Until repurposed by Ikea and kin as particleboard, synthetic wood, etc • Data is the sawdust of our era • Generated every time a piece of software runs • Click trails no longer a worthless byproduct • Can be mined for insights to shape stuff, optimize operations, and new business models Two untapped opportunities in big data: • Generating foresightcheap computing horsepower speeding transformation • Challenge: How to use such foresight to deliver more business value • Micro-segmentation, dynamic pricing, and instantaneous price discrimination • Discovering what causes what • Correlation in statistics ~ Walmart’s beer and diapers sales on Friday night • Causation is the Holy Grail of prediction • Can tweak things that cause sales, returns, or customer loyalty Trifecta is opening up opportunities exclusive to born-digital firms • Abound in information intensive activities • e.g., finance, operations, supply chain, marketing

Opportunity Spotting – Three Questions • How IT is affecting your entire industry? • Your own firm’s place in it? • Whether an IT asset creates a sustainable competitive advantage?

The Three Lenses for IT Strategy Competitive advantage in individual IT assets IT’s effect on industry Firm vis-à-vis archrivals Competitive landscape Best used together Competitive litmus test Five forces model Value Chain Telescope Magnifying glass Microscope

Lens #1: How IT Affects the Five forces What makes an industry attractive or unattractive = profit potential IT’s impact Not firm Threat of New Entrants + IT antidote #2 a. Increases transparency Unconventional competitive barriers • “Facebook effect” • Deep customization + b. Erases geography + c. Blurs industry boundaries + + d. Legacy-free business models Fierceness of Competition Suppliers’ Bargaining Power Customers’ Bargaining Power + + Trifecta breeds these + IT antidote #1 Operational effectiveness Negotiating clout Threat of Substitutes Caps prices, raises costs Often industry outsiders Threat alone suffices

Margins = Oxygen for Firms True test for CA = Margins > archrivals’ Supplier Power Substitutes New Entrants Customer Power + How much customers pay How much it costs you Margins = + Respectable defined by industry Fierceness of Competition Firms, non-profits, governments all need margins to have a future

Nuances about the Five Forces Model • It analyzes an industry, not an individual firm • Bargaining power is about who’s got more clout to force prices down • Substitutes rarely come from your own industry • A mere threat of new entrants caps prices and raises costs

The Bottomline • Fiercer competition squeezes margins… • Must pass on more value to customers • or must spend more competing • Can make an attractive industry unattractive • A high-growth industry is unattractive if margins are unsustainable

Recap: How IT Affects an Industry Suppliers’ bargaining power Customer’s bargaining power Threat of substitutes Threat of new entrants + Increases transparency + + Erases geography Managers cannot control + + Blurs industry boundaries + + Legacy-free business models Increases operational effectiveness Managers can control Unconventional competitive barriers

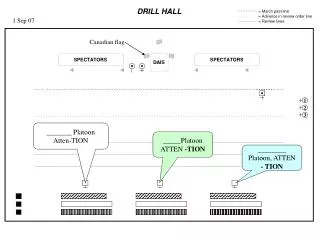

Lens #2: Value Chains • Strategy = How’ll you deliver more value than your archrivals to explicitly IDed • Value creation = Making outputs worth more than inputs • Value chain = lens for understanding this ~ prevailing business model Inbound logistics Outbound logistics After-sales Service Operations Marketing • Each activity can crosscut functions • Each step has physical + informational components trifecta increasing it • Building blocks of strategy undergird all costs and differentiation • IT instrumental to tailor value chain to your firm’s strategic aspiration Supply management Demand Management Secondary activities: HR, accounting, and historically IT Convert into finished products Getting raw materials Getting to customers

Lens #2: Value Stream Each firm has its own value chain Suppliers Retailers Distribution channels Your firm Suppliers Raw Materials Consumers Suppliers Wholesalers Downstream value Upstream value Firm value Vertically integrated if one firm “Enterprise” SCM= flow of materials, information, and money

Transforming Value Chains using IT IT can alter One step Linkages Operational effectiveness Structural reconfiguration Coordination Value-added costs Among functions Among firms

Even One Step can Differentiate Firms Cost-reducing using IT Inbound logistics Outbound logistics After-sales Service Operations Marketing Value-adding using IT

Altering Linkages in a Value Stream Original Structure Consumers Distributors Authors Publishers Wholesalers Retailers $10 $100 $5 $45 $10 $30 Disintermediation (process digitized) “Business model innovation” Publishers Retailers Wholesalers Authors Distributors $45 $70 $5 Amazon Further disintermediation (product digitized) Publishers Authors Distributors Wholesalers Retailers $10 $7 Amazon $3 Now Netflix $6bn production budget = 3xHBO

Differentiation by Coordination • Departmental specialization creates functional silos • But business processescrosscut functions • Need coordination • IT can overlay a connective tissue • Among siloed functions • Among upstream and downstream value-stream partners • Substituting inventory with information • Anticipating shifts in demand with analytics Physical flows Information flows Gelatin suppliers Grocery stores Corn syrup suppliers Supermarkets Packaging suppliers value chain Independent retailers Food color suppliers Supply-side orders Demand-side data

Lens #3: The Competitive Litmus Test N V R i Non-substitutable Inimitable Valuable Rare Creates Competitive Advantage Sustains Competitive Advantage Can a discrete IT asset (an app, infrastructure element, or a data asset) produce a sustainable competitive advantage? • Valuable but not rare a temporary competitive advantage • e.g., most IT infrastructure • Many analytics initiatives • Operational—but not strategic—value • Merely creates competitive parity • Valuable and rare • e.g., purchased apps can often be imitated destroys their rarity • Solution: Creating new apps faster than they’re imitated • But often financially exhausting and unsustainable

Most IT Assets have No Strategic Value • Most operationally-valuable corporate IT assets are not rare • Therefore have no strategic value • Mere competitive necessities

Custom-built IT Assets Sustainable advantage only from IT that archrivals struggle to imitate • Custom-built apps • But can still be reverse-engineered but at great cost • Software per se is not patentable • At best a temporary, unsustainable advantage • Blending apps and data • Amalgamating them to construct another asset that your rivals will struggle more to replicate • Blending an app with proprietary data to create an analytics edge • e.g., Nest IoT thermostat • Using an app to create network effects • Netflix (ratings) 70% of aLL movies watched • Amazon recommendations $30 billion of its annual sales • High-value fraction of a mostly-commodity IT portfolio

Analytics Approaches Analytics approaches Workhorse of analytics Dominates today Predictive Modeling Model discovery Pattern discovery Sentiment analysis Promising for big data Machine learning Neural networks Correlation Descriptive Social network analysis Collaborative filtering Bayesian analysis Cluster analysis Data mining

Summary • Most firms struggle to harness ephemeral big data streams and cheap computing • Better ingredients, better insights: Insights only as good their models from non-IT managers • The three lenses helps grasp how IT… • Is affecting your industry • Can alter how your firm creates value vis-à-vis archrivals • Whether an IT asset’sadvantage is competitively sustainable • Margins are a firm’s oxygen supply • IT reduces industry attractiveness, increasing transparency, blurring industries, enabling new business models, and squeezing margins • Also contains antidotes like a vaccine • Using IT to reimagine value chains: Alter one step or connections • Without clever amalgamation, IT-based advantage is unsustainable