Understanding GDP Components and Their Influence on Economic Indicators

240 likes | 375 Vues

This review explores the key components of Gross Domestic Product (GDP), including consumption (C), investment (I), government spending (G), and net exports (NX). It outlines how disposable income affects consumption patterns and savings. Additionally, the relationship between imports, exports, and economic growth is discussed, highlighting the demand-side equilibrium and the multiplier effect of spending. The impact of fiscal policy on aggregate demand, money supply changes, inflation expectations, and economic growth determinants are also examined, providing a comprehensive overview of macroeconomic dynamics.

Understanding GDP Components and Their Influence on Economic Indicators

E N D

Presentation Transcript

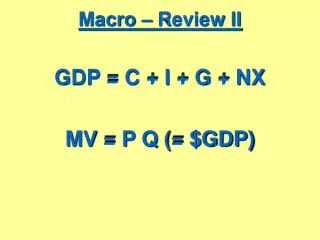

Macro – Review II GDP = C + I + G + NX MV = P Q (= $GDP)

Aggregate Expenditures = AE = GDP Y = AE = C + I + G + NX • Disposable income = Yd =Y-T = after tax income. Yd = Y - T = C + S Consumption is related to disposable income (Y-T). C = Ca +cYd where c = Marginal Propensity to Consume = mpc Ca = Autonomous consumption • Additional income not consumed is saved mpc + mps =1

Imports and Exports The demand for imports depends on current economic activity, YIM = IMa + mpi Y • “mpi” is the marginal propensity to import • Exports are exogenously determined • they depend on conditions in foreign economies, not our economy • Net exports is NX = EX – (IMa + mpi Y) orNX = NXa – mpi Y • Net expects decrease as the economy expands

Demand-Side Equilibrium and the MultiplierAt equilibrium: Y = C + I + G + NX = AEIncrease in Y = Spending Multiplier x {Increase in Autonomous Spending}Multiplier = 1/(mps + mpi)

From Aggregate Expenditure toAggregate Demand:As price level rises, real money balances decrease and consumption function shifts owing toi) wealth effectii) interest rate effectiii) international competition

Demand-Side Policy: Greater Spending Means Higher Prices (c) Aggregate Demand and Supply in the classical range of AS curve. (Prices rise without significant improvements in output and employment.) Price Level AD1 AD Y? Real GDP

Fiscal Policy: Some Definitions • Fiscal policy: government spending and taxing • Demand-side policies • Supply-side policies: • Discretionary Fiscal Policy: aimed at achieving a policy goal. • Automatic Stabilizer: fiscal policy that changes automatically and countercyclically as income changes. • Progressive taxes • Unemployment insurance • Welfare payments / other transfer payments

Functions of Money • Medium of exchange • Unit of account • Standard of Deferred Payment • Store of value

Multiple Creation of Bank Deposits M1Fractional Reserve Banking System: r = .1Deposit expansion multiplier = 1/r(when banks lend all excess reserves andpublic redeposits proceeds of loans into the banking system no leakages)

The Fed’s Policy Tools 1) Reserve Requirements 2) Discount rate “primary credit rate” 3) Open market operations • Manage the public’s expectations Inflation Targeting?

Equation of Exchange: relates quantity of money to nominal GDP • M = money supply (some aggregate) • V = velocity of money (of the aggregate) • P = price level • Q = real GDP • PQ = nominal GDP MV = PQ (Note: V = PQ/M) Money Demand • Transactions demand • Precautionary demand • Speculative demand … fear decline in the value of other assets, so hold money as a safeguard.

Starting at (1): 5% unemployment and 3% inflation. People believe inflation will continue at 3% Curve I. • Then Fed hypes inflation to 6% unemployment falls to 3% (Point 2 on Curve I). • Expectations adjust to 6% inflation Wage demands up Economy moves to point (3) Unemployment returns to 5%. • If expectations adjust instantly, e.g., anticipating Fed’s policy, economy moves directly from (1) to (3). Expectations and the Phillips Curve

Expectations Formation • Adaptive Expectations: expectations of the future based on history • The public acts on its expectations The present depends on the past • Rational Expectations: expectation based on all available relevant information. • The public understands how the economy works. • The public knows the structure and linkages between variables in the economy. • The public anticipates policy actions and their consequence • The public acts now on its expectations The present depends on the future

New Classical Economics:Rational Expectations Policy Ineffectiveness{Expansionary policy movement from 1 to 3}

Macroeconomic ViewpointsLaissez - FaireClassical Monetarist New ClassicalActivist/InterventionistKeynesian New Keynesian

The Modern Keynesian Model:Sticky Prices Demand Management Policies Can Stabilize an Unstable Economy

Long and Variable Policy Lags • 1. Recognition Lag: policymakers need time to realize that there is a problem. • 2. Reaction Lag: they need time to formulate an appropriate policy response. • 3. Effect Lag: policy takes time to implement and work through the economy. • Countercyclical policies can become procyclical policies, worsening fluctuations

Economic Growth • Economic growth: an increase in Real GDP. • Small changes in rates of growth Big changes over many years • Per Capita Real GDP: real GDP divided by population. Determinants of Economic Growth • Size and quality of the labor force • Capital • Land/Natural Resources … are not a necessary condition for economic growth … they can be acquired through trade. • Technology

Determinants of Growth • Size and quality of the labor force • Capital • Land/Natural Resources … are not a necessary condition for economic growth … they can be acquired through trade. • Technology