Modified from Chapter 4

390 likes | 409 Vues

Modified from Chapter 4. Understanding Interest Rates. Here, we are. Learning about the basic concepts for Bonds. There are different concepts of returns to a bond. The most important concept is Yield-To-Maturity. 1. Background Work: Present Value.

Modified from Chapter 4

E N D

Presentation Transcript

Modified from Chapter 4 Understanding Interest Rates Eco 2154

Here, we are • Learning about the basic concepts for Bonds. • There are different concepts of returns to a bond. • The most important concept is Yield-To-Maturity. Eco 2154

1. Background Work: Present Value A dollar tomorrow is less valuable than a dollar today. Interest rate is the discount rate which turns the Future Value into the Present Value. Eco 2154

Rate of Return(ROR or RET) • ROR or RET is the return to a financial investment for one period(year). • This is a very general. Eco 2154

Issue of Holding Period • You may hold an asset for one-period or less. -> Because the asset is a short-term bond; or -> Because you just want to hold for part of the entire duration of bond. : The resultant ROR or RETs are called various ‘yields’ • You may hold an asset for the entire duration of the multiple period. : The accompanying ROR is called Yield-To-Maturity Eco 2154

Yield to Maturity • The yield to maturity is the interest rate that equates the (entire) future value of cash flow payments to be received from a debt instrument with its (one) present value today. • YTM is the effective annual(one year) rate of return if the bond is held for the entire duration of the maturity period. Eco 2154

ROR and YTM • The return of return equals the yield to maturity only if the holding period equals the time to maturity. • A rise in interest rates is associated with a fall in bond prices, resulting in a capital loss if time to maturity is longer than the holding period. • The more distant a bond’s maturity, the greater the size of the percentage price change associated with an interest-rate change. Eco 2154

What if you do hold the debt instrument until it mature? • You may hold the debt instrument of multiple periods of duration only for one year. • There are different ROR: They are not called Yield-To-Maturity, but different Yields Eco 2154

For the financial market, • YTM carries a lot of information, reflecting the investor’s long-term expectations of the financial market, the monetary conditions, and the macroeconomic conditions, and his planning. • There are different YTM depending on the duration of the bond: The different numbers of YTM for the different durations are called ‘Term Structure’. Eco 2154

2. Four Types of Debt Instruments: They have different formulas for Rate of Returns or Interest Rate • Simple Loan • Fixed Payment Loan • Coupon Bond (most common): If the bonds are held for the entire duration, the ROR is called YTM. • Discount Bond Eco 2154

2) ROR of Multi-period Fixed Same Payment Loan :Annuity Eco 2154

3) YTM of Coupon Bonds:Coupon + Lump sum re-payment Eco 2154

Here, we will think about 3 possible cases: • You hold the bond for the entire duration of the bond: Investment period = Duration of Bonds • You hold the bond for only one year. • You hold the bond for less than one year. :(2) and(3) are possible because of ‘secondary market of bonds’, where you can sell long-term bonds before the maturity. Eco 2154

**Approximation Formula of YTM of Coupon Bond Effective Rate of Returns = Yield to Maturity: Actual Interest Rate Average Price = (Purchase Price + 100)/2; Annual Changes in Prices = (Face Value – Purchase Price) / Maturity Period Eco 2154

Some Important Questions: • If Bond Price in the financial market goes up, what will happen to YTM ? • In the financial market with substitutes for bonds, can a bond sold at a higher price than the Face Value? 3) Out of long-term and short-term bonds, which one has more fluctuations in prices? Eco 2154

*Coupon BondDiscount or Premium? Eco 2154

Coupon Bond—Yield to Maturity (Cont’d) The price of a coupon bond and the yield to maturity are negatively related. • Bond’s Market Price < Face Value “Bond has Discount”. Then, YTM > Coupon Rate • Bond’s Market Price > Face Value “Bond has Premium”. Then, YTM < Coupon Rate Eco 2154

Which YTM is going to be determined in the financial market? YTM = Core of Rate of Returns as Equilibrium ROR in the financial market + Risk Premium Eco 2154

What if you hold a multiple period bond for only one year?ROR = Yield, but not YTM Eco 2154

What if you hold a multiple period bond for less than one year?ROR = Yield, but not YTM You will either have the Current Yield or The Capital Gains. Eco 2154

= P C / i c c = p r i c e o f t h e c o n s o l P c = y e a r l y i n t e r e s t p a y m e n t C = y i e l d t o m a t u r i t y o f t h e c o n s o l i c = C a n r e w r i t e a b o v e e q u a t i o n a s i C / P c c F o r c o u p o n b o n d s , t h i s e q u a t i o n g i v e s c u r r e n t y i e l d a n e a s y - t o - c a l c u l a t e a p p r o x i m a t i o n o f y i e l d t o m a t u r i t y 4) Current Yield of Consol or Perpetuity • A bond with no maturity date that does not repay principal but pays fixed coupon payments forever. Eco 2154

5) Discount Bond Eco 2154

Yield on a Discount Basis • Yield on a Discount Basis i =(F – P) /P x 365/(days to maturity) where: i = yield on a discount basis F = face value P = purchase price Eco 2154

Example of Simple Loan Short-term Bonds • T-Bill • CP • CD PV < FV at all times Eco 2154

Example is T-Bill sold at Discount: 1) One Year T-Bill Face Value = 100; Market Price = 95 If Maturity Period = 1 year i= 5% 2) 3-Month T-Bill Face Value = 100; Market Price =99 If Maturity Period = 3 months i= 4% Eco 2154

3. Few Things to Know Rate of Return on a financial asset(bond) has three components: (1) ROR if the same money was invested on the physical goods(factory, land, and gold, etc.) (2) Compensation from inflation which erodes the value of the bond (we can call it ‘Inflation Risk/Certainty’) (3) Other risk premiums Eco 2154

Risk Premiums for a multiple period bond • Default Risk 2) Liquidity Risk 3) Market Risk 4) Macro-economic Risk Eco 2154

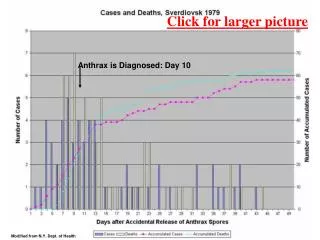

* Market Risk? • Market Risk = risk coming from unexpected changes in prices and returns in the financial market • Prices and returns for long-term bonds are more volatile than those for shorter-term bonds. Long-term bonds have more Risks than short-term bonds Eco 2154

Exmaple) Fluctuations of Bond Prices: Long-term and Short-term Bonds Suppose that YTMs of all bonds in the financial market rise by 1%. ->Bond prices should fall to give a higher YTM. • What is the required change in the market price of a one-year bond? • What is the required change in market price of a ten-year bond? -> According to the Formula, the 10-year bond’s price should change a lot more. Eco 2154

Rate of Return and Interest Rates (cont’d) • The more distant a bond’s maturity, the lower the rate of return that occurs as a result of an increase in the interest rate. • Even if a bond has a substantial initial interest rate, its return can be negative if interest rates rise. Eco 2154

* Liquidity Risk: • You need money or cash, but you may get stuck with the bonds. • In generalThe longer the term, the larger the liquidity risk. Eco 2154

* Macroeconomic Risk • Economy Wide Issues • Inflation Risk + Market Risk in a sense. Eco 2154

2) Real versus Nominal Interest Rates • Nominal interest rate makes no allowance for inflation. • Real interest rate is adjusted for changes in price level so it more accurately reflects the cost of borrowing. Eco 2154

*Fisher Equation: If you are a money-lender, how would you set the nominal interest rate? Eco 2154

There are two versions of Real Interest Rate • Ex-ante Real Interest Rate = Marginal Product of Capital - More or stable in the short-run • Ex-post Real Interest Rate = Nominal Interest Rate – Actual Inflation Rate - Actual Cost of borrowing money/funds - Affects Investment Eco 2154

Ex-ante i= ex-ante r + πe here πe is the expected inflation rate. • Ex-post Ex-post r = i - π here π is the actual inflation rate. Eco 2154

Nominal Interest Rates and Ex-post Real Interest Rate Eco 2154