1 / 0

E-business models

0 likes | 253 Vues

E-business models. What’s different about E-Business?. E-Business require two forms of convergence: Technical level: convergence of multiple technologies into an integrated electronic infrastructure to conduct business. The internet The global telephone system

Télécharger la présentation

E-business models

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

-

E-business models

- What’s different about E-Business? E-Business require two forms of convergence: Technical level: convergence of multiple technologies into an integrated electronic infrastructure to conduct business. The internet The global telephone system The communication standard TCP/IP The addressing system of URLs PC Database of product and customer information Multimedia sound and graphics Universal use of browsers

- Business capabilities within and among firms: The integration of business processes Workflows IT infrastructures Knowledge Data assets E-business will drive organization to provide single point of contact to customers via electronic integration.

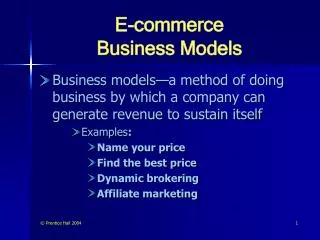

- E-business model A description of the roles and relationships among a firm’s customers, allies, and suppliers that identifies the major flows of product, information, and money, and the major benefits to participants.

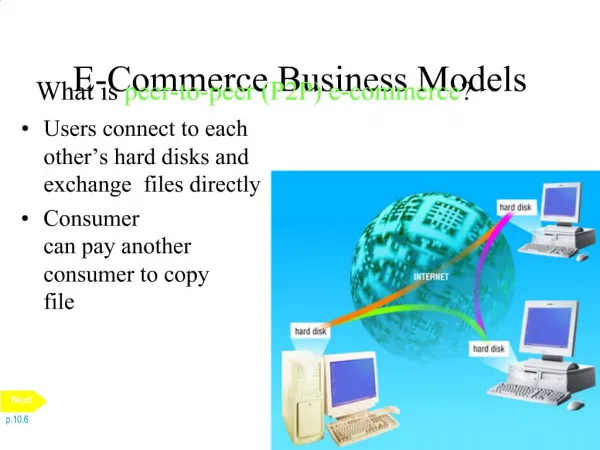

- Atomic E-Business Model Direct – to – Customer Full – Service Provide Portals, Agents, Auctions, Aggregators, and Other Intermediaries

- Direct – to – Customer Types of Direct – to – Customer E-Businesses Direct – to – Customer E-Business model schematic Case Study – CDNOW Logistic Challenge & Channel Management INFRASTRUCTURE Strategic Objective and Value Proposition Sources of Revenue Critical Success Factors Core Competencies

- Dell.com In 1994, Dell pioneered the use of the internet as a channel. Internet accounts for more than 50% of its revenues. Business and individual customers By removing dealer and distributors, Dell sells equivalent computers at higher margins than the competitors. Removing intermediaries also reduces time to market for new products. (1995 – 99)Average annual sales growth was 52% for Dell and 25% for Compaq. Dell’s margin was 5% higher than the industry average overall.

- Dell’s customers are 90% businesses and 10% individuals. Dell uses the internet effectively to deliver different value propositions to different segments within both B2C and B2B marketspaces. For transactional customers (approx. 30%) who need to be acquired

- Types of Direct – to – Customer E-Businesses Space - based firms (dot coms) selling their own branded products such as RealNetworks. Place-based firms also operating over the Internet, selling their own branded products. Gap, Lands’ End, Gillette and Nike Place-based firm selling third-party products both in physical outlets and on internet, such as Barnes & Noble dot-coms selling third-party products, such as CDNOW and Amazon.com

- Internet increases price competition for commodity items and reduces profitability for retailers selling undifferentiated items. Only 25% of direct-to-customer Internet only businesses return a profit The higher rate of direct-to-customer firms overall that make a profit (40%) reflects the result of place-based firms launching Internet businesses

- The dot coms must invest heavily to create a new brand, while catalogers and brick and mortar operators can simply migrate their brand to space 9953421471

- Direct-to-customer e-business model schematic

- Legend for e-business Model Schematic The organization whose business model is illustrated by the schematic The organization or individual from which the firm of interest obtain Goods, services or information. There is generally a flow of money from firm of interest to its suppliers. Who consumes the firm of interest’s goods, services, or information . There is generally a flow of money from customer to firm of interest.

- Legend for e-business Model Schematic An organization whose products help to enhance the demand for the firm of interest’s product A digital connection through which messages flow in both directions. This connection is the internet. The firm with the greatest potential to own the customer relationship. Owning the customer relationship provides the firm with the opportunity to know the largest amount of useful knowledge about The customer.

- Legend for e-business Model Schematic This one direction flow indicates payment from one party to another, In exchange for goods, services or information. This one direction flow indicates transfer of goods or digital products from one party to another Messages flow through all electronic relationships, therefore only those flows of information that are not digital products are represented by this icon. This information is often the result of research about a product or service and usually free.

- Direct-to-customer The firm of interest owns the customer relationship. The customer relationship enables the firm to collect data to profile the customer, who can be encouraged to become repeat customer. Owns customer data – has the potential to develop powerful insight into customers’ needs and desires. Owns transactions – receives a fee or profit margin for the item sold.

- Direct-to-customer Channel conflict Compaq Australia – Harvey Norman Chain stopped stocking the brand. Had other resellers Margins gained from direct sales Direct-to-customer model contains risk as well as opportunity

- Direct-to-customer disasters Boo.com – an online only retailer of fashion and sports wear. Was undone by its own technical ambitions and the unrealistic expectations created among its prospective customers. Other retailers have been undone by a misunderstanding or misapplication of the Direct-to-customer business model Failure to adapt the model as time changes

- CDNOW Case Study One of the poster children of direct selling on the Internet Article - “ CDNOW is one of the pioneers who never crashed or burned. They did it right. They offer the music, the diversity of interests, and best of all they keep it simple. Drawing on their humble beginnings in the early days of August 1994, they have built online market force. They have become a brand name” From its initial public offering price of $16 in early 1998 – despite having lost nearly $11 million on sales of $17 millions the year before – CDNOW’s shares reached a high of $39.25 before falling back to $20. Higher customer acquisition ($45) to attract each customer was given as one of the reason.

- CDNOW Case Study The site offers more than 500,000 CDs and other music related products and 650,000 sound samples, as well as daily news, features, guides to music genres, and exclusive interviews and reviews by CDNOW’s editorial staff. Revenue – direct sales, selling advertisings Paid Yahoo for placements on their site. CDNOW merged with competitor N2K in 1999 and in the same year it announced a merger with Columbia House , the music club jointly owned by Sony and Time Warner. The merger fell through in 2000 but agreed to commit $51 million to prop up CDNOW. Only one month later company’s situation appeared dire

- CDNOW Case Study According to company auditors – “Company has suffered recurring losses from operations, and has a working capital deficiency and significant payment due in 2000 related to marketing agreements that raises substantial doubt about its ability to continue as growing concern” What went wrong? Competition Technical challenge And, an unclear , undifferentiated category 4 direct-to-customer e-business model Amazon entered into CD’s and became the largest online sellers of CDs Technologically CDNOW was challenged by the rise of MP3

- CDNOW Case Study The direct-to-customer e-business model used by CDNOW may have been right for 1994 but it was outdated by 2000. CDNOW had nothing other than CD to sell Plenty of traffic but not enough profit from sales, and inadequate revenue from other sources. CDNOW illustrates the dilemma faced by category 4 direct-to-customer e-business model selling commodity products. Without a large market share or the ability to cross sell a wide variety of products, the value proposition is relatively weak. Consequently, profitability is elusive with customer acquisition rate high relative to the small average sale per customer.

- Logistic Challenge Major challenge – getting the right product to the right address reliably and economically. Non-delivery and wrong delivery : biggest single source of complaints in e-business. Two shipping approaches are available to direct-to-customer firms: Invest outsource

- Invest Firms are building extensive networks of distribution centers and delivery mechanisms. Significant investment and management attention Amazon 200 customer service representatives “put things right”

- Outsource Many service providers offer full service logistics support Federal express fedEx marketplace : one click access to several top online merchants Fast and efficient transaction processing, fulfillment, and payment Critical success factors or core competency ?

- Channel Management Does the firm directly serve customers in both place and space (2 & 3) or in space only (1 & 4)? 2 & 3 – internet as another channel Reduced cost or with greater customer intimacy Channel conflict – could be severe enough to make a manufacturer rethink its online strategy Levi Strauss & Co. abandoned its e-commerce site Channel conflict – can be managed Estee Lauder : skincare and cosmetics company

- INFRASTRUCTURE Application infrastructure Communications IT Management

- INFRASTRUCTURE Payment transaction processing to process online customer payments ERP to process customer transactions Workflow infrastructure to optimize business process performance Communication network services linking all points in the enterprise to each other and the outside world, often using the TCP/IP protocol

- INFRASTRUCTURE The installation and maintenance of workstations and local area networks supporting the large number of people required to operate a direct-to-customer model; Service-level agreements between business and the IT group or outsourcer to ensure, monitor, and improve the system necessary for the model

- Strategic Objective and Value proposition Traditional retail – buy, move and sell E-business direct-to-customer model – sell, buy and move Firm of interest : Higher margins Expanded markets Greater information about customers Customer Greater choice Increased convenience Lower costs

- Strategic Objective and Value proposition One of the most profitable of the models, as the firm own all of the three customer assets: Relationship Data Transaction The model is potentially profitable particularly for companies holding large market shares and offering a clearly differentiated value proposition Dell, Realnetworks … Other categories of 1 & 2 firms

- Strategic Objective and Value proposition For the firms following a less differentiated models (firms 3 & 4) profits will be hard to achieve as internet facilitates Easy comparison on objective measures such as price Therefore, only a small number of category 3 & 4 firms will thrive and capture large market share

- Sources of Revenue Direct sales to customer Supplemental revenues – Advertising Sale of customer information Product placement fees Higher margins may also be attained – Reducing the cost to serve the customer directly Cutting steps out of the distribution chain

- Sources of Revenue RealNetworks’s approximate breakdown of revenue sources : Consumer media players (40%) Streaming software for business customers (30%) Content delivery (20%) Advertising (10%)

- Critical Success Factors Create and maintain customer awareness, in order to build a critical mass of users to cover the fixed cost of building an electronic presence Reduce customer acquisition costs Strive to own the customer relationship and understand individual customer needs Increase repeat purchases and average transaction size

- Critical Success Factors Provide fast and efficient transaction processing, fulfillment, and payment Ensure adequate security for the organization and its customers Provide interfaces that combine ease of use with richness of experience, integrating multiple channels

- Core Competencies Forming and managing strategic partnerships with suppliers, payment processors, fulfillment houses, and others in the supply chain. Using the ownership of the customer information assets to understand customer needs, thereby increasing revenues and margins Marketing, prospecting, and selling electronically using banner advertisements, emails, affiliate programs, and click throughs from allies. Creating unique content to reduce price competition on commodities

- Full – Service Provider Full – Service Provider E-Business model schematic B2C & B2B Full – Service Providers INFRASTRUCTURE Channel and Segments Case Study GE Supply Company Strategic Objective and Value Proposition Sources of Revenue Critical Success Factors Core Competencies

- Full – Service Provider Model combines the strength of both the direct-to-customer and the intermediary models. A firm using the Full – Service Provider model provides total coverage of customer needs in a particular domain consolidated via a single point of contact. Sourced internally or externally Domain : financial services, health care, or industrial chemicals

- Full – Service Provider Prudential Advisor, established by Prudential Securities, a subsidiary of the Prudential Insurance Company of America. Prudential Advisor is redefining the full service relationship and bringing together a wealth of resources to support educated investment decisions. Allows customer to interact in person or by telephone with a live financial adviser. A flat fee for trade, and an annual fee

- Prudential Advisor allows Prudential Securities to own the customer relationship, the data about what the customers are doing with regards to investment Some of the transactions Helps Prudential to cross sell Third party does not own the customer relationship

More Related