June, 2011

200 likes | 355 Vues

June, 2011. TFKB PROFILE. CURRENT STATUS. BEFORE MERGER. AFTER MERGER. SALES PROTOCOL. WITH. Family Finans and Anadolu Finans merged under the name of Turkiye Finans after the approval of BRSA dd.28.12.2005. Special Finance House gained the status of Participation Bank in 2005. .

June, 2011

E N D

Presentation Transcript

TFKB PROFILE CURRENT STATUS BEFORE MERGER AFTER MERGER SALES PROTOCOL WITH • Family Finans and Anadolu Finans merged under the name of Turkiye Finans after the approval of BRSA dd.28.12.2005. • Special Finance House gained the status of Participation Bank in 2005. • In 2008, as a part of NCB’s international expansion strategy, 64.68% share of Turkiye Finans was acquired by NCB whereas Ulker Group and Boydak Holding remained as strategic partners with 13.76% and 21.56% shares respectively. • TFKB with NCB partnership will continue its growth performance and prove to be more competitive in both national and international markests in the forthcoming period. • 183 branches and 6 regional branches all over Turkey. • More than 500.000 individual and 20.000 corporate customers. • 360.356 credit cards and 3404 employees. • Family Finans operated with special finance house status with interest free banking principles between 1985 – 2005 owned by Ulker Group. • Anadolu Finans operated with special finance house status with interest free banking principles between 1991-2005 owned by Boydak Holding.

SHAREHOLDERS • The National Commercial Bank is the most prominent of Saudi banks and was the first bank established in Saudi Arabia (1953). • The Bank operated 280 branches throughout the Kingdom, dedicated exclusively to Islamic Banking services. • They have an OBU in Bahrain a branch in Beirut, a rep. office in each London, Singapore and Seoul. They are aiming to open a rep. office in China and to take over a bank in Egypt. • The credit rating of the bank has increased to A by Fitch Agency and A+ by Standard and Poors. NCB is the largest Bank in terms of capital in the Arab world. The Bank’s paid-up capital at year-end of 2009 is US$ 4,000 million. • Total assets at year-end 2009 totaled US$ 68,654 million. • Net profit for fiscal year 2009 totaled US$ 1,077 million. • Shareholders’ equity at year-end 2009 totaled US$ 7,806 million. • Founded in 1944 • 10,9 billion USD turnover in 2008, • 1,3 billion USD exports and international operations’ revenue. • Employing around 29,500 employees at 68 companies and 53 factories, 10 of which are in abroad. • 13 companies of Ülker Group are enlisted among top 500 industrial firms in Turkey. • Market leader in many sub-segments of food and beverage industries and operating in packaging, IT, real estate sectors. • Founded in 1959 • USD 3.4 billion turnover in 2008 • USD 363 million export volume • More than 11.000 employees • 22 Companies • Leader of Furniture, Home Textile, Cable Sectors • Factories are located in Turkey (Kayseri and Bursa,) .

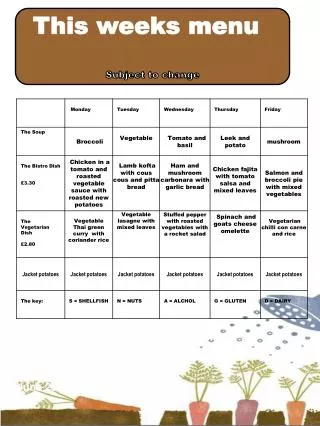

PRODUCTS AND SERVICES • SME Sectoral Packages and SME Financing • FX • Guarantee Support • Leasing • Profit/ Loss Participation • Franchising and Agricultural Loans • Letter of Credits and Guarantees • Personal Financing • Credit Cards • POS • Invoice Payments • Securities • Correspondent Banking • Exports/ Imports • Customer Transfers • Check Collection • ECA/SEP/GSM/ITFC Credits • Syndications • Project Financing • Consulting Services • Treasury Transactions • Internet Banking • Mobile Banking • ATM Banking • SMS Banking • E-Reminder Service • Telephone Banking

TFKB FIGURES LAST 5 YEARS BY GRAPHICS

TFKB FIGURES LAST 5 YEARS BY GRAPHICS

RANKING* AMONG PRIVATE BANKS IN TURKEY * As of December 2010 **TFKB ranks 12th byassets *** TFKB ranks 11th byprofitability

OUR BRANCHES Kastamonu Giresun Mardin • İSTANBUL : 72Branches + İstanbul Anadolu and Avrupa Regional Branches • ANKARA : 15 Branches+Ankara Regioal Branch • İZMİR : 5 Branches + İzmir Regional Branch • ADANA : 4 Branches + Adana Regional Branch • KAYSERİ : 20 Branches + Kayseri Regional Branch • THROUGHOUT TURKEY: 183 Branches

AWARDS “2007 BEST ISLAMIC BANK AND THE SERVICE PROVIDING INSTITUTION” BY ISLAMIC FINANCE NEWS MAGAZINE “2008 BEST ISLAMIC BANK IN TURKEY” BY GLOBAL FINANCE MAGAZINE

“2009 BEST ISLAMIC BANK IN TURKEY” BY ISLAMIC FINANCE NEWS MAGAZINE” “2010 BEST ISLAMIC FINANCE BANK IN TURKEY” BY GLOBAL FINANCE NEWS MAGAZINE”

ISLAMIC BANKING DEFINITIONS Mudaraba Murabaha Musharakah Sukuk