Credit Default Swaps

410 likes | 803 Vues

The Good, The Bad, and The Ugly. Credit Default Swaps. Garrett Vogenbeck BA 543 - June 2, 2009. Agenda. Credit Default Swap Basics The Good The Bad The Ugly Conclusion The Future of the CDS. http://www.youtube.com/watch?v=sZoJvtJbLQo. Credit Default Swaps.

Credit Default Swaps

E N D

Presentation Transcript

The Good, The Bad, and The Ugly Credit Default Swaps Garrett Vogenbeck BA 543 - June 2, 2009

Agenda • Credit Default Swap Basics • The Good • The Bad • The Ugly • Conclusion • The Future of the CDS • http://www.youtube.com/watch?v=sZoJvtJbLQo

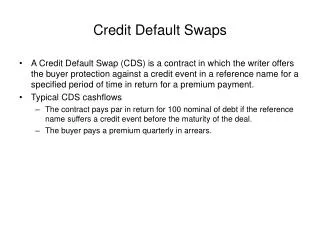

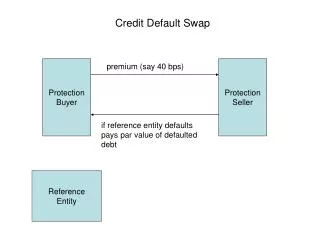

Credit Default Swaps • A credit default swap (CDS) is a credit derivative used to provide protection against an issuer of debt in the case of a credit event (default). • The CDS is a contract that protects a counterparty against the reference entity (the issuer of the debt instrument) from defaulting.

Origin of the CDS • The CDS was created by JP Morgan in 1994 at the Boca Raton Resort & Club during an “Off-Site Weekend” • It was created in order to offset default risk to a third party.

CDS Types • A Single Name Credit Default Swap is one in which only one reference entity exists. • A Basket Credit Default Swap is one in which multiple reference entities exist. • A Credit Default Swap Index has multiple entities and is a standardized index of credit risk protection.

Terminology • The Swap Premium is the payment from protection buyer to protection seller. • The spread is the annual amount the protection buyer pays the seller (expressed as a percentage of the notional value, or face value of the debt instrument). • Cash Settlement: The protection seller pays a cash value following a credit event. • Physical Settlement: The protection buyer delivers the defaulted asset and the seller pays the par value to the buyer.

Demonstration of Physical Settlement Underlying Debt Instrument Swap Premium Protection Buyer Protection Buyer Credit Default Swap Credit Event Par Amount

The Popularity of the CDS • CDSs are the most popular form of credit derivatives, and for good reason. Source: (Global Tinfoil Analysis, http://globaltinfoilanalysis.blogspot.com/2008/10/lehman-demolition-to-continue-for-weeks.html)

Accounting Implications • A major reason for JP Morgan to invent the CDS was its effects on their books. • JP Morgan had a lot of debt, and by using CDSs to transfer risk found a way to reorganize their numbers.

A Solid Investment • Historically, only 0.2% of investment grade companies will default in any one year (Falkenstein). • That being said, the CDS should allow managers of funds to use CDSs to safely reduce the credit exposure risk involved to manipulate the fund to better fit the investors’ risk profile.

Capital Structure Arbitrage • CDSs can be used in a capital structure arbitrage strategy. • Profit is made based on changes in a CDS’s spread. EXAMPLE: Imagine a corporation that is having problems and whose stock price is dropping, but the CDS spread is remaining unchanged. A hedge fund could be created in which $10 million dollars is used to purchase CDSs at the current price. When the spread does increase, the fund can turn around and sell those CDSs at a higher price for a net gain.

An Important Note • CDSs themselves are not broken. • The way they have been used recently have caused problems. • According to Blythe Masters, who helped create the CDS: “Ironically, the CDS product has been performing exactly as it was intended to.”

Weapons of Financial Destruction • In the 2002 Berkshire Hathaway Annual Report, Warren Buffet famously claimed that “derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.” • Berkshire Hathaway sold more than $2.5 billion in CDSs in 2008, and the company eventually posted a $2.2 billion loss stemming from Berkshire Hathaway's credit derivative business.

No Regulation • Neither the SEC, the Treasury Department, or the Federal Reserve regulates CDSs. • In 2008, the SEC petitioned congress for authorization to regulate. • Expect impending legislation.

“Naked Short Selling” • A CDS can be purchased without holding the underlying asset. • Critics claim that CDSs are now mostly used for speculative purposes rather than to hedge risks. • In other words, CDSs are simply a tool investors use to gamble.

Speculation Vs. Hedging • A New York Times Editorial quoted Eric Dinallo, the insurance superintendent for New York State as saying that “some 80 percent of the estimated $62 trillion in credit default swaps outstanding in 2008 were speculative.”

Pension Fund Note: This example is directly inspired by the instructional Youtube videos produced by The Khan Academy: http://www.khanacademy.org/ http://www.youtube.com/user/khanacademy Let’s assume a pension fund has a lot of money to invest, while a corporation wants to finance its debt through issuing bonds. Corporation

Pension Fund The corporation issues a 10-year bond with a 10% coupon, which seems a good fit to the pension fund’s manager. $10 Million 10% Corporation

Pension Fund However, the pension fund is limited to investing only in safe investments. Enter credit rating agencies. $10 Million 10% Corporation

Because the pension fund’s charter limits its investment capabilities, this investment is not allowed. Pension Fund $10 Million 10% Credit Rating Agency Corporation Rated BB

Pays 1% to buy a CDS Pension Fund AIG Bond is insured $10 Million 10% Rated AAA Credit Rating Agency Corporation Rated BB

Pension Fund AIG Bond is insured $10 Million 10% Pays 1% to bundle a CDS with the bond Rated AAA Credit Rating Agency Corporation Rated BB

Pension Fund The result is that the bond essentially becomes a AAA rated investment… AIG $10 Million 10% 9% Rated AAA Credit Rating Agency Corporation Rated BB

Lack of Regulation • Companies such as AIG that performed such shenanigans were not required to post adequate collateral for their CDSs because of their high credit rating. • No regulation prevented AIG from selling billions in protection without keeping collateral for such risky investments.

A Poor Perspective • AIG treated CDSs too much like traditional insurance. • Insurance policies such as life insurance, auto insurance, etc., follow predictable trends

AIG’s Collapse • AIG sold protection on mortgage-backed securities and became one of the largest players in the credit derivatives business.

AIG’s Collapse • Most companies that sold protection would net out their risk. That is, they also bought CDSs to hedge their own risk. …. AIG only sold CDSs.

AIG’s Collapse • The beginning of the end for AIG came in March 2005 when then CEO Maurice “Hank” Greenberg resigned after revelations that he was involved with improper accounting practices. …. The next day, AIG’s credit rating was downgraded, and per the collateral covenants in their CDS contracts, they immediately had to post $1.6 billion in collateral.

AIG’s Collapse • As the economic situation worsened and more mortgage-backed securities defaulted, AIG was on the hook for over $440 billion in CDS payouts. • AIG’s credit rating was again downgraded in September 2008. …. AIG received a federal bailout in the form of $85 billion.

The GM Bankruptcy • CDSs may have played a large role in GM going bankrupt.

The GM Bankruptcy According to an article in the Financial Times: “It only takes opposition by 10% of the bondholders to stymie an out-of-court restructuring of GM. The FT believes that there are enough bondholders who, via being net short GM bonds via credit default swaps, have good reason to block a negotiated outcome and force the automaker into bankruptcy.”

The GM Bankruptcy “Hedge funds and other investors stand to make billions of dollars on credit insurance contracts if GM declares bankruptcy, a prospect that is complicating efforts to persuade creditors to agree to a restructuring plan for the automaker, analysts say.”

Successful Hedge Fund Example • An article released today by Bloomberg reports that BlueMountain LLC will make $817 Million through its flagship hedge fund as a result of derivatives trades. “BlueMountain bought pieces of Detroit-based General Motors Corp.’s $4.5 billion credit line and purchased derivatives linked to GM’s unsecured debt that would pay out if the company defaults, according to the letter.”

A Lack of Transparency • Bondholders may have been more apt to favor the GM bankruptcy because it is more profitable for them. • It was unknown who wrote the protection for the CDSs involved with GM. • Therefore, those parties were not at the negotiation table with the Obama administration and GM.

Obama’s Regulatory Framework • On May 13, 2009, the U.S. Department of the Treasury release a press release stating the Obama Administration’s proposals for a comprehensive regulatory framework for all Over-The-Counter Derivatives.

Conclusion • The CDS itself is not to blame for the current economic situation. • It is a combination of poor performance in the housing market, by credit rating agencies, and a lack of oversight and transparency. • AIG, although acting legally, took upon an enormous amount of risk that ultimately affected us all. • Expect the current administration to pass regulatory reforms aimed to curb this problem.

Questions? Source: (Rob Chevalier, The Economist, http://www.economist.com/finance/displaystory.cfm?story_id=12552204)