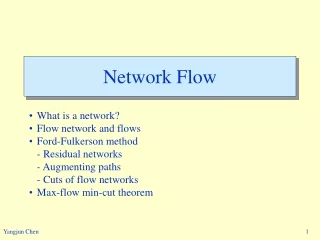

ENGM 732 Network Flow Programming

140 likes | 271 Vues

ENGM 732 Network Flow Programming. Network Flow Models. Generous Electric. [Fixed] (cost). A. [-30]. (4). (7). M. Push available supply at primary warehouses Ship to secondary Meet demand at secondary We have 80+70+90=240 flow in And 30+25+35+50=140 out.

ENGM 732 Network Flow Programming

E N D

Presentation Transcript

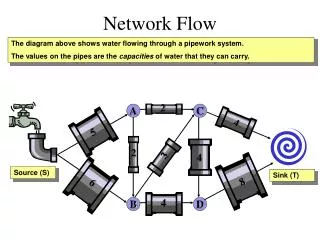

ENGM 732Network Flow Programming Network Flow Models

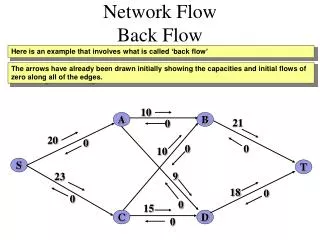

Generous Electric [Fixed] (cost) A [-30] (4) (7) M Push available supply at primary warehouses Ship to secondary Meet demand at secondary We have 80+70+90=240 flow in And 30+25+35+50=140 out. Flow in must = flow out How do we resolve? [80] V [-25] (6) (7) [70] L C [-35] D [90] R [-50]

Generous Electric [Fixed] (cost) A [-30] (4) (7) M Push available supply at primary warehouses Ship to secondary Meet demand at secondary Add a dummy node [80] V [-25] (6) (7) [70] L C [-35] D [90] R [-50] (0) (0) (0) D [-100]

Generous Electric [Fixed, Slack, Cost] (cost) A [-30] (4) (7) [0,80,1.0] M Push available supply at primary warehouses Ship to secondary Meet demand at secondary Add a dummy node V [-25] (6) (7) [0,70,1.2] L C [-35] D [0,90,1.1] R [-50]

K Power K Power has 2 fields from which they obtain fuel for their plants. It is sent to one of two facilities for refinement before being sent to generating plants. Refinery A produces 1 unit from 2 units of input and has a capacity of 50 units per year. Refinery B produces 1 unit from 3 units of input and has a capacity of 75 units per year. Refined fuel is sent to one of two plants. Each unit of fuel produced by refinery B produces 1 unit of power. Each unit of fuel produced by refinery A produces 0.8 units of power.

K-Power Shipping cost for mineral ore is $0.01 per mile. Distances ore fields and refineries follow: Field Refinery A Refinery B 1 100 200 2 80 70 Shipping cost for refined ore to generating station is $0.01 per mile. Refinery Station A Station B A 100 120 B 80 50 Costs for generating power at stations A and B are Station Cost Capacity A $1.50 50 B $1.75 75

K-Power (Capacity, cost, gain) [Fixed, slack, cost) F1 F2 F2 F1 RB RA RB SB SA SB SA RA (100,1,1) [0,500,0] (M,1,.8) (50,1.5,1) (100,1,.5) (M,1,1) (100,2,1) (200,4,1) (M,1.2,.8) (M,.8,1) (M,.5,.9) (M,.8,1) (M,.5,.9) (200,0.5,1) (M,2,1) [0,500,0] (100,2,1) (M,.7,1) (75,1.75,1) (200,5,1) (150,1,.33) (M,.5,1) Mine ore Ship to Refinery Refine the ore Ship to Stations Station generation To Distribution

Economic Valuation Suppose we have two projects, A & B A B Initial cost $50,000 $80,000 Annual maintenance 1,000 3,000 Increased productivity 10,000 15,000 Life 10 10 Salvage 10,000 20,000

10 9 9 . . . 0 1 2 3 10 50 Economic Valuation A NPW(10) = -50 + 9(P/A,10,10) + 10(P/F,10,10) = -50 + 9(6.1446) + 10(.3855) = $9,156

20 12 12 . . . 0 1 2 3 10 Economic Valuation B NPW(10) = -80 + 12(P/A,10,10) + 20(P/F,10,10) = -80 + 12(6.1446) + 20(.3855) = $1,445

Economic Valuation 1 2 (-$9,156) [1] [-1] (-$1,445)

Investment Cap • Suppose I can invest in Multiple projects but I have an investment cap of $100M. Initial Cost NPW return (above cost) • A1 $50M $75M • A2 $30M $60M • A3 $20M $45M • A4 $30M $50M

Economic Valuation 1 2 A1+A2+A3 A1+A3+A4 A2+A3+A4 [1] [-1] A1+A2 A1+A4

K-Chair (Sales) (0,M,1) (lower, upper, cost) [Fixed, slack, cost] (0,500,5) [-500,-1500,-20] (0,M,1) (0,M,.2) [800,M,2] (400,750,7) (0,M,2) [-100,-300,-15] 3 SF 9 NY 7 5 1 (0,M,0) (500,1000,3) 6 2 C H 10 8 4 [-500,-1000,-20] [800,M,1.5] (250,250,4) [-500,-1000,-18]