Industry Panel Perspectives May 2012

230 likes | 356 Vues

In this May 2012 industry panel, experts discuss critical challenges and developments in the modernized eFile (MeF) system. Highlights include a roadmap for form support, the impact of slow acknowledgments on refund delays, and the significance of taxpayer communication regarding expectations. Panelists also address return preparer regulations, the attrition of tax preparers, and the compliance landscape shaped by the IRS. With insights on managing upcoming tax seasons and addressing industry confusion, this discussion aims to prepare stakeholders for future financial complexities.

Industry Panel Perspectives May 2012

E N D

Presentation Transcript

Industry Panel Perspectives May 2012

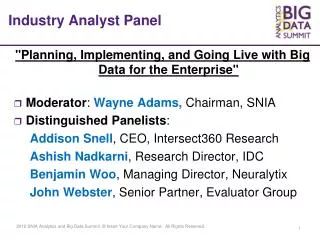

Industry Panel Perspectives May 2012 Modernized eFile (MeF) Presented by Michele Geraci

Background • MeF Roadmap • 2010: Support for 23 Forms • 2011: Additional Forms and Focus on Infrastructure • 2012: Support for Remaining Forms/Schedules

Challenges • Slow Acknowledgements Lead to MeF Shutdown • Refund Delays • Return Processing Issues

Impact • Taxpayers • Delayed Refunds • Where’s My Refund • Industry • Significant Call Volume • Brand Image Impact

Recommendations • Support Legacy EF for Another Tax Season • Set Taxpayer Expectations for Refund Timing

Industry Panel Perspectives May 2012 Return Preparer Regulations Presented by Kathy Pickering

Upcoming Challenges • Tax Preparer Attrition • Test Schedule Compression • PTIN Information and the Freedom of Information Act • Compliance / Enforcement of Regulations • Preparer Penalties

Successes • IRS personally delivering first certificates • Recognition and celebration of accomplishment • IRS engagement and communication • Establishment of Return Preparer Program office • Willingness to review/revise plans – e.g. fingerprinting • Proactive problem solving for potential issues

Industry Panel Perspectives May 2012 Tax Armageddon Presented by John Sapp, CPA

Prophecy and PrognosticatorsDecember 2012 – The end of the World? “…Ticking Time Bomb…” “…Total Confusion…” “…Real disaster in the filing season…” “…Very Very Concerned…”

Prophecy and PrognosticatorsDecember 2012 – The end of the World? ? ? ?

93 Expiring or Expired Tax Provisions • Federal Debt Limit • Election Year • BCA Spending Cuts • Medicare Payment Rate Reduction • Why not just extend? • Deficit from $3.0 Trillion to $11.0 Trillion “Ticking Time Bomb”

AMT Exemption • Depreciation • Above the line Deductions • After AGI Deductions • Tax Rates • Taxable Income “Very Very Concerned”

“Total Confusion” • Taxpayers • Politicians • IRS • Financial Markets (ASC 740) • IRS • Tax Preparers • Industry

“Real Disaster” • Confusion • Inability to file • Delayed Season start • Support and Communication • Resource Allocation

Industry Panel Perspectives May 2012 Forward Framework Presented by Dave Olsen

Communication Framework • Real time MeF world of expectations • Key Principles • Transparency • Timeliness

Communication Framework • Proposed Definition of an Event Interruption of a process for over x minutes…

Communication Framework Communication Process Foundation • Leverage industry front-line with • Taxpayers • Preparers • Initial Alert / Hourly Updating • Internal / External Channel Consistency • Data Availability

Objectives • Build on planning process successes • Long term – “Dashboard” • Partner and move forward