Understanding Unemployment Types and Fiscal Policy in Economics

390 likes | 504 Vues

This document provides an overview of various types of unemployment, including structural, frictional, cyclical, and seasonal. It features exam questions related to government spending's benefits, fiscal policy definitions, and the Federal Reserve's roles. Students are instructed to review chapters in the EOCT book to prepare for the macro unit test. Key topics include expansionary and contractionary fiscal policy, monetary policy, and the organization of the Federal Reserve System. Utilize this material for effective study before the upcoming assessments.

Understanding Unemployment Types and Fiscal Policy in Economics

E N D

Presentation Transcript

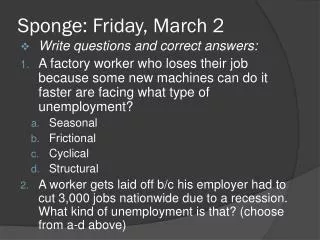

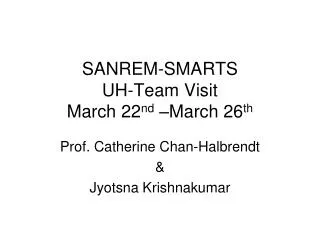

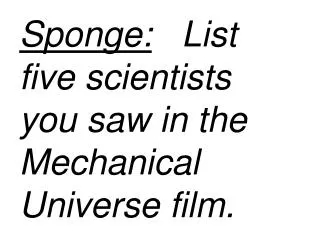

Sponge: Friday, March 2 • Write questions and correct answers: • A factory worker who loses their job because some new machines can do it faster are facing what type of unemployment? • Seasonal • Frictional • Cyclical • Structural • A worker gets laid off b/c his employer had to cut 3,000 jobs nationwide due to a recession. What kind of unemployment is that? (choose from a-d above)

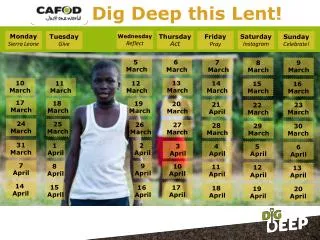

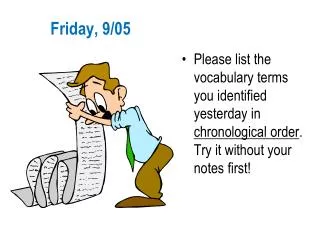

Sponge: Monday, March 5 • What are three ways in which you benefit from government spending? • See p. 324 in your textbook to understand and define Gross National Product • Macro unit test on Thursday • To study for the test, read chapter 3 in the orange EOCT book and answer questions on pages 65, 69, and 70-72 • DUE THURSDAY • Tutorial today after school and Tues-Thurs 7:30-8:00 a.m.

SSEMA3 The student will explain how the government uses fiscal policy to promote price stability, full employment, and economic growth. a. Define fiscal policy. b. Explain the government’s taxing and spending decisions.

Fiscal Policy • Fiscal policy: How government taxing and spending policy can be used to influence the macroeconomy. • Fiscal policy is used by Congress (and approved or vetoed by the President)

Fiscal Policy: When is it used? • Contractionary Fiscal Policy: A decrease in government spending and/or an increase in taxes designed to decrease aggregate demand in the economy and control inflation • Expansionary Fiscal Policy: An increase in government spending and/or a decrease in taxes designed to increase aggregate demand in the economy, thus increasing real output and decreasing unemployment.

SSEMA3 The student will explain how the government uses fiscal policy to promote price stability, full employment, and economic growth. • a. Define fiscal policy. • b. Explain the government’s taxing and spending decisions.

SSEMA2 The student will explain the role and functions of the Federal Reserve System. a. Describe the organization of the Federal Reserve System. b. Define monetary policy. c. Describe how the Federal Reserve uses the tools of monetary policy to promote price stability, full employment, and economic growth.

The Federal Reserve • The Federal Reserve (“Fed”) serves as the nation’s central bank, which is designed to oversee the banking system and regulate the quantity of money in the economy. • The Fed is a privately owned institution, authorized in 1914 by Congress to ensure the health of the nation’s banking system.

Fed’s Organization: 4 Parts • The Fed is run by its Board of Governors: • Seven members appointed by the President of the United States. • The Chairman of the Board is the most important position: presiding, directing, and testifying about Fed policy. She/He is appointed by the President.

Fed’s Organization: 4 Parts 2. Federal Open-Market Committee (FOMC) • FOMC sets and directs U.S. monetary policy 3. 12 regional Federal Reserve Banks 4. Member banks

Three Primary Functions of the Fed • Regulate the private banking industry to make sure banks follow federal laws intended to promote safe and sound banking practices. • Act as a banker’s bank, making loans to other banks and as a lender of last resort. • Control of the supply of money, i.e. Monetary Policy.

Monetary Policy: Definition • The actions of a central bank that determine the size and rate of growth of the money supply, which in turn affects interest rates. Monetary policy is maintained through actions such as increasing the interest rate, or changing the amount of money banks need to keep in the vault (bank reserves).

Sponge: Tuesday, March 6 • What is the largest sector of the macroeconomy--C, I, G or (X-M)? • Someone who wants lower taxes and less government spending is (a) fiscally liberal or (b) fiscally conservative? • Macro unit test will be this Thursday, March 8 • Due Thursday: Read chapter 3 in orange EOCT book and answer all questions in the chapter (including those at the end) as a review for test • Write out the question AND the correct answer (not just the letter) • No Current event due this week, but I will accept make-ups

Sponge: Wednesday, March 7 • With a group of 3-4 students, prepare a chart like the one on page 411 and fill in the squares to show the impact that the Fed’s monetary policies have on the money supply, the economy and you. • Macro unit test TOMORROW! • Due TOMORROW: Read chapter 3 in orange EOCT book and answer all questions in the chapter (including those at the end) as a review for test • Write out the question AND the correct answer (not just the letter)

SSEMA2 The student will explain the role and functions of the Federal Reserve System. a. Describe the organization of the Federal Reserve System. b. Define monetary policy. c. Describe how the Federal Reserve uses the tools of monetary policy to promote price stability, full employment, and economic growth.

Full Employment Stable Prices Sustainable Economic Growth Goals of Monetary Policy

The Fed’s Key Tools of Monetary Policy • Discount Rate (DR) • The interest rate charged by the Federal Reserve to banks that borrow on a short-term (usually overnight) basis • Reserve Requirements (RR) • The amount of money banks must keep on reserve at the Fed • Open Market Operations (OMO) • Buying and selling Treasury securities between the Fed and selected financial institutions in the open market • Most important tool; directed by the FOMC

DR. RROMO Remember DR. RROMO!!

Fed Monetary Policies: OMO • Open-Market Operations: The primary way in which the Fed changes the money supply is through the purchase and sale of U.S. government bonds.

Fed Monetary Policies: OMO • To increase the money supply, the Fed buys outstanding government bonds from the public. • Effects of buying bonds: • This puts money back into the hands of people and businesses who can then spend it in the marketplace • Causes interest rates to drop and spending to increase • Therefore, OMO purchases are expansionary

Fed Monetary Policies: OMO • To decrease the money supply, the Fed sells government bonds to the public. • Money that is saved is not spent in the marketplace • Remember that bonds and other Treasury bills are a way for the government to borrow money • Bonds and other government securities are a safe way for people and institutions to save • Therefore, OMO sales are contractionary

Enhance your notes • With a partner, read the description of OMO in the textbook on pages 403 to 404 • What can you add to your notes about OMO?

Quick Quiz! • How does the Fed increase the supply of money in the economy?

Monetary Policy:Reserve Requirements • The supply of money in the economy is affected by the amount of deposits that is kept in banks as reserves and the amount that is lent out. • The Fed sets banks’ reserve requirements

Bank “T-Account” Example First National Bank Assets Liabilities Reserves $10.00 Loans $90.00 Deposits $100.00 Total Assets $100.00 Total Liabilities $100.00

Bank “T-Account” Example A “T-Account” illustrates the financial position of a bank that accepts deposits, keeps a portion as reserves and lends out the rest. First National Bank Assets Liabilities Reserves $10.00 Loans $90.00 Deposits $100.00 Total Assets $100.00 Total Liabilities $100.00

Impact of Changes of RR • If the Fed increases the reserve requirement, it decreases amount of money in circulation in the economy • With a higher RR, banks have less money to lend • This is called a “tight” money policy • Lowering the RR pumps more money into the economy b/c banks have more to lend • This is an “easy” money policy

Enhance your notes • With a partner, read the description of RR in the textbook on page 403 • What can you add to your notes about RR?

Monetary Policy: Discount Rate • THE BASICS: • Discount rate = the interest rate that banks and other financial institutions pay the Fed in order to borrow money • Interest rate = a percentage that a lender charges a borrower in exchange for a loan

Monetary Policy: Discount Rate • THE BASICS: • Discount Rate (DR) • Applies to short-term loans made directly to commercial banks from the Federal Reserve System. • The higher the DR charged by the Fed, the higher the interest rate banks must charge borrowers in order to still make money

Monetary Policy: Discount Rate • IN PRACTICE: • Higher interest rates (via higher DR) encourage people to save, rather than borrow and spend • People would rather earn high interest on their savings than pay high interest on borrowed money • Therefore, the money supply decreases • Lower interest rates (via lower DR) results in more loans, causing money supply to increase and therefore spending to increase

Effects of Low Interest Rates • Generally, low interest rates stimulate the economy because there is more money available to lend. • Consumers buy cars and houses. • Businesses expand, buy equipment, etc. • Why does the Fed lower interest rates? • If inflation is in check, lower rates stimulate economic activity, thus boosting economic growth.

Effects of High Interest Rates • The Fed raises interest rates as an effective way to fight inflation. • Inflation—a sustained rise in the general price level; that is, all prices are rising together. • Consumers pay more to borrow money, dampening spending. • Businesses have difficulty borrowing; unemployment rises.

Enhance your notes • With a partner, read the description of DR in the textbook on page 404 • What can you add to your notes about DR?

Tools of Monetary Control The Fed has three instruments of monetary control: • Open-Market Operations: • Buying and selling bonds. • Changing the Reserve Ratio: • Increasing or decreasing the ratio. • Changing the Discount Rate: • The interest rate the Fed charges other banks for loans.

Work Period: Tuesday, March 6 • Finish double-bubble comparing fiscal policy and monetary policy • With a group of 3-4 students, prepare a chart like the one on page 411 and fill in the squares to show the impact that the Fed’s monetary policies have on the money supply, the economy and you. • Closing @ 9:20: Review standard break-down sheet

Review • What are the three main roles of the Federal Reserve System? • Where is your Fed? • What are the goals of monetary policy? • What happens when the Fed lowers interest rates? Raises interest rates? • What is inflation? Why should it concern you? • What is the name of the Fed’s monetary policymaking body? • What is the discount rate?

Sponge: Thursday, March 8 Who is this handsome gentleman and what does he stand for?