1 / 0

FIRE ASSESSMENT Options, Methodology & Timetable For Action

0 likes | 206 Vues

FIRE ASSESSMENT Options, Methodology & Timetable For Action. Finance Department March 10, 2014. Topic of Discussion. What is a Fire Assessment Fee City Property Tax Revenue Stream Fire Assessment Methods Schedule. Fire Assessment Methods. Availability Approach.

Télécharger la présentation

FIRE ASSESSMENT Options, Methodology & Timetable For Action

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

-

FIRE ASSESSMENTOptions, Methodology& Timetable For Action

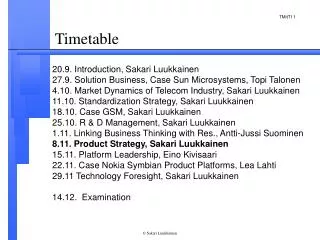

Finance Department March 10, 2014 - Topic of Discussion What is a Fire Assessment Fee City Property Tax Revenue Stream Fire Assessment Methods Schedule

- Fire Assessment Methods

- Availability Approach Availability Approach Option Premise is “All Properties Receive a Benefit From the Availability of Fire Service”. Benefit is Derived From a 24/7 State of Readiness. Respond to All Parcels – Developed & Undeveloped. In Addition, the Value of Buildings and Developed Parcels and Protection From Loss is 2nd Factor. This Provides for Property Owners Availability to Fire Insurance at Reasonable Rates This Option Has Been Validated by 4 Circuit Courts and is Now in Front of the Florida Supreme Court.

- Demand/Calls For Service Approach Demand/Calls For Service Approach Option Premise is “Costs are Apportioned to Property Classes Based Upon the Demand for Service for that Class”. Costs Based Upon Calls For Service Relative to the Number of Calls to Each Property Class. This Option Has Been Validated by the Florida Supreme Court.

- Pro’s & Con’s ofTwo Options

- What is A Fire Assessment Fee?

- Fire Service Fee General Definition An Availability Fee to Recover all or a Portion of the Cost of Providing Fire Service to the City. Emergency Medical Services are Not Included in the Calculation. Methodology: Fire Services Fee is Calculated based on a Cost of Service Fee May Be Assessed (On Tax Bill As Special Assessment) Fee May Have Two Billing Components: Residential Properties Pay Per Dwelling Unit Basis Non-Residential Parcels Categorized by Property Class in Manner that Reasonably Shares the Cost of Fire/Emergency Services

- Why Use Assessments? Benefit Based, Not Valued Based Fee is Based on Value of Service Provided and Not the Value of Property Tax Equity Tool, Cures Tax Inequities Similarly Situated Properties Treated the Same Corrects Inequities Caused By: Homestead Exemption Save Our Homes Other Real Estate Factors Revenue Diversification Dedicated Revenue Source Establishes Cost Per Billing Unit for Services and Facilities Annual Decision

- Statutory AuthorityFor Fire Assessment Two Rules Property Must Receive a Special Benefit Benefit Must be Fairly & Reasonably Applied to Each Property Two Ways To Collect For Fire Service Fee For Service Under Home Rule (City of Tallahassee) Put on Utility Bill Cut Off Service if They Don’t Pay Special Assessment (Chapter 170, FL Statutes) Put on Property Tax Bill or Utility Bill Separate Bill – Lien if Not Paid

- Benefits of Fire Assessments High Level of Revenue Stability for Vital Fire Service Equitable Method of Paying for this Key Service Fire Assessment is an Alternative Stable Revenue Source The Fee Can be Adjusted Down or Up Based on Level of Service Desired The Fire Assessment is a Progressive Fee that Can Be Directly Connected to the Services Provided

- Fire Assessment Fees in the State of Florida

- Current Locations For Fees City of Tavares - $142.00 City of Lady Lake (Provided by The Villages) - $181.00 The Villages (Inside Lady Lake) - $90.11 City of Minneola - $59.00 Lake County - $181.00 City of Mascotte - $120.00

- History of the City’s Property Tax Revenue

- City Property Tax Value

- Example of Property Value Decrease

- City Property Tax Value

- Schedule

- Implementation Schedule City Completes a Fire Assessment Study City Reads Ordinance (1st Reading) City Reads Ordinance (2nd Reading) City Adopts Initial Assessment Resolution City Publishes Notice of Public Hearing to Adopt Final Assessment Resolution City Mails First Class Notices to Affected Property Owners Public Hearing to Adopt Final Assessment Resolution City Certifies Fire Assessment Roll to Tax Collector Tax Bill Mailed by Tax Collector (In November 2015)

More Related