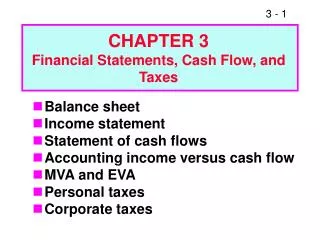

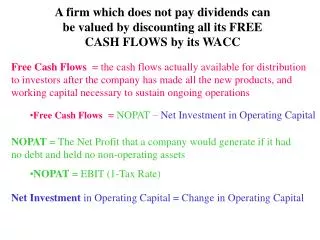

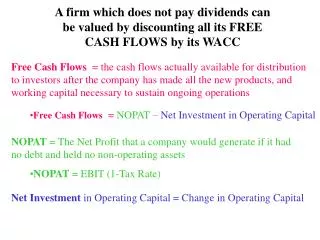

Net operating profit - PowerPoint PPT Presentation

View Net operating profit PowerPoint (PPT) presentations online in SlideServe. SlideServe has a very huge collection of Net operating profit PowerPoint presentations. You can view or download Net operating profit presentations for your school assignment or business presentation. Browse for the presentations on every topic that you want.