Financial Analysis Metrics for Company XYZ

220 likes | 234 Vues

This guide provides insight into key financial ratios and performance indicators for evaluating the financial health of Company XYZ. Learn about current ratio, creditors days, dividend yield, debt/equity ratio, and more to make informed investment decisions.

Financial Analysis Metrics for Company XYZ

E N D

Presentation Transcript

Who has …… Current Ratio Start Card

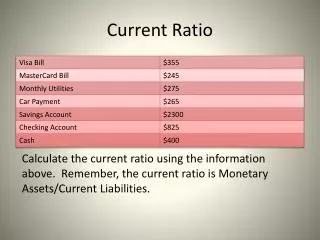

Current Assets Current Liabilities Creditors Days (Average period of credit received)

Trade Creditors X 12 (or 365) Credit Purchases Dividend Yield

Dividend per Share Market Price per Share Debt/Total Capital Percentage X 100

Debt Capital Total Capital Gross Margin X 100

Gross Profit Sales DPS Dividend per share X 100

Total Ordinary Dividend Number of issued ordinary shares Return on Shareholders Funds

Profit (after tax and preference divs) Ordinary Shares plus reserves Debt/Equity Ratio X 100

Price Dividend Ratio Debt Capital : Equity Capital

Market Price per Share Dividend per Share Net Margin

Acid Test Net Profit before interest and tax Sales X 100

Current Assets – C. Stock Current Liabilities P/E Ratio

Market Price per Share EPS (Earnings per share) Stock Turnover

(OS + CS) 2 Cost of Sales Average Stock ( ) Fixed Asset Turnover

Sales Fixed Assets Dividend Cover

Profit (after tax and preference dividends) Total Ordinary Dividend Return on Capital Employed (RoCE)

Profit before interest and tax Shareholders Funds + LT Liabilities Mark-Up X 100

Gross Profit Cost of Sales Debtors Days (Average period of credit Allowed) X 100

Trade Debtors X 12 (or 365) Credit Sales Interest Cover

Operating Profit Interest Charges Earnings Per Share (EPS)

I Have …… Profit (after tax and preference dividends) Number of Issued Ordinary Shares End Card

Sequence • Current Ratio • Creditors Days • Dividend Yield • Debt/Total Capital % • Gross Margin • DPS • Return on Shareholder Funds • Debt/Equity Ratio • Price Dividend Ratio • Net Margin • Acid Test • P/E Ratio • Stock Turnover • Fixed Asset Turnover • Dividend Cover • Return on Capital Employed (RoCE) • Mark-Up • Debtors Days • Interest Cover • Earnings Per Share