Decision Theory

240 likes | 718 Vues

Decision Theory. Learning Objectives. Structuring the decision problem and decision trees Types of decision making environments: Decision making under uncertainty when probabilities are not known Decision making under risk when probabilities are known Expected Value of Perfect Information

Decision Theory

E N D

Presentation Transcript

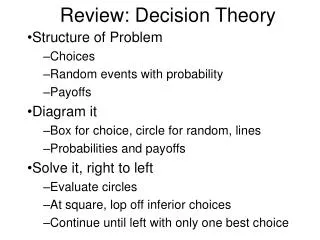

Learning Objectives • Structuring the decision problem and decision trees • Types of decision making environments: • Decision making under uncertainty when probabilities are not known • Decision making under risk when probabilities are known • Expected Value of Perfect Information • Decision Analysis with Sample Information • Developing a Decision Strategy • Expected Value of Sample Information

Types Of Decision Making Environments • Type 1: Decision Making under Certainty. Decision maker know for sure (that is, with certainty) outcome or consequence of every decision alternative. • Type 2: Decision Making under Uncertainty. Decision maker has no information at all about various outcomes or states of nature. • Type 3: Decision Making under Risk. • Decision maker has some knowledge regarding probability of occurrence of each outcome or state of nature.

Decision Trees • A decision tree is a chronological representation of the decision problem. • Each decision tree has two types of nodes; round nodes correspond to the states of nature while square nodes correspond to the decision alternatives. • The branches leaving each round node represent the different states of nature while the branches leaving each square node represent the different decision alternatives. • At the end of each limb of a tree are the payoffs attained from the series of branches making up that limb.

Decision Making Under Uncertainty • If the decision maker does not know with certainty which state of nature will occur, then he/she is said to be making decision under uncertainty. • The five commonly used criteria for decision making under uncertainty are: • the optimistic approach (Maximax) • the conservative approach (Maximin) • the minimax regret approach (Minimax regret) • Equally likely (Laplace criterion) • Criterion of realism with (Hurwicz criterion)

Optimistic Approach • The optimistic approach would be used by an optimistic decision maker. • The decision with the largest possible payoff is chosen. • If the payoff table was in terms of costs, the decision with the lowest cost would be chosen.

Conservative Approach • The conservative approach would be used by a conservative decision maker. • For each decision the minimum payoff is listed and then the decision corresponding to the maximum of these minimum payoffs is selected. (Hence, the minimum possible payoff is maximized.) • If the payoff was in terms of costs, the maximum costs would be determined for each decision and then the decision corresponding to the minimum of these maximum costs is selected. (Hence, the maximum possible cost is minimized.)

Minimax Regret Approach • The minimax regret approach requires the construction of a regret table or an opportunity loss table. • This is done by calculating for each state of nature the difference between each payoff and the largest payoff for that state of nature. • Then, using this regret table, the maximum regret for each possible decision is listed. • The decision chosen is the one corresponding to the minimum of the maximum regrets.

Example: Marketing Strategy Consider the following problem with two decision alternatives (d1 & d2) and two states of nature S1 (Market Receptive) and S2 (Market Unfavorable) with the following payoff table representing profits ( $1000): States of Nature s1s3 d1 20 6 Decisions d2 25 3

Example: Optimistic Approach An optimistic decision maker would use the optimistic approach. All we really need to do is to choose the decision that has the largest single value in the payoff table. This largest value is 25, and hence the optimal decision is d2. Maximum DecisionPayoff d1 20 choose d2d2 25 maximum

Example: Conservative Approach A conservative decision maker would use the conservative approach. List the minimum payoff for each decision. Choose the decision with the maximum of these minimum payoffs. Minimum DecisionPayoff choose d1d1 6 maximum d2 3

Example: Minimax Regret Approach For the minimax regret approach, first compute a regret table by subtracting each payoff in a column from the largest payoff in that column. The resulting regret table is: s1s2 Maximum d1 5 0 5 d2 0 3 3 minimum Then, select the decision with minimum regret.

Example: Equally Likely (Laplace) Criterion Equally likely, also called Laplace, criterion finds decision alternative with highest average payoff. • First calculate average payoff for every alternative. • Then pick alternative with maximum average payoff. Average for d1 = (20 + 6)/2 = 13 Average for d2 = (25 + 3)/2 = 14 Thus, d2 is selected

Example: Criterion of Realism (Hurwicz) • Often called weighted average, the criterion of realism (or Hurwicz) decision criterion is a compromise between optimistic and a pessimistic decision. • First, select coefficient of realism, a, with a value between 0 and 1. When a is close to 1, decision maker is optimistic about future, and when a is close to 0, decision maker is pessimistic about future. • Payoff = a x (maximum payoff) + (1-a) x (minimum payoff) In our example let = 0.8 Payoff for d1 = 0.8*20+0.2*6=17.2 Payoff for d2 = 0.8*25+0.2*3=20.6 Thus, select d2

Decision Making with Probabilities • Expected Value Approach • If probabilistic information regarding the states of nature is available, one may use the expected Monetary value (EMV) approach (also known as Expected Value or EV). • Here the expected return for each decision is calculated by summing the products of the payoff under each state of nature and the probability of the respective state of nature occurring. • The decision yielding the best expected return is chosen.

Expected Value of a Decision Alternative • The expected value of a decision alternative is the sum of weighted payoffs for the decision alternative. • The expected value (EV) of decision alternative di is defined as: where: N = the number of states of nature P(sj) = the probability of state of nature sj Vij = the payoff corresponding to decision alternative di and state of nature sj

Example: Marketing Strategy • Expected Value Approach Refer to the previous problem. Assume the probability of the market being receptive is known to be 0.75. Use the expected monetary value criterion to determine the optimal decision.

Expected Value of Perfect Information • Frequently information is available that can improve the probability estimates for the states of nature. • The expected value of perfect information (EVPI) is the increase in the expected profit that would result if one knew with certainty which state of nature would occur. • The EVPI provides an upper bound on the expected value of any sample or survey information.

Expected Value of Perfect Information • EVPI Calculation • Step 1: Determine the optimal return corresponding to each state of nature. • Step 2: Compute the expected value of these optimal returns. • Step 3: Subtract the EV of the optimal decision from the amount determined in step (2).

Example: Marketing Strategy • Expected Value of Perfect Information Calculate the expected value for the best action for each state of nature and subtract the EV of the optimal decision. EVPI= .75(25,000) + .25(6,000) - 19,500 = $750