Introduction to Decision Analysis

720 likes | 1.15k Vues

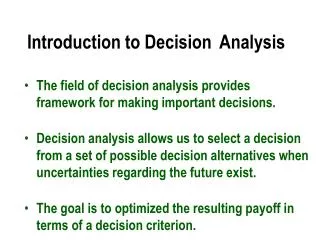

Introduction to Decision Analysis. The field of decision analysis provides framework for making important decisions. Decision analysis allows us to select a decision from a set of possible decision alternatives when uncertainties regarding the future exist.

Introduction to Decision Analysis

E N D

Presentation Transcript

Introduction to Decision Analysis • The field of decision analysis provides framework for making important decisions. • Decision analysis allows us to select a decision from a set of possible decision alternatives when uncertainties regarding the future exist. • The goal is to optimized the resulting payoff in terms of a decision criterion.

Components of a Decision Model • A set of possible decisions • discrete, continuous • finite, infinite • A set of possible events that could occur (states of nature) • discrete, continuous • finite, infinite • Payoffs (returns or costs) associated with each decision/state of nature pair

Payoff Table Analysis • Payoff Tables • Payoff Table analysis can be applied when - • There is a finite set of discrete decision alternatives. • The outcome of a decision is a function of a single future event. • In a Payoff Table - • The rows correspond to the possible decision alternatives. • The columns correspond to the possible future events. • Events (States of Nature) are mutually exclusive and collectively exhaustive. • The body of the table contains the payoffs.

EXAMPLETOM BROWN INVESTMENT DECISION • Tom Brown has inherited $1000. • He has decided to invest the money for one year. • A broker has suggested five potential investments. • Gold. • (Junk) Bond. • Growth Stock. • Certificate of Deposit. • Stock Option Hedge. • Tom has to decide how much to invest in each investment.

The States of Nature are Mutually Exclusive and Collective Exhaustive • Constructing a Payoff Table • Determine the set of possible decision alternatives. • for Tom this is the set of five investment opportunities. • Defined the states of nature. • Tom considers several stock market states (expressed by changes in the DJA) State of Nature DJA Correspondence S.1:A large rise in the stock market Increase over 1000 points S.2: A small rise in the stock market Increase between 300 and 1000 S.3: No change in the stock market Change between -300 and +300 S.4: A small fall in stock market Decrease between 300 and 800 S5: A large fall in the stock market Decrease of more than 800

Determining Payoffs • Our broker reasons: • Stocks and bonds generally move in the same direction of the market • Gold is an investment hedge that seems to move opposite to the market direction • A C/D account pays the same interest irrespective of market conditions • Specifically our broker’s analysis leads to the following payoff table:

Dominated Decision Alternatives The Stock Option hedge is dominated by the Bond Alternative, because the payoff for each state of nature for the stock option the payoff for the bond option. Thus the stock option hedge can be eliminated from any consideration.

Decision Making Criteria • Classifying Decision Making Criteria • Decision making under certainty • The future state of nature is assumed known • Decision making under risk • There is some knowledge of the probability of the states of nature occurring. • Decision making under uncertainty. • There is no knowledge about the probability of the states of nature occurring.

Decision Making Under Certainty • Given the “certain” state of nature, select the best possible decision for that state of nature

Decisions for Decision Making Under Certainty If we knewLarge Small No Small Large this ===> Rise Rise Change Fall Fall Gold-100 100200 300 0 Bond 250 200 150 -100 -150 Stock 500 250 100 -200 -600 C/D 60 60 60 60 60 Choose => Stock Stock Gold Gold C/D

Decision Making Under Uncertainty • The decision criteria are based on the decision maker’s attitude toward life. • These include an individual being pessimistic or optimistic, conservative or aggressive. • Criteria • Maximin Criterion - pessimistic or conservative approach. • Minimax Regret Criterion - pessimistic or conservative approach. • Maximax criterion - optimistic or aggressive approach. • Principle of Insufficient Reasoning.

Decision Making Under Uncertainty • The decision criteria are based on the decision maker’s attitude toward life. • These include an individual being pessimistic or optimistic, conservative or aggressive. • Criteria • Maximax (Minimin), Maximin (Minimax), Minimax Regret, Principle of Insufficient Reasoning

The Maximax Criterion • This criterion is based on the best possible scenario. • It fits both an optimistic and an aggressive decision maker. • An optimistic decision maker believes that the best possible outcome will always take place regardless of the decision made. • An aggressive decision maker looks for the decision with the highest payoff (when payoff is profit)

The Optimal decision TOM BROWN - continued • To find an optimal decision. • Find the maximum payoff for each decision alternative. • Select the decision alternative that has the maximum of the “maximum” payoff.

The Maximin Criterion • This criterion is based on the worst-case scenario. • It fits both a pessimistic and a conservative decision maker. • A pessimistic decision maker believes that the worst possible result will always occur. • A conservative decision maker wishes to ensure a guaranteed minimum possible payoff.

The Optimal decision TOM BROWN - Continued • To find an optimal decision • Record the minimum payoff across all states of nature for each decision. • Identify the decision with the maximum “minimum payoff”.

The Minimax Regret Criterion (“I shoulda”) • This criterion fits both a pessimistic and a conservative decision maker. • The payoff table is based on “lost opportunity,” or “regret”. • The decision maker incurs regret by failing to choose the “best” decision.

To find an optimal decision • For each state of nature. • Determine the best payoff over all decisions. • Calculate the regret for each decision alternative as the difference between its payoff value and this best payoff value. • For each decision find the maximum regret over all states of nature. • Select the decision alternative that has the minimum of these “maximum regrets”.

- (-100) The Optimal decision 500 = 600 500 TOM BROWN - continued -100 500 500 -100 -100 500 -100 -100 Investing in Gold incurs a regret when the market exhibits a large rise 500 500 Let us build the Regret Table

The Principle of Insufficient Reason • This criterion might appeal to a decision maker who is neither pessimistic nor optimistic. • It assumes all the states of nature are equally likely to occur. • The procedure to find an optimal decision. • For each decision add all the payoffs. • Select the decision with the largest sum (for profits).

TOM BROWN - continued • Sum of Payoffs • Gold $600 • Bond $350 • Stock $50 • C./D $300 • Based on this criterion the optimal decision alternative is to invest in gold.

Summary • Maximax Decision -- Stock • Maximin Decision -- C/D • Minimax Regret -- Junk Bond • Insufficient Reason -- Gold • Isn’t there a better way?

(Probability)(Payoff) Over States of Nature • Decision Making Under Risk • The Expected Value Criterion • If a probability estimate for the occurrence of each state of nature is available, payoff expected value can be calculated. • For each decision calculate its expected payoff by Expected Payoff =S Based on past market performance the analyst predicts: P(large rise) = .2, P(small rise) = .3, P(No change) = .3, P(small fall) = .1, P(large fall) = .1

The Optimal decision TOM BROWN - continued (0.2)(250) + (0.3)(200) + (0.3)(150) + (0.1)(-100) + (0.1)(-150) = 130

When to Use the Expected Value Approach • The Expected Value Criterion is useful in cases where long run planning is appropriate, and decision situations repeat themselves. • One problem with this criterion is that it does not consider attitude toward possible losses.

Expected Value of Perfect Information(EVPI) • The Gain in Expected Return obtained from knowing with certainty the future state of nature is called: Expected Value of Perfect Information (EVPI) • It is also the Smallest Expect Regret of any decision alternative. Therefore, the EVPI is the expected regret corresponding to the decision selected using the expected value criterion

Stock TOM BROWN - continued If it were known with certainty that there will be a “Large Rise” in the market -100 250 500 60 Large rise Similarly, ... the optimal decision would be to invest in... Expected Return with Perfect information = 0.2(500)+0.3(250)+0.3(200)+0.1(300)+0.1(60) = $271 EVPI = ERPI - EV = $271 - $130 = $141

Bayesian Analysis - Decision Making with Imperfect Information • Bayesian Statistic play a role in assessing additional information obtained from various sources. • This additional information may assist in refining original probability estimates, and help improve decision making.

When the stock market showed a large rise the forecast was “positive growth” 80% of the time. TOM BROWN - continued • Tom can purchase econometric forecast results for $50. • The forecast predicts “negative” or “positive” econometric growth. • Statistics regarding the forecast. Should Tom purchase the Forecast ?

SOLUTION • Tom should determine his optimal decisions when the forecast is “positive” and “negative”. • If his decisions change because of the forecast, he should compare the expected payoff with and without the forecast. • If the expected gain resulting from the decisions made with the forecast exceeds $50, he should purchase the forecast.

Tom needs to know the following probabilities • P(Large rise | The forecast predicted “Positive”) • P(Small rise | The forecast predicted “Positive”) • P(No change | The forecast predicted “Positive ”) • P(Small fall | The forecast predicted “Positive”) • P(Large Fall | The forecast predicted “Positive”) • P(Large rise | The forecast predicted “Negative ”) • P(Small rise | The forecast predicted “Negative”) • P(No change | The forecast predicted “Negative”) • P(Small fall | The forecast predicted “Negative”) • P(Large Fall) | The forecast predicted “Negative”)

P(B |A i)P(A i) [ P(B | A 1)P(A 1)+ P(B | A 2)P(A 2)+…+ P(B | A n)P(A n) ] P(A i| B) = 0.16 0.56 = X 0.2 0.3 0.3 0.1 0.1 0.286 0.375 0.268 0.071 0.000 The probability that the stock market shows “Large Rise” given that the forecast predicted “Positive” The Probability that the forecast is “positive” and the stock market shows “Large Rise”. • Bayes’ Theorem provides a procedure to calculate these probabilities Posterior Probabilities for “positive” economic forecast Observe the revision in the prior probabilities

Bayesian Prob. for “Negative” Forecast s P(s) P(Neg|s) P(Neg and s) P(s|Neg) Large Rise .20 .20 .04 .04/.44= .091 Small Rise .30 .30 .09 .09/.44= .205 No Change .30 .50 .15 .15/.44= .341 Small Fall .10 .60 .06 .06/.44= .136 Large Fall .10 1 .10 .10/.44= .227 .44

Gold Gold • Expected Value of Sample Information • The expected gain from making decisions based on Sample Information. • With the forecast available, the Expected Value of Return is revised. • Calculate Revised Expected Values for a given forecast as follows. • EV(Invest in……. |“Positive” forecast) = =.286( )+.375( )+.268( )+.071( )+0( ) = • EV(Invest in ……. | “Negative” forecast) = =.091( )+.205( )+.341( )+.136( )+.227( ) = Bond -100 100 200 300 0 $180 $84 250 -100 100 200 200 150 -100 300 -150 0 -100 100 200 300 0 Bond 0 -100 100 200 300 $120 $ 65 250 -100 100 200 150 200 -100 300 -150 0

EREV = Expected Value Without Sampling Information = 130 Expected Value of Sample Information - Excel • The rest of the revised EV s are calculated in a similar manner. So, Should Tom purchase the Forecast ? Invest in Stock when the Forecast is “Positive” ERSI = Expected Return with sample Information = (0.56)(250) + (0.44)(120) = $193 Invest in Gold when the forecast is “Negative”

EVSI = Expected Value of Sampling Information = ERSI - EREV = 193 - 130 = $63. Yes, Tom should purchase the Forecast. His expected return is greater than the Forecast cost. • Efficiency = EVSI / EVPI = 63 / 141 = 0.45

Decision Trees • The Payoff Table approach is useful for a single decision situation. • Many real-world decision problems consists of a sequence of dependent decisions. • Decision Trees are useful in analyzing multi-stage decision processes.

Characteristics of the Decision Tree • A Decision Tree is a chronological representation of the decision process • There are two types of nodes • Decision nodes (represented by squares) • State of nature nodes (representing by circles). • The root of the tree corresponds to the present time. • The tree is constructed outward into the future with branches emanating from the nodes. • A branch emanating from a decision node corresponds to a decision alternative. It includes a cost or benefit value. • A branch emanating from a state of nature node corresponds to a particular state of nature, and includes the probability of this state of nature.

BILL GALLEN DEVELOPMENT COMPANY • B. G. D. plans to do a commercial development on a property. • Relevant data • Asking price for the property is $300,000 • Construction cost is $500,000 • Selling price is approximated at $950,000 • Variance application costs $30,000 in fees and expenses • There is only 40% chance that the variance will be approved. • If B. G. D. purchases the property and the variance is denied, the property can be sold for a net return of $260,000 • A three month option on the property costs $20,000 which will allow B.G.D. to apply for the variance. • A consultant can be hired for $5000 • P (Consultant predicts approval | approval granted) = 0.70 • P (Consultant predicts denial | approval denied) = 0.90

What should BGD do? • Construction of the Decision Tree • Initially the company faces a decision about hiring the consultant. • After this decision is made more decisions follow regarding • Application for the variance. • Purchasing the option. • Purchasing the property.

0 3 Do nothing 0 Buy land Apply for variance 4 2 -300,000 -30,000 Purchase option Do not hire consultant -20,000 0 1 Apply for variance 11 Let us consider the decision to not hire a consultant -30,000 Hire consultant -5000

Buy land and Apply for variance 120,000 Build Sell 6 7 8 -500,000 950,000 Approved 0.4 5 Denied -70,000 Sell 0.6 9 10 260,000 Buy land Build Sell 13 14 16 15 Approved 950,000 -300,000 -500,000 100,000 0.4 12 Denied 0.6 17 -50,000 Purchase option and Apply for variance

Let us consider the decision to hire a consultant This is where we are at this stage

-5000 2 20 Do not hire consultant Let us consider the decision to hirea consultant 0 Do Nothing 1 Buy land Apply for variance 19 21 -300,000 Hire consultant -30,000 Predict Approval -5000 Purchase option 0.4 -20,000 Apply for variance 28 -30,000 18 Predict Denial -5000 36 0.6 Do Nothing Buy land Apply for variance 35 37 -300,000 -30,000 Purchase option -20,000 Apply for variance 44 -30,000

115,000 Build Sell 23 24 25 -500,000 950,000 Approved ? 0.8235 22 Denied -75,000 Sell ? 0.1765 26 27 260,000 Consultant predicts approval Posterior Probability of approval | consultant predicts approval) = 0.8235 Posterior Probability of denial | consultant predicts approval) = 0.1765 The consultant serves as a source for additional information about denial or approval of the variance. Therefore, at this point we need to calculate the posterior probabilities for the approval and denial of the variance application

Determining the Optimal Strategy The rest of the Decision Tree is built in a similar manner. Now, • Work backward from the end of each branch. • At a state of nature node, calculate the expected value of the node. • At a decision node, the branch that has the highest ending node value is the optimal decision. • The highest ending node value is the value for the decision node. Let us illustrate by evaluating one branch -- Hire consultant and consultant predicts approval

80500 115,000 115,000 115,000 115,000 115,000 (115,000)(.8235)=94702.5 115,000 80500 115,000 80500 80500 ? -75,000 -75,000 -75,000 - -75,000 -75,000 -75,000 -75,000 ? -22500 -22500 (-75,000)(.1765)= -13237.5 -22500 Build Sell 23 24 25 -500,000 950,000 Predict approval Approved 0.8235 22 Denied 81483 Sell 0.1765 26 27 260,000 • $81,483 is the expected value if consultant predicts approval and land is bought • In a similar manner, the expected value if consultant predicts approval and the option is purchased is $68,525 • The expected value if the consultant predicts approval and BGD does nothing is -$5,000 (the consultant’s fee). Thus if consultant recommends approval -- BUY LAND

Evaluation of Other Branches • DO NOT HIRE CONSULTANT • Do nothing EV = $0 • Buy land EV = $6,000 • Purchase option EV = $10,000 <==BEST • HIRE CONSULTANT -- PREDICTS DENIAL • Do nothing EV = -$5,000 <===BEST • Buy land EV = -$40,458 • Purchase option EV = -$27,730

BEST COURSE OF ACTION • EV(DO NOT HIRE CONSULTANT) = $10,000 • EV(HIRE CONSULTANT) = .4(81,483) + .6(-5000) = $29,593.20 OPTIMAL STRATEGY -- • HIRE CONSULTANT • If consultant predicts approval -- buy the land • If consultant predicts denial -- do nothing