European Microfinance Network

100 likes | 250 Vues

European Microfinance Network. Challenging the Western European Microfinance sector …. The Western European Context.

European Microfinance Network

E N D

Presentation Transcript

European Microfinance Network Challenging the Western European Microfinance sector …

The Western European Context • A difficult context for micro entreprise development and creation (administrative complexity, inappropriate bank services, low entrepreneurial culture,Welfare State, indebtness,etc.) • A young but growing sector • A big variety of actors • Mainly small organisations, few staff, few national organisations • Limited outreach • Performances to be improved • Dependency on subsidies, difficult sustainability • Inadequate legal environment

History European Microfinance Network • Foundation in Barcelona on April 28th 2003. • Founding members are Adie (France), nef (U.K) and Evers&Jung (Germany) • Seed finance from the “Caisse des Dépôts et Consignations” – France and the European Commission – DG Employment through the Transnational Exchange Program. Mission The mission of EMN is to promote micro finance as a tool to fight social and economic exclusion and to promote micro-entrepreneurship and self employment. This will be achieved by supporting the development of microfinance organisations, through the dissemination of good practices and by improving the regulatory frameworks for micro finance and self-employment and micro enterprises at European Union and Member State levels.

Members • 36 members from 16 European Countries • Members are mainly practitioners, banks, research institutes, think tanks, etc.

Main Achievements since 2004 • Broadened our network base in order to achieve 40 members by the end of 2005 • Developed our strategic plan 2003-2006 • Developed 5 adapted training modules and provide training services for our members – 14 training sessions reaching around 400 people • Organised three exchange visits in France, the UK and Finland for 65 participants • Organised two European conferences, Brussels, September 2004 • 26 – 28 October in Barcelona • Creation and update of a website and production of a quarterly e-newsletter • Started a new project on the integration of migrants through microcredit • Partnered with members in 4 studies of the microfinance sector in Europe (general overview, policy environment, women, migrants) • Celebrated the International Year of Microcredit • Ongoing lobbying of the EU and other European States • Reinforced the secretariat with new staff • Secured funding

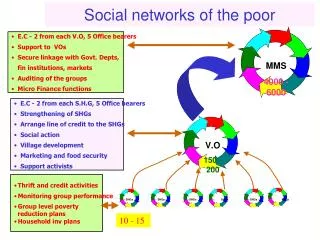

Main topics • The public served by microfinance providers (women, migrants, gypsies) • Client activities (working in the informal sector) • Non-financial services (innovative approaches) • Methodologies (how to reach clients, how to measure performance and impact, how to deal with delinquency, how to collect proper information) • Staff management (training loan officers, working with volunteers) • The external environment (working with banks, with social partners, with the EU, understanding international microfinance practices) • Improving the European legal and regulatory framework, both for micro finance programmes and start-ups and micro enterprise development.

Main issues • Securing appropriate funding: • Usually short term, • Heavy administrative accountability, • Specific requirements poorly adapted • National base • Structural limitations (lack of staff, no time, no proper information system), • Different cultures (from NGOs to banks, language barriers, different levels of activities, outreach,) • Different priorities (from basic training to lobbying) • Achieving recognition from various stakeholders (Europe, national governments, public, microfinance sector…)

Overcoming issues by … • Finding alternative ways of funding • Multiplying opportunities for networking using different tools • Offering capacity building services • Being more visible • Getting better structured at secretariat level • Better knowing members (develop more personal contacts, direct visits…) • Giving time to time

Challenging the sector … • To become more involved in transnational and international exchange … • To become more professional … • To become more visible and better known … • To work in a better environment … To clearly understand needs To design appropriate services (training, exchange, assistance, etc.) To strengthen research capacity and communication To develop lobbying capacities …

Thank you ! European Microfinance Network 4 bd. Poissonnière 75 009 Paris Tel: +33 1 56 03 59 68 Fax: +33 1 56 03 59 77 www.european-microfinance.org