Money Markets

210 likes | 391 Vues

Money Markets. Reading: Chapter VI Cuthbertson & Nitzsche:. Money Market Instruments. Money market (MMI) instruments are typically short-term intruments for borrowing and lending. Gains from holding MMI: the price paid lies below the price received at maturity. Two forms:

Money Markets

E N D

Presentation Transcript

Money Markets Reading: Chapter VI Cuthbertson & Nitzsche:

Money Market Instruments • Money market (MMI) instruments are typically short-term intruments for borrowing and lending. • Gains from holding MMI: the price paid lies below the price received at maturity. • Two forms: • Buy security at a discount, i.e. P < FV ‘Dollar Discount’: D =FV – P. • Earn interest, i.e. TV > FV ‘Dollar Interest’: TV – FV. Money Markets

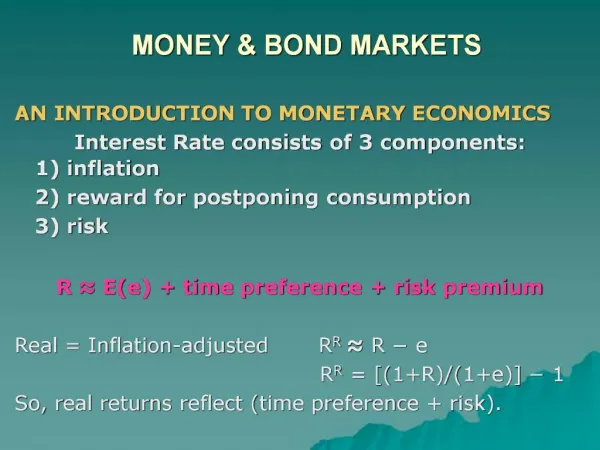

Caveats • Securities traded in market have varying maturities. • Changing interest rate environment implies the rate of return on new issues may differ from the original rate of return on older issues Price of older issues must adjust to compensate. • Rates quoted may refer to different ‘day count conventions’ • Rates quoted may be on discount or on yield basis • Need to find valid basis for comparison, i.e. agreed upon measures of return, in order to find correct price, given FV and time to maturity, t. Money Markets

Key Variables for Financial Assets • Price paid • Maturity value • Interest (coupon) payments • Dates money changes hands • Legal Aspects • Risks Money Markets

Key co-ordinates of MM Instruments • Key coordinates: • Amount received • Time elapsed from payment to receipt (time to maturity) • Amount invested • From these coordinates a rate of return can be calculated • Here we ignore risk and legal aspects Money Markets

Rate of Return Conventions • There exist various rates of return that are quoted MMIs • They depend on a number of conventions: • Day count convention examples: • Actual/Actual • Actual/360 • 30/360 [Months assumed to have 30 days: Continental] • Discount (PFV) vs. yield (FVTV) • Annualised return? Simple annualised return usually quoted. Money Markets

360 vs. 365 Day Year • Loan type example: • 360: €1,000,000, 10%, 3 months: 0.1(90/360)1,000,000 = 25,000 • 365: €1,000,000, 10%, 3 months: 0.1(90/365)1,000,000 = 24,657 • Convert 360365: 0.1(365/360) = 0.10139 Money Markets

Number of Days to Maturity • 4.12. 12.05.: • Actual 159 days • 30 day months 4.12.4.05. is 150 days • 4.05.12.05.: 8 days • By 30 day month rule: 158 days. • Implied annualisation factor: • Actual/actual: 159/365 • Actual/360: 159/360 • 30/360: 158/360 Money Markets

Pricing Pure Discount Instruments • Annualised discount rate: • Price: • Dollar Discount: a = days in year & m = days to maturity N.B.: d is expressed in % terms Money Markets

Example Pure Discount Instrument • 91-day UK T-Bill actual/actual, FV = £1m, P = 950,000 • Discount rate? d = 0.2005 = [(1,000,000-950,000)/1,000,000](365/91) • ‘Sterling Discount? D = £50,000 • Yield? y = 0.2111 Money Markets

From Discount to Yield • Replace FV in the denominator with P: • or • y > d • The greater is y or d,the greater is (y-d) Money Markets

Example discount Instrument • UK Bank Acceptance for £1m, 87 days to maturity, P such that 12% discount. • Sterling Discount? • Price? Money Markets

Yield Quoted Instruments • Annualised Yield: • Price: • Terminal Value: Money Markets

Notice the equivalent Functional Form Money Markets

Example: Yield Instrument • Issue: £1m CD @ 12.5% for 120 days • Resale in secondary Market 58 days later to yield 11% • Price? Check results… Money Markets

Comparison: US Money & Bond Rates • Money Market Price: P = 95, FV = 100, m = 91 • Bond Market Price: Pb = 95, FV = 100, m = 91 • Money Market Discount Rate: • Bond Market Discount Rate: • Money Market Yield: • Bond Market Yield: • Money Market ‘Bond Yield Equivalent’: Money Markets

Example: US T-Bill • P = 97.912 FV = 100 m = 182 act./360 • d? Money Markets

Example: US CD • $1m 90 days 7% yield act./360 • TV? Money Markets

Example: US CD • Actual/360 • Original issue: $5m to yield 7.25%, 60 days • Sold after 39 days to yield 7% • At what price did the CD trade? • Find discounted present value of TV: Money Markets

Comparing Rates • Convert to Prices • Calculate benchmark rate (often compound) • US T-Bill, 90 days, d = 0.1, FV = $100 , act./360 • PT= 100-10(90/360)=97.5, D = 2.5 • Simple Annual: [(100/97.5)-1](365/90) = 0.104 • Compound return: [(100/97.5)365/90-1] = 0.108 Money Markets

Comparing Rates (continued) • Eurodollar, 90 days, y = 0.1, act./360 • TV = 97.5[1+0.1(90/360)] = 99.94 • Simple Annual: [(99.94/97.5)-1](365/90) = 0.1015 • Compound: (99.94/97.5)365/90-1 = 0.1054 Money Markets