Comprehensive Guide to Cost-Volume-Profit Analysis and Operational Budgeting

500 likes | 640 Vues

This lecture delves into the essentials of Cost-Volume-Profit (CVP) analysis, focusing on sales mix considerations, margin of safety, operating leverage, and business applications of CVP. It also covers operational budgeting, the significance of effective budget planning, and the steps management can take to ensure objectives are met. An exploration of the master budget, production budget, and material purchases is included, providing practical examples to enhance understanding. Key concepts such as financial and operational goals, employee participation, and cash flow management are emphasized for successful budgeting.

Comprehensive Guide to Cost-Volume-Profit Analysis and Operational Budgeting

E N D

Presentation Transcript

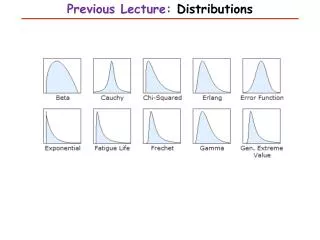

Previous Lecture • Chapter # 19: Sales Mix Considerations • Margin of Safety • Operating Leverage • Cost-Volume-Profit Analysis • Business Applications of CVP • Additional Considerations in CVP • CVP Analysis When a Company Sells Many Products

Previous Lecture • The overall contribution margin ratio • Break-even in sales dollars • The High-Low Method • Assumptions Underlying CVP Analysis

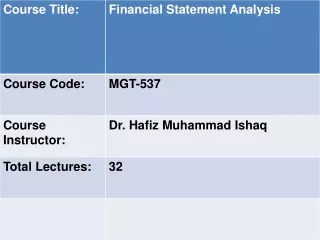

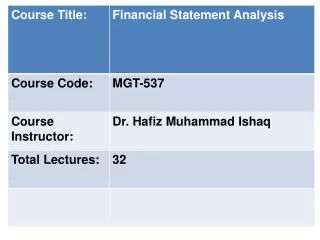

Chapter22 Operational Budgeting

Control Steps taken by management to ensure that objectives are attained. Planning Developing objectives for acquisitionand use of resources. Budgeting: The Basis forPlanning and Control A budget is a comprehensive financialplan for achieving the financial andoperational goals of an organization.

Enhanced managerialresponsibility Coordinationof activities Performanceevaluation Benefits Assignment of decisionmaking responsibilities Benefits Derived from Budgeting

Budget Problems Perceived unfair or unrealistic goals. Poor management-employee communications. Solution Reasonable and achievable budgets. Employee participation in budgeting process. Establishing Budgeted Amounts: The “Behavioral” Approach

Participation in Budget Process Flow of Budget Data

2001 2002 2003 2004 C a p i t a l B u d g e t s The Budget Period The annual operating budget may be divided into quarterly or monthly budgets. A continuous budget is usually a twelve-month budget that adds one month as the current month is completed.

Cost of goodssold and endinginventorybudgets Salesforecast Productionschedule • Budgeted • financial budgets: • cash • income • balance sheet Capitalexpendituresbudget Operatingexpensebudgets The Master Budget

Preparing the Master Budget:An Illustration That’s enough talkingabout budgets, nowshow me an example!

EstimatedUnit Sales EstimatedUnit Price Analysis of economic and market conditions+Forecasts of customer needs from marketing personnel Preparing the Master Budget:An Illustration SalesBudget

Ellis Magnet Co. is preparing budgets for the quarter ending June 30. The sales price is $10 per magnet. Budgeted sales for the next four months are: April 20,000 magnets @ $10 = $200,000 May 50,000 magnets @ $10 = $500,000 June 30,000 magnets @ $10 = $300,000 July 25,000 magnets @ $10 = $250,000 Preparing the Master Budget:An Illustration The Sales Budget July is needed for June ending inventory computations.

Sales Budget Production Budget Completed The Production Budget

Ellis wants ending inventoryto be 20 percent of the next month’s budgeted sales in units. 4,000 units were on hand March 31. Let’s prepare the production budget. The Production Budget

Production must be adequate to meet budgeted sales and to provide sufficient ending inventory. • Budgeted product sales in units • + Desired product units in ending inventory • = Total product units needed • – Product units in beginning inventory • = Product units to produce The Production Budget

Production Budget Units Production Budget MaterialPurchases Completed The Production Budget

Units to produce • × Material needed per unit • = Material needed for units to produce • + Desired units of material in ending inventory • = Total units of material needed • – Units of material in beginning inventory • = Units of material to purchase The Production BudgetMaterial Purchases The material purchases budget is based on production quantity and desired material inventory levels.

Five pounds of material are needed for each unit produced. Ellis wants to have materials on hand at the end of each month equal to 10 percent of the following month’s production needs. The materials inventory on March 31 is 13,000 pounds. July production is budgeted for 23,000 units. The Production BudgetMaterial Purchases

Materials used in production cost $.40per pound. One-half of a month’s purchases are paid for in the month of purchase; the other half is paid for in the following month. No discount terms are available. The accounts payable balance onMarch 31 is $12,000. Cash Payments forMaterial Purchases

Production Budget UnitsMaterial Production Budget Labor Completed The Production Budget

Each unit produced requires 3 minutes (.05 hours) of direct labor. Ellis employs 30 persons for 40 hours each week at a rate of $10 per hour. Any extra hours needed are obtained by hiring temporary workers also at $10 per hour. The Production BudgetDirect Labor

Production Budget UnitsMaterialLabor Production Budget ManufacturingOverhead Completed The Production Budget

Variable manufacturing overhead is $1 per unit produced and fixed manufacturing overhead is $50,000 per month. Fixed manufacturing overhead includes $20,000 in depreciation which does not require a cash outflow. The Production BudgetManufacturing Overhead

Production Budget SellingandAdministrativeExpenseBudget Completed Selling and Administrative(S&A) Expense Budget

Selling expense budgets contain both variable and fixed items. Variable items: shipping costs and sales commissions. Fixed items: advertising and sales salaries. Administrative expense budgets contain mostly fixed items. Executive salaries and depreciation on company offices. Selling and Administrative(S&A) Expense Budget

Variable selling and administrative expenses are $.50 per unit soldand fixed selling and administrative expenses are $70,000 per month. Fixed selling and administrative expenses include $10,000 in depreciation which does not require a cash outflow. Cash Payments for(S&A) Expenses

I have seen a lot of cashpayments but no cashreceipts. Show me somecash receipts! Cash Receipts Budget

All sales are on account. Ellis’s collection pattern is: 70 percent collected in month of sale 25 percent collected in month after sale 5 percent will be uncollectible Accounts receivable on March 31 is $30,000, all of which is collectible. Cash Receipts Budget

End of Today's Session Allah Hafiz