Challenges and Opportunities in the Stamping Industry: Financial Analysis and Market Outlook

150 likes | 283 Vues

The stamping industry is currently grappling with significant financial challenges, particularly in the US market, where suppliers are seeing a 30-40% decline in utilization, leading to facility closures and increased bankruptcies. While suppliers in Europe and Asia are faring slightly better, the risk management for stamping suppliers remains critical. This report covers market segmentation, financial assessments of suppliers, and technological improvements. It also highlights opportunities in Latin America and Eastern Europe, emphasizing the need for dual-sourcing and strategic relationships for enhanced stability.

Challenges and Opportunities in the Stamping Industry: Financial Analysis and Market Outlook

E N D

Presentation Transcript

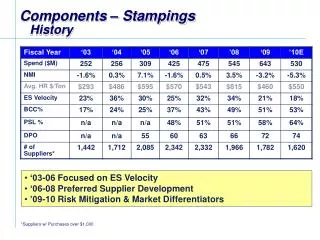

Components – Stampings History • ‘03-06 Focused on ES Velocity • ‘06-08 Preferred Supplier Development • ’09-10 Risk Mitigation & Market Differentiators *Suppliers w/ Purchases over $1,000

Components - Stampings Market Segmentation * US Market Only

Components - Stampings Market Update Stamping Industry facing significant financial stress: Avg. Supplier seeing 30-40% decline in utilization Closing Facilities / Chapter 7 Bankruptcies Market Value of Assets are worthless Financial Issues contained mostly to USA Stampers: EU/Asia suppliers faring a little better Fabrication/Enclosures revenue down 10-20% Risk Mitigation for Stamping Suppliers is Critical 3

Components – Stamping Supplier Financial Analysis ~$100M in Purchases w/ Highly Leveraged Suppliers / Dual-Sourcing is Required Note: Financial Data based upon received Surveys from 93 Preferred Suppliers

Components – Stamping Supplier Financial Analysis Enclosure/Fab Suppliers have better financials Stamping Suppliers are more exposed to Automotive; thus facing more financial issues than other Preferred Suppliers Note: Financial Data based upon received Surveys from 93 Preferred Suppliers

Components – Stamping Market Outlook No Relief Until 2012 Excess Capacity *White Goods -21.5% Auto Industry Volume Growth: US EU AP ‘04-’08 CAGR -1.7% 0.9% 8.4% ‘08-’13 CAGR -0.9% 3.3% 5.8% • Massive Consolidation is Expected (capacity must come offline) • Buyer Power may decrease slightly (but not significantly!) • FY’10 Outlook: more bankruptcies Source Data: DataMonitor June 2009

Components – Stamping Technology Improvements • Very Slow Technological Growth over past 50 years • Latest Advancements may prove significant though • Servo-Motor • Hydraulic • Press • Shorter Stroke increases Productivity • Smaller Press Required • 20-40% Energy Savings • In-die Sensors for Improved Quality • Quiet / Improved working condition • Hydraulic • Press • Improved Stroke Velocity • Quick Die Changeover Productivity • Mechanical Press • Mechanical Motion / Flywheel Design • Requires large space • Frequent Maintenance 2005+ 1930s-1990s 1990s-2005 • Supplier Costs will be Decreasing • Suppliers that have the financial resources to invest will survive

Components – Stampings FY’10 Initiatives Risk Mitigation: Quarterly Updates of Financial Assessments Contingency Plans Preferred Supplier Development Develop “Future” Marquee Suppliers Material Price Management (Deal Management) DPO 100% of Preferred with 5th/3rd Prox or equivalent Inventory Improvement thru Regionalization

Components - Stampings Preferred Supplier Development Enclosure ($142M) Niche Stamping ($84M) Strategic Relationships: Conghua, KBL, Prince, Hoffman, Rittal Focus Areas: Mexico, India Strategic Relationships: Valfsan Focus Areas: LASCO, APSCO Sheet Metal Fab ($120M) Traditional Stamping ($303M) Strategic Relationships: Danco, Everyday, JM Kappa, Ningbo Spring, Kirac Focus Areas: E. Europe Strategic Relationships: ICE, Brittany, ISIL, E&W, Lide, Ulus, Sesan Semak, Clairon Focus Areas: E. Europe FY’10 Focus: Building Stronger Relationships & Demonstrating Value of Preferred Supplier Program 9

Components - Stampings Material Adjustment Strategies Team will continue to utilize all four strategies to meet divisional requirements & strategy.

Components – Stampings Opportunities in Latin America Total Current Demand North & L. America Sites = $277M N. America Sourced $193M ROW Sourced $30M L. America Sourced $54M Exported to Mexico $48M FY’10 Focus: Process – MMI & Rosemount Flow ($2M) MAC – Appliance Control ($1.5M) ENP – ASCO Power ($2M)

Components – Stampings Opportunities in Eastern Europe Total Current Demand For European Sites = $97M W. Europe Sourced $60M ROW Sourced $6M E. Europe Sourced $31M FY’10 Focus: Process – Rosemount Measurement ($2M) IA – Leroy-Somer ($1M) ENP – Liebert Europe ($2M)

Components - Stampings Strategy by Market Segment Niche Stamping ($84M) Supplier Size: Large Value: Technical Competency Key Strategies: Develop BCC Suppliers Enclosure ($142M) Supplier Size: Large Value: Automation and Secondary Ops Key Strategies: Localization (where applicable) Two-tier approach to high/low volume Lean (Reduce Lead-time) High Complexity Sheet Metal Fab ($120M) Supplier Size: Small-Medium Value: Low Volume / High Mix Key Strategies: Consolidate Supply Base Localization Traditional Stamping ($303M) Supplier Size: Medium-Large Value: Efficiency and Steel Price Key Strategies: Chase the Best Price of Steel! Dual-Sourcing / Risk Mitigation Low Low High Volume 13

Components - Stampings Market Differentiators Material Standardization: Leverage Common Grades/Gauges across Business Groups Material Optimization: Scrap Reduction thru tool & part design Material Price Management Strategic Use of Steel-Pass Thru Program Portfolio Approach of 3, 6, 12-month fixed price contracts Tooling Standardization Utilize common sizes/design to increase ease of transferability Execution of these strategies will differentiate Emerson from the competition. 14