Reviewing…

170 likes | 370 Vues

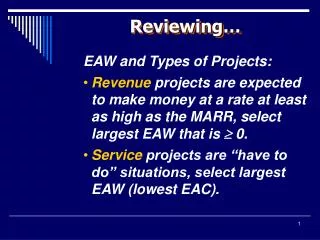

Reviewing…. EAW and Types of Projects: Revenue projects are expected to make money at a rate at least as high as the MARR, select largest EAW that is 0. Service projects are “have to do” situations, select largest EAW (lowest EAC). Reviewing….

Reviewing…

E N D

Presentation Transcript

Reviewing… • EAW and Types of Projects: • Revenue projects are expected to make money at a rate at least as high as the MARR, select largest EAW that is 0. • Service projects are “have to do” situations, select largest EAW (lowest EAC).

Reviewing… • For a capital purchase (P) with a salvage value (S), the EAC can be calculated two ways: • P(A I P, i, n) – S (A I F, i, n) • (P – S) (A I P, i, n) +S*i • Annual equivalent Opportunity • for loss of value cost

BOND TERMINOLOGY • Face Value, Par Value, Maturity Value • – How much the borrower will pay the holder when it matures. • Coupon Rate, Nominal Annual Interest Rate • –Nominal yearly interest rate paid on face value. • Bond Dividend • – Interest paid periodically until maturity • Maturity Date • – Date at which you receive the face value • Market Value, Current Price • – What someone is willing to pay for the remaining cash flows. • Yield to Maturity • – Actual interest rate earned over holding period

Coupon Rate Dividend Periods / Yr Coupon Rate Dividend Periods / Yr CFD with Bond Terms… ib = Dividend = (Face Value) (ib) – or – Face Value Face Value Yield Rate = ia = (1+ ib) m – 1 Dividend 0 1 2 3 n periods (to Maturity Date) Bond Price Yield to Maturity = i* such that NPW = 0

Problem 1 A bond with a face value of $25 000 pays a coupon rate of 4% in quarterly payments, and will mature in 6 years. If the current MARR is 2% per year, compounded quarterly, how much should the maximum bond price be?

0 1 2 3 Problem 1 • Given: • MARR = 2% per year, cpd quarterly • Face Value = $25 000 • Coupon Rate of 4%, paid quarterly • Maturity in 6 years • Find Max. Price: ib = Coupon Rate =4% / yr= 1% /qtr. Dividends/yr4 qtr /yr Face Value = $25 000 Dividend = (Face Value) (ib) = ($25 000) (.01) = $250/pd n = (6 yr)(4 qtr) = 24 qtrs yr Bond Price (maximum)

Problem 1, cont. • Given: • MARR = 2% per year, cpd quarterly • Face Value = $25 000 • Coupon Rate of 4%, paid quarterly • Maturity in 6 years • Find Max. Price: Finding effective MARR to match dividend period: MARR = 2%/yr, cpd quarterly, so find a quarterly equivalent rate! a.) Find effective quarterly rate (to match compounding), since pp = cp: r m i = so inserting values and solving for i: i = = 0.5%/qtr. 2% / yr 4 qtrs / yr

0 1 2 3 Problem 1, Cont. • Given: • MARR = 2% per year, cpd quarterly • Face Value = $25 000 • Coupon Rate of 4%, paid quarterly • Maturity in 6 years • Find Max. Price: Finding NPW of remaining cash flows at effective MARR: $25 000 i = 0.5% / qtr. $250/pd n =24 qtrs Bond Price = $250(P/A, 0.5%, 24) + $25 000(P/F, 0.5%, 24) =$250 (22.5629) + $25 000 (.8872)= $27 822.30

Problem 2 You desire to make an investment in bonds provided you can earn a yield rate of 12% per year on your investment, compounding monthly. How much can you afford to pay for a bond with a face value of $10 000 that pays a coupon rate of 10% in quarterly payments, and will mature in 20 years?

0 1 2 3 Problem 2, Cont. • Given: • MARR = 12% per year, cpd monthly • Face Value = $10 000 • Coupon Rate of 10%, paid quarterly • Maturity in 20 years • Find Max. Price: ib = Coupon Rate =10%= 2.5%/pd. Dividends/yr4 Face Value = $10 000 Dividend = (Face Value) (ib) =($10 000) 2.5% = $250/pd n = (20 yr)(4 qtr) = 80 qtrs yr Bond Price (maximum)

Problem 2, cont. • Given: • MARR = 12% per year, cpd monthly • Face Value = $10 000 • Coupon Rate of 10%, paid quarterly • Maturity in 20 years • Find Max. Price: Annual Bond Yield needs to equal MARR: Yield Rate = effective 12%/yr, so find a quarterly equivalent rate! a.) Find effective monthly rate (to match compounding), so set: 12% = .12 = (1 + imo )12– 1 and solving for i: 1 imo = (1.12)12 – 1 = 0.949%/mo. b.) Find effective quarterly rate (to match dividend period): iqtr = (1+ imo) m – 1 = (1+.00949)3 – 1 =2.874% / qtr Note: 3 mo. per qtr! (Check:ia = (1+ iqtr) m – 1 = (1+.02874)4 – 1 = 12% / yr !)

0 1 2 3 Problem 2, Cont. • Given: • MARR = 12% per year, cpd monthly • Face Value = $10 000 • Coupon Rate of 10%, paid quarterly • Maturity in 20 years • Find Max. Price: ib = Coupon Rate =10%= 2.5%/pd. Dividends/yr4 Face Value = $10 000 Quarterly Yield Rate = 2.874% / qtr Dividend = (Face Value) (ib) =($10 000) 2.5% = $250/pd n = (20 yr)(4 qtr) = 80 qtrs yr Bond Price = $250(P/A, 2.874%, 80) + $10 000(P/F, 2.874%, 80) =$250 (31.19054) + $10 000 (.10367)= $8 834

Problem 3 A $1 000 face value bond will mature in 10 years. The annual rate of interest is 6%, payable semi-annually. If compounding is semi-annual and the bond can be purchased for $870, what is the yield to maturity in terms of the effective annual rate earned?

Problem 3, Cont. • Given: • Bond Price = $ 870 • Face Value = $1 000 • Coupon Rate of 6%, cpd & paid semi-annually • Maturity in 10 years • Find Annual Yield to Maturity: i = $1 000 ib = Coupon Rate =6%= 3% / Dividend pd. Dividends/yr2 Dividend = (Face Value)(ib) = ($1 000) (3%) = $30/pd 0 1 2 3 n = (10 yr)(2 divs) = 20 pds yr $870 Find semi-annual Yield to Maturity = i* such that NPW = 0

Problem 3, cont. • Given: • Bond Price = $ 870 • Face Value = $1 000 • Coupon Rate of 6%, cpd & paid semi-annually • Maturity in 10 years • Find Annual Yield to Maturity: i = Want NPW = 0 $30 (P/A, i*, 20) + $1 000 (P/F, i*, 20) = $870 $1 000 Try 4% $30 (P/A,4%, 20) + $1 000 (P/F, 4%, 20) =$ 864Low! Try 3% $30 (P/A,3%, 20) + $1 000 (P/F, 3%, 20) = $1 000High! Dividend =$30/pd 0 Still need to come up with a closer value … 1 2 3 n =20 pds $870 Yield to Maturity = i* such that NPW = 0

Problem 3, cont. • Given: • Bond Price = $ 870 • Face Value = $1 000 • Coupon Rate of 6%, cpd & paid semi-annually • Maturity in 10 years • Find Annual Yield to Maturity: Need to interpolate: 4% $ 864(Low), 3% $1000 (High), Find x% = $870: x%–3%=4%– 3% 870–1000 864– 1000 x= 3 +130= 3.96% / 6 mo. 136 Need to convert semi-annual (6 mo.) yield rate to Annual Yield Rate: Yield Rate = ia = (1+ i6 mo) m – 1 ia = (1+ .0396) 2 – 1 Annual Yield to Maturity = 8.08% / yr !