13.4 Product Differentiation

270 likes | 542 Vues

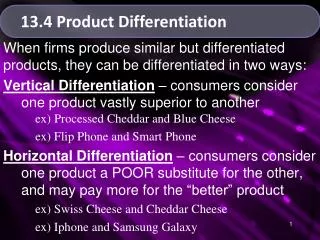

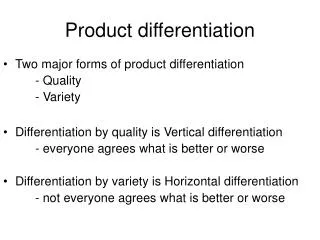

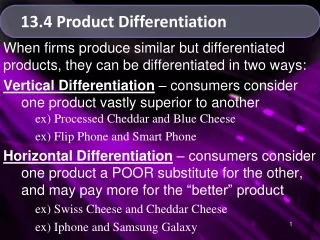

13.4 Product Differentiation. When firms produce similar but differentiated products, they can be differentiated in two ways: Vertical Differentiation – consumers consider one product vastly superior to another ex) Processed Cheddar and Blue Cheese ex ) Flip Phone and Smart Phone

13.4 Product Differentiation

E N D

Presentation Transcript

13.4 Product Differentiation • When firms produce similar but differentiated products, they can be differentiated in two ways: • Vertical Differentiation – consumers consider one product vastly superior to another ex) Processed Cheddar and Blue Cheese • ex) Flip Phone and Smart Phone • Horizontal Differentiation – consumers consider one product a POOR substitute for the other, and may pay more for the “better” product • ex) Swiss Cheese and Cheddar Cheese • ex) Iphone and Samsung Galaxy

13.4 Product Differentiation • Horizontal Differentiation ≈ Brand Loyalty • Firms spend money on advertising and “exclusive deals” to maintain horizontal differentiation • A product with WEAK horizontal differentiation will be MORE sensitive to its own and rivals’ price changes. • (Small price change =>Large demand change) • A product with STRONG horizontal differentiation will be LESS sensitive to its own and rivals’ price changes. • (Small price change =>Small demand change)

13.4 Product Differentiation Shift in demand is due to a change in rivals’ price.

Bertrand Competition – Horizontally Differentiated Products • Assumptions: • Firms set price* • Differentiated product • Simultaneous • Non-cooperative • *Differentiation means that lowering price below your rivals' will not result in capturing the entire market, nor will raising price mean losing the entire market so that residual demand decreases smoothly

Bertrand Competition – Differentiated Example Q1 = 100 - 2P1 + P2"Coke's demand" Q2 = 100 - 2P2 + P1"Pepsi's demand" MC1 = MC2 = 5 What is Coke’s residual demand when Pepsi’s price is $10? $0? Q1(10) = 100 - 2P1 + 10 = 110 - 2P1 Q1(0) = 100 - 2P1 + 0 = 100 - 2P1 Chapter Thirteen

Residual Demand Coke’s Price 110 100 Pepsi’s price = $0 for D0 and $10 for D10 D10 D0 Coke’s Quantity 0 Chapter Thirteen

Marginal Revenue (from Residual Demand) Each firm maximizes profits based on its residual demand by setting MR (based on residual demand) = MC Coke’s Price 110 Pepsi’s price = $0 for D0 and $10 for D10 100 D10 D0 MR10 5 MR0 0 Coke’s Quantity Chapter Thirteen

Optimal Price and Quantity When MC=MR, we calculate price and quantity Coke’s Price • Example: • MR=MC • MRR(10) = 55 - Q1(10) = 5 • Q1(10) = 50 • P1(10) = 30 • Therefore, firm 1's best response to a price of $10 by firm 2 is a price of $30 110 100 30 27.5 D10 D0 MR10 5 MR0 0 Coke’s Quantity 45 50 Chapter Thirteen

Reaction Functions • Q1 = 100 - 2P1 + P2"Coke's demand" • Q2 = 100 - 2P2 + P1"Pepsi's demand" • MC1 = MC2 = 5 • Solve for firm 1's reaction function for any arbitrary price by firm 2 • P1 = 50 - Q1/2 + P2/2 • MR = 50 - Q1 + P2/2 • MR = MC => 5 = 50 - Q1 + P2/2 • Q1 = 45 + P2/2 • (continued)

Reaction Functions • Q1 = 100 - 2P1 + P2"Coke's demand" • Q2 = 100 - 2P2 + P1"Pepsi's demand" • MC1 = MC2 = 5 • Q1 = 45 + P2/2 • Continue Solving for the reaction function • Q1 = Q1 • 100 - 2P1 + P2 = 45 + P2/2 • P1 = 27.5 + P2/4 • Likewise, P2 = 27.5 + P1/4

Equilibrium P1 = 27.5 + P2/4, P2 = 27.5 + P1/4 Q1 = 100 - 2P1 + P2"Coke's demand" Q2 = 100 - 2P2 + P1"Pepsi's demand" Solving for price and quantity: P1 = 27.5 + P2/4 P1 = 27.5 + (27.5 + P1/4 )/4 4P1 = 110 + 27.5 + P1/4 3.75P1 =137.5 P1* = 110/3 = P2* (Due to symmetry) Q1 = 100 - 2P1 + P2 Q1 = 100 - 110/3 Q1* = 190/3 = Q2* (by symmetry)

Equilibrium P1* = 110/3 = P2* Q1* = 190/3 = Q2* MC1 = MC2 = 5 Calculating Profits. 1* = TR-TC 1* = (P1* - MC1)Q1* 1* = (110/3 - 5)190/3 1* = 2005.55 = 2* (By symmetry) • Both Coke and Pepsi make profits of 2005.55 when they produce 63.3 each at a price of $36.67 each.

Equilibrium and Reaction Functions Pepsi’s Price (P2) P1 = 27.5 + P2/4 (Coke’s R.F.) P2 = 27.5 + P1/4 (Pepsi’s R.F.) Bertrand Equilibrium P2 = 110/3 • 27.5 Coke’s Price (P1) P1 = 110/3 27.5 Chapter Thirteen

Equilibrium Notes • Equilibrium occurs when all firms simultaneously choose their best response to each others' actions. • Graphically, this amounts to the point where the best response functions cross. • Profits are positive in equilibrium since both prices are above marginal cost! • Even if we have no capacity constraints, and constant marginal cost, a firm cannot capture all demand by cutting price.

Horizontal Differentiation Solving Steps • Use Residual Demand (given) • Calculate (residual) MR • MR=MC and demand to find reaction functions (in terms of Prices) • Use reaction functions to solve for P’s • Use P’s to solve for Q`s • Solve for `s • Summarize Chapter Thirteen

13.5 Monopolistic Competition • Assumptions: • Firms set price • Differentiated products • Many buyers and sellers • Free entry and exit • Products are ASSUMED to be imperfect substitutes for each other. • Due to differentiated products, each firm has its own residual demand curve and optimizes like a monopoly:

13.5 Short Run Monopolistic Competition Price Marginal Cost Short-Run Profit P* Average Cost q* D Quantity MR Chapter Thirteen

Monopolistic Competition Example P = 100 - Q TC = 10+Q2 Calculate Equilibrium price and Quantity TR= PQ = 100Q – Q2 MR = ∂TR/ ∂Q = 100 - 2Q MC = ∂TC/ ∂Q =2Q MR = MC 100 - 2Q = 2Q Q* = 25 P = 100 – Q P = 100 – 25 P* = 75

Monopolistic Competition Example P = 100 - Q Q* = 25 TC = 10+Q2 P* = 75 Calculate Profits AC = TC/Q = 10/Q+Q * = TR – TC = (P-AC)Q* = (32.5-10)45 = 1,012.5 * = (75- [10/25+25])25 * = (75- [10/25+25])25 * = $1240 • This firm will charge a price of $75 and sell 25 units for profits of $1240

13.5 Short Run Monopolistic Competition Example Price Marginal Cost Short-Run Profit 75 25.4 Average Cost 25 D Quantity MR Chapter Thirteen

Monopolistic Competition, Short-RunSolving Steps • Use Residual Demand (given) • Calculate (residual) MR • MR=MC to solve for P • No Step (Take a bread, eat a sandwich) • Use P to solve for Q • Solve for `s • Summarize Chapter Thirteen

Long-Run Monopolistic Competition • In the short run, profit is available • There is free entry and exit • THEREFORE • Firms will enter, decreasing individual residual demand until: • P=AC (profits=0) • Note: P≠MC since MC≠ AC in these examples

Monopolistic Competition Long Run Equilibrium Price Marginal Cost P*=AC Average Cost q* Quantity MR Dnew Dold Chapter Thirteen

Chapter 13 Conclusions • Market structure is determined by: • Number of Firms • Product Differentiation • Market structure can be measured using the 4-firm concentration ratio (4CR) or the Herfindahl-Hirschman Index (HHI) • In a Cournot oligopoly firms choose quantities and make profits

Chapter 13 Conclusions • 4) In a Bertrand Oligopoly firms choose prices and make no profits (Perfect Competition outcome) • 5) In a Stackleberg Oligopoly one firm acts first, for higher output and profits • 6) A Dominant Firm works as a monopoly once the fringe has been removed from the demand

Chapter 13 Conclusions • 7) A Dominant Firm has incentives to keep the competitive fringe small • 8) Oligopolies with differentiated products operate with their demand curves SLIGHTLY affected by rivals • 9) Monopolistic Competition works like a monopoly, but free entry eliminates profits. • 10) Economics is awesome