UNL PARs and Effort Reporting Workshop

490 likes | 526 Vues

Learn about UNL's Personnel Activity Report (PAR) form, accurate effort certification, and efficient PAR completion system. Coaching on PAR completion for federal projects.

UNL PARs and Effort Reporting Workshop

E N D

Presentation Transcript

PARs and Effort Reporting NURAMP Spring 2017

Workshop Objectives By the end of this workshop, you will be able to: • Understand UNL’s Personnel Activity Report (PAR) form • Identify all parts of a PAR • Name the reasons for completing a PAR consistently and accurately • Complete an example PAR

Objectives, continued • Accurately certify expended effort • on federally and some non-federally funded projects • under a cost share agreement • Develop a system for efficiently completing and certifying a PAR • Coach others (faculty, students and staff) about how to complete a PAR

Main Workshop Topics • About PARs and effort reporting • Certification steps • Reporting cost share • Reporting for 9/12 employees

About PARs and Effort Reporting • The mechanism used to confirm that salaries charged to each sponsored agreement are reasonable in relation to the actual work performed. • UNL has chosen the “after-the-fact” activity records methodology. • At UNL, known as PARs (Personnel Activity Reports).

Reasons for Effort Reporting Federal regulations (Uniform Guidance 2CFR§200.430) require institutions that receive federal funds to maintain systems that accurately reflect the work performed and provide reasonable assurance the charges are accurate, allowable and properly allocated. Reporting is required for all employees paid from federal or federal flow-through projects and/or under a cost sharing agreement.

When is a PAR created? • When salary is from a federal or federal pass-through source (salary certification) • 24-XXXX-XXXX-XXX • 25-XXXX-XXXX-XXX • Some 26-XXXX-XXXX-XXX • When cost share is required - quantifiable • For IANR Hatch/Smith-Lever cost objects • 21-62DD-0762 federal funds • 21-62DD-0862 state match • 21-63DD-0763 federal funds • 21-63DD-0863 state match

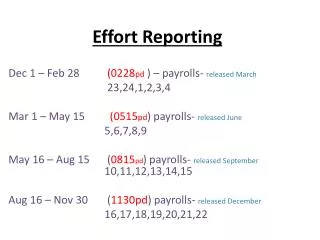

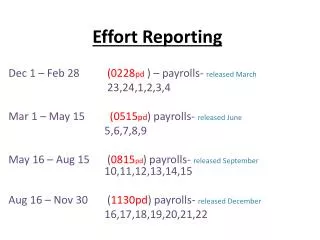

How often are PARs generated? • Three times a year: • June distribution • For the spring period: January through May • September distribution • For the summer period: June through August: • January distribution • For the fall period: September through December

Who certifies the PAR? • A person with first-hand knowledge of the effort: • Employee • Supervisor • Principal Investigator • Employees should report their own effort • Or effort may be reported by a responsible person using suitable means of verification that the work was performed

Why accurate and on-time PARs matter • UNL must comply with Uniform Guidance 2CFR§200.430 to avoid: • Loss of federal funds • Debarment list • Inability to receive future federal funds • Disallowance of items of expense upon audit

Categories of effort • Instruction • Teaching, training and direct administration activities, including departmental research. • All research and development activities that ARE NOT separately budgeted and accounted for as organized research. • Research • Includes organized research, except Ag Experiment Station • All research and development activities that ARE separately budgeted and accounted for

Categories of effort • Public Service: • Public Service related programs and projects • Financed by federal and non-federal agencies • Not instruction or organized research (excludes cooperative extension) • Other Sponsored Activities: • Public Service activities, except cooperative extension • Funded by federal and non-federal agencies.

Categories of effort • Agricultural Experiment Station: • All research activities separately budgeted and accounted for • Administered by the Agricultural Experiment Station • All Agricultural Experiment Station research activities included, whether funded from university, Hatch, or any other federal or non-federal funds.

Categories of effort • Cooperative Extension Service: • All extension service activities administered by the Cooperative Extension Service Division of the Institute for Agriculture & Natural Resources (IANR). • Patient Care Services .

Categories of effort • Administration (all administrative effort) • Student administration • Advising and counseling; student affairs and service activities • Departmental administration • Administrative and supporting activities • Benefit an academic department’s common or joint departmental objectives • Sponsored project administration • Effort to develop and administer sponsored projects • College/school administration • Supervisory, managerial, or administrative duties in dean’s office • General administration • University-wide general executive and administrative activities or committee efforts

Categories of effort • Other Institutional Activities • Public/community service activities and extension services • Funded by institutional funds: e.g., State Museum, University Television • Plus UNL’s auxiliary operations • Resident halls, unions, libraries, or athletics.

Parts of a PAR Form, continued Print Your Name Sign Your Name Date

Steps for the Certification • Ignore cost objects and other items if no effort is associated with the payment (e.g.,fellowships, professorships, workstudy, stipends, cell phone charges, federal retirement, WBS #s from other campuses, negative amounts). • Identify cost objects under your department’s scope. • Calculate the % for each cost object and handwrite it on the left hand side of the form under the correct category.

Steps for the Certification, continued • Use “remarks” if needed to: • Explain why some cost objects were ignored • Indicate that just a portion of the 100% was certified • Indicate that the cost share was modified • Indicate 9/12 appointment • Alert Sponsored Programs that other action is required. • Print name and date. Sign the form. • Return to Sponsored Programs before due date (45 days from date PAR was received).

Try It! • Using the handout, work alone or in pairs to complete a basic PAR form.

2505060081001: $4,000/$20,000 = 20% 2601160145001: $8,000/$20,000 = 40% 2162220001: $6,000/$20,000 = 30% 2161220001: $2,000/$20,000 = 10% Return to: Post Award Admin 151 Prem S. Paul Research Center 0861 Jane Jones 10 20 40 30 Jane Jones Jane Jones 1/15/2014

Common Odd Scenarios • Items to ignore: professorships, fellowships, workstudy, stipends, cell phone charges, federal retirement, WBS’s from other campuses • PAFs / Retros: Affecting same period & previous periods • More than one department involved

Fellowship Professorship Work study

PAFs / Retros: Same period Return to: Post Award Admin 151 Prem S. Paul Research Center 0861 313 80 4 16 $487 was incorrectly charged to the cost object 25-0506-0063-001

Retros: Different periods Summer 2012 100 Re: retros, it’s very important to go back and review all of the PARs that are affected. If a PAR was already certified and a retro is made after the certification, then the PAR needs to be REVISED. Revised Spring 2012 75 25 78.7 21.3 Remarks: Retro made on Summer PAR: $1740.19 was incorrectly charged to 25-0511-0044-001 during May 2012

UNL Retroactive Payroll Justification Form Use this form for all retro adjustments older than 60 days. • Go to the Sapphire website: http://sapphire.nebraska.edu • Follow this path: Business Forms > UNL Business Forms > Human Resources > Forms (blank) > Retro PAF Instructions and Forms

Department 2 More Than One Department Involved Department 1 JULIE JONES Department 2 Department 1 Department 2 Department 1 2550.10 145.00 2156.30 54.40 Department 2 Dr. Jones Dr. Espy 2377011411 4.1 Department 1 notes: “Just Athletics effort” Department 1

Reporting Cost Share Cost share is the portion of a project that is borne by the University • If required as part of the project, UNL must document it was provided • Items must conform with same rules/regulations as direct charges the award falls under • Must support the work of the project • Can include salary and non-salary items as well as third party

Some notes on cost share • Cost share or matching funds • must come from a valid source other than the sponsored project and are identified in the proposal/agreement/contract • cannot come from another grant or sponsored project • percentage cannot be greater than the portion of salary paid from non-grant funds • There are two main types of cost share • Mandatory • Voluntary

Mandatory and Voluntary Definitions Mandatory • Required by sponsor as review criterion or condition of obtaining award Voluntary • Resources offered when no requirement in the sponsor's funding announcement • Nebraska strongly discourages voluntary cost sharing and it should not be offered or given for industry-sponsored projects • Quantified voluntary cost sharing becomes a commitment if project funded, then it’s mandatory

Cost Share vs. Matching Funds • Terms often used interchangeably • Matching funds are specific type of cost share, where grantee “matches” sponsor funding according to sponsor-specified ratio

In-kind and Cash Definitions In-kind Resources Nebraska already has available whether or not there are grant funds • Examples: • Existing state-funded faculty and staff time/effort that can be devoted specifically to project • Waived or unrecovered indirect cost amount, if sponsor allows Cash New costs Nebraska would incur in support of the project – expenses wouldn’t exist if not for project • Examples: • Personnel to be hired by Nebraska specifically to help with project • Project travel costs funded from a department account • Registration fees Note: Not all sponsors define these terms the same. If a sponsor requires these costs to be identified separately, need to check definition they use for each.

Third-Party Cost Share DEFINITION: Contributions given to a specific grant or contract by individual or group from outsideboth university and sponsoring agency. This can be the most difficult form of cost share to document and track. Types of third-party contributions: • In-kind • Non-cash contribution, such as personnel time, supplies, materials, etc., provided by third-party • Third-party responsible for adequately tracking and reporting to Nebraska their contributions • Cash • Cash commitment from non-Nebraska and non-project sponsor funding • May come through a donation to the NU Foundation Note: Should the 3rd party fail to provide the promised match, Nebraska is responsible for providing it.

Award with Cost Share When Nebraska accepts cost share as a condition of an award, Nebraska is required to maintain accurate records that are verifiable in our accounting system. • The department is responsible for tracking and documenting non-personnel cost share. • Details of documentation must be provided to OSP post-award for reporting.

Key Take-Away: Cost share expenditures can ONLY be used once Eligible costs can be allocated between multiple projects Example: You have 4 projects that all use a certain chemical, each project requires cost share. You have purchased $100 worth of the chemical. You can allocate an amount toward each project’s cost share requirement up to a total of $100. You must be able to justify the allocation just as you would for direct costs to the project.

Reporting for 9/12 Employees • Salary for 9-month employees is paid over 12 months (9/12) • A PAR may be issued when employee is not engaged in any work activities, but still receives a salary payment • 9-month employees may be paid additional salary to teach or work on sponsored research in the summer

Scenario 1: The employee gives no effort during the summer; the PAR form was generated only because the salary is split over 12 months • Mark all percentages as 0. • Cross out 100% total and write 0. • Remarks box: • Indicate that the employee is paid 9/12 and • That all effort was expended during the academic year (September-May).

Scenario 2: The employee gives effort during summer only to a sponsored project (no teaching) • Cross off all instructional salary sources • Record instructional effort as 0. • Calculate effort for sponsored research (or other non-teaching activities) using funding sources for those projects. • Remarks box: • Indicate that the employee is paid 9/12 and • All effort for the summer months was expended on the sponsored project(s).

Example, no instruction 2105220001 0.0 74 2605220001001 26 REMARKS: 9/12 employee, no instruction given during summer

PARs Guidebook Please access our Guidebook for Completing the Personnel Activity Reports. It can be found at: • http://research.unl.edu/sp1/docs/PARguidelines.pdf For Further Assistance . . . Contact the Office of Sponsored Programs Samantha Swanson 402-472-3608 sswanson7@unl.edu