Banking system

510 likes | 724 Vues

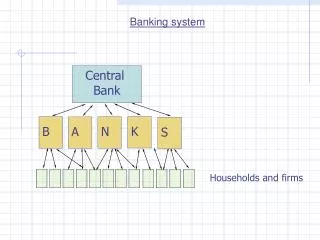

Banking system. Central Bank. K. B. N. A. S. Households and firms. The role of commercial banks is to Serve as a financial intermediary between savings and investments; Assist the process of money circulation, connect lenders to borrowers, in other words, “create money”.

Banking system

E N D

Presentation Transcript

Banking system Central Bank K B N A S Households and firms

The role of commercial banks is to • Serve as a financial intermediary between savings and investments; • Assist the process of money circulation, connect lenders to borrowers, in other words, “create money”. • Money in the economy is represented not only by Federal Reserve notes (a.k.a. dollar bills) but also by loans made and taken out. • It is in this sense that commercial banks are able to “create money”.

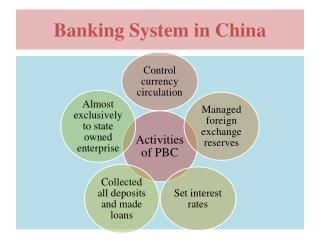

Central Bank and monetary policy • The functions of a Central Bank are to: • serve as the last resort for commercial banks experiencing cash flow problems; • maintain the rules under which the banking system operates; • by doing so, regulate the amount of money in the economy (often referred to as “money supply”).

In the U.S., the role of a Central Bank is performed by the Federal Reserve System, or the Fed for short. • The mission of the Fed is to promote economic stability and economic growth. • It does so by affecting money supply (methods are to be discussed below). • The chair is appointed by the President/Congress • Other than that, it is independent of the government (can conduct any policy it wants) • Consists of 12 regional banks

The Fed performs its main mission, promoting economic stability and growth, by regulating money supply and therefore compensating economic forces within a business cycle. • The idea : • Money supply up • interest rate down • easier to get a loan • a boost to investment and consumption • an overall stimulus to the economy • … and vice versa. • Therefore when the economy is in a recession, the Fed should __________ the money supply. • When the economy is growing too fast, the Fed should __________ the money supply.

The Fed performs its main mission, promoting economic stability and growth, by regulating money supply and therefore compensating economic forces within a business cycle. • The idea : • Money supply up • interest rate down • easier to get a loan • a boost to investment and consumption • an overall stimulus to the economy • … and vice versa. • Therefore when the economy is in a recession, the Fed should increase the money supply. • When the economy is growing too fast, the Fed should __________ the money supply.

The Fed performs its main mission, promoting economic stability and growth, by regulating money supply and therefore compensating economic forces within a business cycle. • The idea : • Money supply up • interest rate down • easier to get a loan • a boost to investment and consumption • an overall stimulus to the economy • … and vice versa. • Therefore when the economy is in a recession, the Fed should increase the money supply. • When the economy is growing too fast, the Fed should decrease the money supply.

The Fed performs its main mission, promoting economic stability and growth, by regulating money supply and therefore compensating economic forces within a business cycle. • The idea : • Money supply up • interest rate down • easier to get a loan • a boost to investment and consumption • an overall stimulus to the economy • … and vice versa. • Therefore when the economy is in a recession, the Fed should increase the money supply. • When the economy is growing too fast, the Fed should decrease the money supply. Expansionary monetary policy

The Fed performs its main mission, promoting economic stability and growth, by regulating money supply and therefore compensating economic forces within a business cycle. • The idea : • Money supply up • interest rate down • easier to get a loan • a boost to investment and consumption • an overall stimulus to the economy • … and vice versa. • Therefore when the economy is in a recession, the Fed should increase the money supply. • When the economy is growing too fast, the Fed should decrease the money supply. Expansionary monetary policy Contractionary monetary policy

Tools of monetary policy “Fractional reserve banking”: (assume 10% reserve requirement) RESERVES RESERVES RESERVES $50 $40.50 $45 Bank 1 Bank 3 Bank 2 $405 loan $450 loan $500 deposit $450 dep. $405 dep. etc. Jared John Jane $450 purchase $405 purchase Acme, Inc. SUBWAY

What happens if the reserve ratio requirement is raised? ________ money is put in reserves, __________ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _____________. This causes the interest rate to _____________ , and the economy to _______________ . Conversely, a lower reserve ratio requirement would ______________ the money supply, ___________ the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _____________. This causes the interest rate to _____________ , and the economy to _______________ . Conversely, a lower reserve ratio requirement would ______________ the money supply, ___________ the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to _____________ , and the economy to _______________ . Conversely, a lower reserve ratio requirement would ______________ the money supply, ___________ the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to increase , and the economy to _______________ . Conversely, a lower reserve ratio requirement would ______________ the money supply, ___________ the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to increase , and the economy to slow down . Conversely, a lower reserve ratio requirement would ______________ the money supply, ___________ the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to increase , and the economy to slow down . Conversely, a lower reserve ratio requirement would increase the money supply, ___________ the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to increase , and the economy to slow down . Conversely, a lower reserve ratio requirement would increase the money supply, lower the interest rates, and ________________________ the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to increase , and the economy to slow down . Conversely, a lower reserve ratio requirement would increase the money supply, lower the interest rates, and boost the economy.

What happens if the reserve ratio requirement is raised? _ MORE _ money is put in reserves, _ LESS__ money returns back to the economy. As a result, the overall amount of money in the economy (loans included) _ decreases _. This causes the interest rate to increase , and the economy to slow down . Conversely, a lower reserve ratio requirement would increase the money supply, lower the interest rates, and boost the economy. A change in the reserve ratio requirement is a very powerful instrument. That’s why it is used only under extreme circumstances.

Instrument #2. Discount rate Banks may borrow money from the Fed at the interest rate set by the Fed. That rate is called the discount rate. When the discount rate is raised, the cost of getting money from the Fed for the bank __________________. As a result, the supply of money ___________. The interest rates in the economy ___________ Economic activity ______________

Instrument #2. Discount rate Banks may borrow money from the Fed at the interest rate set by the Fed. That rate is called the discount rate. When the discount rate is raised, the cost of getting money from the Fed for the bank increases. As a result, the supply of money ___________. The interest rates in the economy ___________ Economic activity ______________

Instrument #2. Discount rate Banks may borrow money from the Fed at the interest rate set by the Fed. That rate is called the discount rate. When the discount rate is raised, the cost of getting money from the Fed for the bank increases. As a result, the supply of money decreases. The interest rates in the economy ___________ Economic activity ______________

Instrument #2. Discount rate Banks may borrow money from the Fed at the interest rate set by the Fed. That rate is called the discount rate. When the discount rate is raised, the cost of getting money from the Fed for the bank increases. As a result, the supply of money decreases. The interest rates in the economy go up. Economic activity ______________

Instrument #2. Discount rate Banks may borrow money from the Fed at the interest rate set by the Fed. That rate is called the discount rate. When the discount rate is raised, the cost of getting money from the Fed for the bank increases. As a result, the supply of money decreases. The interest rates in the economy go up. Economic activity slows down. Current federal discount rate = 0.75%

A different concept: Federal funds rate – the rate at which large financial institutions borrow from and lend to each other their reserve funds in the most short-term (overnight) transactions. This is the rate that is announced after Federal Reserve meetings. Currently, the federal funds rate = …. It is important to understand that the Fed funds rate is largely determined by market forces (supply and demand for such loans), so the rate announced by the Fed is just a target. However, given the amount of Fed reserves is sufficiently large and sufficiently diversified, the Fed is a large enough player in the market to be able to maintain the rate with a fairly high accuracy, and it does so by… 0.25%

#3. Buying and selling paper assets (usually U.S. Treasury bills/bonds), also known as “open-market operations”. The reserves held by the Fed are both in dollar bills and in other assets, such as Treasury bills. A Treasury bill is basically a bond issued by the government. It promises to pay back a certain amount of money at a certain future date. A Treasury bill is an asset but it is NOT money! The Fed can enter the market for financial assets and buy or sell U.S. Treasury bills.

When the Fed sells Treasury bills, it receives money and stores it. Some money gets withdrawn from the economy. Money supply decreases. The equilibrium interest rate increases. When the Fed buys Treasury bills, it pays for them with dollars. Money gets injected in the economy, thus money supply increases. The equilibrium interest rate decreases .

Other rates we may encounter : LIBOR, or London InterBank Offered Rate – the rate at which large London banks borrow unsecured funds from each other. Used as a reference for a wide variety of transaction (including those in the U.S.). Prime rate – the rate of interest at which banks lend to favored customers, i.e., those with high credibility. Most importantly, it is a reference rate that serves as an indicator of a situation in the national money market. As of August 18, 2010, the U.S. prime rate is … 3.25%

Limitations of monetary policy: Monetary policy is very effective in slowing down an economic boom. When firms and households spend money too fast, a decrease in money supply may limit their ability to do so. During a recession, firms and households are reluctant to spend money. Increasing the money supply and making money more readily available will not necessarily have a positive effect on spending. Thus, other (non-monetary) instruments are sometimes needed.

Latest events in the financial system • Imprudent practices in the financial sector and some decisions made by the Fed; • Causing a financial crisis and an economic recession; • The resulting questioning of principles and policies governing the financial system. • The overhaul plan proposed by Obama/Geithner: • Giving the Fed more power to oversee the financial system (supervise, take over, or break up (large) financial companies); • Creating a new agency, “Financial Stability Oversight Council”, that would coordinate policy and help resolve disputes among regulators

Fiscal policy – the basics “Fiscal policy” is the short name for decisions that involve government spending and taxation policy. The government receives money from taxes. This money can be spent on various government programs.

Recall the expression for the Gross Domestic Product, GDP = An increase in any of the (positive) terms would stimulate the economy. Monetary policy attempts to affect C and I, which are determined by households and firms’ decisions. If households and firms refuse to increase their spending even after the Fed has eased its monetary policy, then the government has to step in and inject some money in the economy directly (G) in hopes of getting it going. + (X – M) + I C + G

How it works: An increase in government spending increases “aggregate demand” and therefore stimulates the economy. A decrease in government spending decreases “aggregate demand” and slows the economy down. A tax increase leaves firms and households with ________ money they can spend, thus _______________ the economy. Conversely, a decrease in tax rates _______________ the economy. Example: the tax cut by the Bush administration. LESS SLOWING DOWN STIMULATES

Problems/limitations of fiscal policy: • 1. Timing – unlike in the case of monetary policy, approval of any fiscal measure takes substantial amounts of time. This makes fiscal policy more effective in the long term than in the short term. • 2. The government can spend only what it earns through taxes, or its budget will not balance. • Sometimes, situation calls for strong expansionary measures (increasing spending AND cutting taxes simultaneously), causing a budget deficit. • The government can get the missing amount of money by • printing money (a BAD decision!), • borrowing money (borrow today, promise to pay back in the future) – leads to budget deficits

Why the deficit is a problem: • Money spent on paying interest on the debt could be used on some government programs; • By borrowing money, the government competes with banks and pushes up the interest rate(“Crowding- out effect” – replacing investments) • The country may need higher taxes in the future to meet the claims, esp. those by foreign creditors • Higher fiscal debt restricts the government’s ability to respond to other possible challenges • In the worst-case scenario, potential borrowers may lose faith in U.S. government repaying the debt and refuse to further lend money to it (a fall in the value of the dollar inflation)

“governmentbudget deficit” = the annual budget shortfall Annual deficits add up to make the total amount of government debt accumulating over the years. “Public debt” (a.k.a. “the national debt”) = part of the total (“gross”) debt that is held by the public, i.e. states, corporations, individuals, and foreign governments. The rest is held by the government itself (i.e. the Trust for Social Security, Federal Disability Insurance, etc.).

Interesting and important facts about the debt: • As of January 25, 2010, the total government debt is $14 trillion, or 95.6% of the annual GDP ($14.7 trillion). • Of this, the public debt accounts for $8.6 trillion, or 60% of the GDP (ranked 5th among the G8 countries) • Approximately $4.4 trillion is held by foreign citizens and institutions.Biggest foreign lenders – PR China ($1 tril), Japan ($0.8 tril) • For more information, see www.usdebtclock.org

Automatic stabilizers - Instruments that somewhat dampen the fluctuations in economic activity • Tax system • Unemployment benefits • Welfare programs • International trade, to some extent