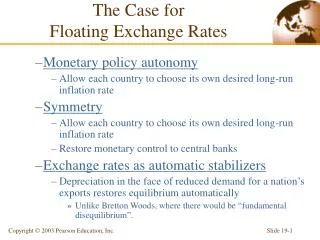

The Case for Floating Exchange Rates

200 likes | 447 Vues

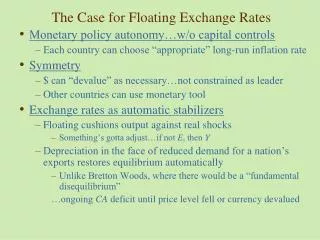

The Case for Floating Exchange Rates. Monetary policy autonomy…w/o capital controls Each country can choose “appropriate” long-run inflation rate Symmetry $ can “devalue” as necessary…not constrained as leader Other countries can use monetary tool Exchange rates as automatic stabilizers

The Case for Floating Exchange Rates

E N D

Presentation Transcript

The Case for Floating Exchange Rates • Monetary policy autonomy…w/o capital controls • Each country can choose “appropriate” long-run inflation rate • Symmetry • $ can “devalue” as necessary…not constrained as leader • Other countries can use monetary tool • Exchange rates as automatic stabilizers • Floating cushions output against real shocks • Something’s gotta adjust…if not E, then Y • Depreciation in the face of reduced demand for a nation’s exports restores equilibrium automatically • Unlike Bretton Woods, where there would be a “fundamental disequilibrium” …ongoing CA deficit until price level fell or currency devalued

The Case for Floating Exchange Rates Exchange rate, E 2 E2 DD2 DD2 (a) Floating exchange rate DD1 DD1 Y1 Y1 Y2 Output, Y Exchange rate, E (b) Fixed exchange rate 3 1 1 E1 E1 AA1 AA1 AA2 Y2 Y3 Output, Y Effects of a Temporary Fall in Export Demand Depreciation leads to higher demand for and output of domestic products Fixed exchange rates mean output falls as much as the initial fall in aggregate demand

The Case Against Floating Exchange Rates • Lack of discipline • … but a floating exchange rate bottles up inflation in a country whose government is “misbehaving”. • Destabilizing speculation • Hot money …but “fundamental disequilibrium” one-way bet under fixed rates • Countries can be caught in a “vicious circle” of depreciation and inflation. E Pim CoL W P E • Floating exchange rates make a country more vulnerable to money market disturbances. • Fixed rates cushion output against monetary shocks L M nothing shifts under fixed rates

The Case Against Floating Exchange Rates Exchange rate, E DD 1 E1 2 E2 AA2 AA1 Output, Y Y2 Y1 A Rise in Money Demand Under a Floating Exchange Rate

The Case Against Floating Exchange Rates • Injury to International Trade and Investment • Exporters and importers face greater exchange risk. • But forward markets can protect traders against foreign exchange risk. • International investments face greater uncertainty about payoffs denominated in home country currency. • Uncoordinated Economic Policies • Countries can engage in competitive currency depreciations. …under Bretton Woods, policies “coordinated” via US privilege • A large country’s fiscal and monetary policies affect other economies …aggregate demand, output, and prices become more volatile across countries if policies diverge. • Free Float Really Managed Float • Fear of depreciation – inflation spiral intervention

The Case Against Floating Exchange Rates • Speculation and volatility in the foreign exchange market • If traders expect a currency to depreciate in the short run, they may quickly sell the currency to make a profit, even if it is not expected to depreciate in the long run. • Expectations of depreciation lead to actual depreciation in the short run. • The assumption we’ve been using that expectations do not change when temporary economic changes occur is not valid if expectations change quickly in anticipation of even temporary economic changes. • In fact, exchange rate volatility has increased since 1973

The Case Against Floating Exchange Rates Floating and Discipline: Inflation Rates in Major Industrialized Countries, 1973-1980 (percent per year)

Nominal and Real Effective Dollar Exchange Rate Indexes, 1975–2006Purchasing Power Parity??? Source: International Monetary Fund, International Financial Studies.

Due to contractionary monetary policy and expansive fiscal policy in the U.S., the dollar appreciated by about 50% relative to 15 currencies from 1980–1985. • This contributed to a growing US current account deficit • Countries then engaged in 2 major efforts to influence exchange rates: • The 1985 Plaza Accord reduced the value of the dollar relative to other major currencies… “bringing down dollar” • The 1987 Louvre Accord: intended to stabilize exchange rates • Specified zones of +/- 5% around which current exchange rates were allowed to fluctuate. • Quickly abandoned • The October 1987 stock market crash made production, employment and price stability the primary goals for the U.S. central bank exchange rate stability became less important. • New targets were (secretly) made after October 1987, but central banks had abandoned these targets by the early 1990s.

Macroeconomic Interdependence Under Floating RateThe Large Country Case • Effect of a permanent monetary expansion by Home • Home’s currency depreciates, Home output rises • Foreign output may rise or fall. • Foreign’s currency appreciates Foreign’s output falls • Home’s economy expands Foreign sells more to Home • Effect of a permanent fiscal expansion by Home • Home output rises, Home’s currency appreciates • Foreign output rises • Foreign’s currency depreciates Foreign’s output rises • Home’s economy expands Foreign sells more to Home

Macroeconomic Interdependence Under Floating Rate Unemployment Rates in Major Industrialized Countries, 1978-2000 (percent of civilian labor force)

Exchange Rate Trends and Inflation Differentials, 1973–2006 Source: International Monetary Fund and Global Financial Data.

Interdependence of “Large” Countries:Rebalancing • The U.S. has depended on saved funds from many countries, while it has borrowed heavily. • The U.S. has run a current account deficit for many years due to its low saving and high investment expenditure. • As foreign countries spend more and lend less to the U.S., • interest rates may rise • the U.S. dollar will depreciating • the U.S. current account will improve (becoming less negative).

Global External Imbalances, 1999–2006 Source: International Monetary Fund, World Economic Outlook, April 2007.

U.S. Real Interest Rate, 1997–2007 Source: Global Financial Data. Real interest rates are defined as ten-year government bond rates less average inflation over the preceding twelve months. The data are twelve-month moving averages of monthly real interest rates so defined.

What Has Been Learned Since 1973? • After 1973 central banks intervened repeatedly in the foreign exchange market to alter currency values. • To stabilize output and the price level when certain disturbances occur • To prevent sharp changes in the international competitiveness of tradable goods sectors • Monetary changes had a much greater short-run effect on the real exchange rate under a floating nominal exchange rate than under a fixed one. • The international monetary system did not become symmetric until after 1973. • Central banks continued to hold dollar reserves and intervene. • The current floating-rate system is similar in some ways to the asymmetric reserve currency system underlying the Bretton Woods arrangements … exorbitant privilege

What Has Been Learned Since 1973? • The Exchange Rate as an Automatic Stabilizer • Experience with the oil shocks of 1973 and 1979 favors floating exchange rates. • The effects of the U.S. fiscal expansion after 1981 provide mixed evidence on the success of floating exchange rates. • Discipline • Inflation rates accelerated after 1973 and remained high through the second oil shock. • The system placed fewer obvious restraints on unbalanced fiscal policies. • Example: The high U.S. government budget deficits of the 1980s.

What Has Been Learned Since 1973? • Destabilizing Speculation • Floating exchange rates have exhibited much more day-to-day volatility. • The question of whether exchange rate volatility has been excessive is controversial. • In the longer term, exchange rates have roughly reflected fundamental changes in monetary and fiscal policies and not destabilizing speculation. • Experience with floating exchange rates contradicts the idea that arbitrary exchange rate movements can lead to “vicious circles” of inflation and depreciation. • International Trade and Investment • For most countries, the extent of their international trade shows a rising trend after the move to floating.

Many fixed exchange rate systems have developed since 1973. • European monetary system and euro zone • The Chinese central bank currently fixes the value of its currency. • ASEAN countries have considered a fixed exchange rates and policy coordination.