Grandfathered Plans under ACA

70 likes | 222 Vues

Grandfathered health plans under the Affordable Care Act (ACA) are those that have not changed in benefits or contribution levels since March 23, 2010. These plans must end lifetime limits on coverage and allow young adults to stay on their parents' plan until age 26. However, they are not required to cover preventive care for free or guarantee appeal rights. The ACA also imposes various taxes and fees that may affect employee benefits, such as the PCORI and Transitional Reinsurance fees. Additionally, ACA Exchanges provide options for those without employer coverage.

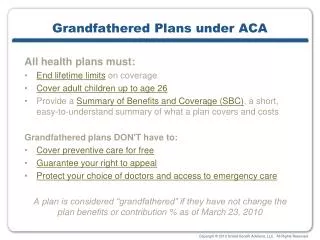

Grandfathered Plans under ACA

E N D

Presentation Transcript

Grandfathered Plans under ACA • All health plans must: • End lifetime limits on coverage • Cover adult children up to age 26 • Provide a Summary of Benefits and Coverage (SBC), a short, easy-to-understand summary of what a plan covers and costs • Grandfathered plans DON'T have to: • Cover preventive care for free • Guarantee your right to appeal • Protect your choice of doctors and access to emergency care • A plan is considered “grandfathered” if they have not change the plan benefits or contribution % as of March 23, 2010

Taxes and FeesEmployee Impact • FSA Changes: Dollar cap and removal of non-prescribed OTC medications (FICA impact) • Some of the taxes that are passed through in claims expenses • Pharmaceutical Manufacturer Tax: 1% • Medical Device Maker Tax: 2.3% • Fully-Insured Health Insurance Provider Tax is 2.3% • State specific surcharges to run Exchanges

Employer Taxes and FeesTo help offset the cost of coverage expansion and other ACA provisions Patient-Centered Outcome Research Institute (PCORI) 2014-2019 PCORI fees funds research that evaluates and compares health outcomes, clinical effectiveness, risks and benefits of medical treatments and services. The research will help patients, health care professionals and policymakers make better informed decisions about treatment options. The annual fee in year one is $1 per covered life per plan; year two increases to $2 and subsequent years through 2019 the fee is increased by per capita amount of national health care expenditures. Transitional Reinsurance Fee (2014 – 2016) This fee will be used to spread the financial risk across all health insurers to provide greater financial stability. This fee will be in place for the first three years of the Health Care Exchanges. The fee in 2014 is $63 per covered life per plan. Estimated for D211: $300,000

Exchanges and Subsidies • What are Exchanges? • A marketplace which will allow individuals to compare and purchase individual or family health insurance. These plans are offered to all individuals, however, they are geared towards the following: • Individuals that were unable to get coverage due to medical condition; • Individuals that do not have coverage through their employer; • Individuals eligible for government subsidy.

Health Care Exchange • An employee may enroll in an exchange even if they have access to employer-provided coverage, but they will not be eligible for a premium subsidy, and the employer thus faces NO penalties, if employee is: • offered coverage that provides Minimum Value and is Affordable • (Reminder: Exchange subsidy eligibility is also tied to 100%-400% of Federal Poverty Level.) • District 211 Health Plans are deemed affordable and meet the minimum essential guidelines

Minimum Value Plans • Minimum Value – provides this if one of its health plans is actuarially expected to pay ≥ 60% of employee claim costs. District 211 PPO 3 Silver Plan - Exchange

Cadillac Tax • ‘Cadillac Tax’– 40% excise tax that District 211 pays if any plan premium is above an established annual threshold beginning in 2018. • Applies to other benefits (dental & vision) if ‘linked’ to medical plan choice • 2018 Annual PPACA Thresholds • Single Coverage: $ 10,200 • Family Coverage: $ 27,500 • 2013D211 PPO 3 Plan • Single Coverage: $ 6,572 • Family Coverage: $ 17,749