RECAP LAST CLASS

330 likes | 498 Vues

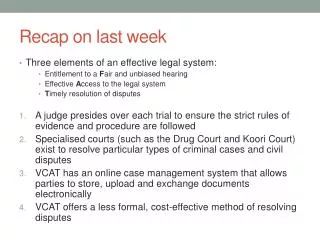

RECAP LAST CLASS. FINANCIAL SECURITIES & MARKETS. DEBENTURE A DEBENTURE ALSO CALLED A NOTE IS AN UNSECURED CORPORATE BOND OR A CORPORATE BOND THAT DOES NOT HAVE A CERTAIN LINE OF INCOME OR EQUIPMENT TO GUARANTEE REPAYMENT OF PRINCIPAL UPON THE BOND’S MATURITY. FINANCIAL SECURITIES & MARKETS.

RECAP LAST CLASS

E N D

Presentation Transcript

FINANCIAL SECURITIES & MARKETS DEBENTURE • A DEBENTURE ALSO CALLED A NOTE IS AN UNSECURED CORPORATE BOND OR A CORPORATE BOND THAT DOES NOT HAVE A CERTAIN LINE OF INCOME OR EQUIPMENT TO GUARANTEE REPAYMENT OF PRINCIPAL UPON THE BOND’S MATURITY

FINANCIAL SECURITIES & MARKETS DEBENTURE • ARE MEDIUM TO LONG-TERM DEBT INSTRUMENT USED BY LARGE COMPANIES TO OBTAIN FUNDS • A CORPORATION RECEIVES AN ADVANTAGE WHEN IT ISUES DEBENTURES (AS OPPOSED TO ISSUING SECURED CORPORATE BONDS) BECAUSE IT MEANS THAT THE COMPANY DOES NOT HAVE TO SET ASIDE CERTAIN ASSETS OR INCOME IN ORDER TO GUARANTEE AGAINST ITS DEFAULT IN PAYING BACK THE PRINCIPAL AT MATURITY

FINANCIAL SECURITIES & MARKETS DEBENTURE • DEBENTURES ARE GENERALLY FREELY TRANSFERABLE BY THE DEBENTURE HOLDER • DEBENTURE HOLDERS HAVE NO VOTING RIGHTS AND INTEREST GIVEN TO THEM IS A CHARGE AGAINST PROFIT IN COMPANY’S FS

FINANCIAL SECURITIES & MARKETS DEBENTURE • WHERE REPAYMENT IS SECURED BY A CHARGE OVERLAND THE DOCUMENT IS CALLED A ‘MORTGAGE’ • WHERE REPAYMENT IS SECURED BY A CHARGE OTHER ASSETS OF THE COMPANY THE DOCUMENT IS CALLED A ‘DEBENTURE’

FINANCIAL SECURITIES & MARKETS DEBENTURE • WHERE NO SECURITY IS INVOLVED, THE DOCUMENT IS CALLED A ‘NOTE’ OR • ‘UNSECURED DEPOSIT NOTE’

FINANCIAL SECURITIES • PREFERRED STOCK • COMMON STOCK

PREFERRED STOCK • A PREFERRED STOCK IS A FORM OF EQUITY SECURITY. IT COMBINES FEATURES OF BOTH DEBT AND COMMON STOCK

MOST IMPORTANT FEATURES PF PREFERRED STOCK • PREFERNCE TO DIVIDENDS • PREFERNCE TO ASSETS • BASICALLY A FIXED RETURN • INDEFINITE LIFE • USUALLY NONVOTING • CUMULATIVE DIVIDENDS

MOST IMPORTANT FEATURES PF PREFERRED STOCK PREFERNCE TO DIVIDENDS • DIVIDENDS MAY BE DECLARED ON PREFERRED STOCK AFTER THE FIRM HAS PAID ITS OPERATING EXPENSES, COVERED ITS INTEREST CHARGES AND PAID THE APPLICABLE TAXES. • PREFERRED STOCK HAS PERFERENCE OVER COMMON STOCK WHEN DIVIDENDS ARE DISTRIBUTED.

MOST IMPORTANT FEATURES PF PREFERRED STOCK PREFERNCE TO DIVIDENDS • THE ACTUAL PAYMENT OF THE DIVIDEND IS DISCRETIONARY AND MUST BE DECLARED BY THE BOARD OF DIRECTORS. • IF THE BOARD DECLINES TO DECLARE A DIVIDEND, IT IS DECLINING TO SHARE THE PROFITS OF THE FIRM WITH THE SHAREHOLDER

MOST IMPORTANT FEATURES PF PREFERRED STOCK PREFERNCE TO DIVIDENDS • THUS THE OMISSION OF A DIVIDEND IS NOT THE SAME AS THE DEFAULT ON A DEBT. • WHENEVER DIVIDENDS ARE DECLARED, PREFERRED STOCKHOLDERS MUST RECEIVE THEIR DIVIDEND BEFORE A DIVIDEND CAN BE PAID TO A COMMON STOCKHOLDERS

MOST IMPORTANT FEATURES PF PREFERRED STOCK PREFERNCE TO ASSETS IN THE EVENT OF LIQUIDATION OF THE FIRM, THE PREFERRED SHARE HOLDERS CLAIMS ARE BEFORE THE COMMON SHAREHOLDERS. IN CASE OF LIQUIDATION; • THE BONDHOLDERS ARE PAID FIRST THEN; • PREFERRED SHAREHOLDERS • COMMON STOCKHOLDERS

MOST IMPORTANT FEATURES PF PREFERRED STOCK • JUST BONDHOLDERS CAN RECEIVE ONLY ASSETS EQUAL TO THE FACE VALUE OF THE DEBT • PREFERRED SHAREHOLDERS CAN RECEIVE ONLY ASSETS EQUAL TO THE PAR VALUE OF THE STOCK

MOST IMPORTANT FEATURES PF PREFERRED STOCK BASICALLY A FIXED RETURN • THE MAXIMUM RETURN ON PREFERRED STOCK IS USUALLY LIMITED TO THE STATED DIVIDEND. • IN SOME CASES THE PREFERRED STOCK CONTAINS A PARTICIPATING FEATURE THAT ALLOWS THE HOLDER TO SHARE IN EARNINGS ABOVE SOME SPECFIC POINT

MOST IMPORTANT FEATURES PF PREFERRED STOCK INDIFINITE LIFE • MOST PREFERRED STOCK ISSUES HAVE NO STATED MATURITY. • AT THE SAME TIME, MOST ISSUES HAVE A CALL FEATURE SIMILAR TO CORPORATE BOND

MOST IMPORTANT FEATURES PF PREFERRED STOCK USUALLY NONVOTING • MOST PREFERRED STOCK DOES NOT CONTAIN PROVISIONS TO ALLOW ITS HOLDERS TO VOTE OR HAVE OTHER VOICES IN THE MANAGEMENT OF THE FIRM • SOMETIMES AN EXCEPTION IS STATED IN THE STOCK CERTIFICATE

MOST IMPORTANT FEATURES PF PREFERRED STOCK CUMULATIVE DIVIDENDS • MOST PREFERRED STOCKS HAVE A CUMULATIVE FEATURE THAT REQUIRES UNPAID DIVIDENDS IN ANY ONE YEAR TO BE CARRIED FORWARD TO THE NEXT. • WHEN THIS HAPPENS, THE PREFERRED DIVIDENDS ARE SAID TO BE IN ARREARS.

COMMON STOCK • IS A SECURITY REPRESENTING THE RESIDUAL OWNERSHIP OF A CORPORATION. • IT GUARANTEES ONLY THE RIGHT TO PARTICIPATE IN SHARING THE EARNINGS OF THE FIRM IF THE FIRM IS PROFITABLE.

COMMON STOCK • COMMON SHAREHOLDERS HAVE THE ADDITIONAL RIGHT TO VOTE AT STOCKHOLDERS MEETINGS ON ISSUES AFFECTING FUNDAMENTAL POLICIES OF THE CORPORATION • ALSO SHAREHOLDERS HAVE THE RIGHT TO ELECT THE MEMBERS OF THE BOARD OF DIRECTORS

COMMON STOCK • RIGHT TO INSPECT THE FIRM’S BOOKS ONLY FOR LEGITIMATE PURPOSE OF EVALUATING THE PERFORMANCE OF MANAGEMENT • RIGHT TO OBTAIN A LIST OF THE NAMES AND ADDRESSES OF OTHER SHAREHOLDERS

COMMON STOCK • A FIRM MAY ISSUE MORE THAN ONE CLASS OF COMMON STOCK. • OFTEN DIVIDED INTO TWO CLASSES USUALLY DESIGNATED AS CLASS A AND CLASS B. • THE HOLDER OF ONE CLASS DO NOT HAVE THE RIGHT TO VOTE ON CORPORATE METTERS EXCEPT IN SPECIFIED SITUATIONS.

COMMON STOCK • THE FIRM’S COMMON SHAREHOLDERS ARE ENTITLED TO RECEIVE DIVIDENDS, IF AND WHEN THEY ARE DECLARED BY THE BOARD OF DIRECTORS. • BASICALLY, THERE ARE THREE TYPES OF DIVIDENDS; • CASH DIVIDENDS • STOCK DIVIDENDS • PROPERTY DIVIDENDS

COMMON STOCK CASH DIVIDENDS • THESE ARE THE MOST COMMON FORM AND EXPRESSED IN TERMS OF RS PER SHARE. EXAMPLE: IF A FIRM DECLARES A DIVIDEND OF RS4 PER SHARE, A SHAREHOLDER WITH 100 SHARES RECEIVE A CHEQUE FOR RS400 AS THE SHARE OF THE CASH DIVIDENDS

COMMON STOCK STOCK DIVIDENDS • THESE OCCUR WHEN THE BOARD VOTES TO GIVE EACH SHAREHOLDER ADDITIONAL STOCK ON A PERCENTAGE BASIS. A 5 % STOCK DIVIDEND GIVES 5 SHARES OF THE COMPANY’S STOCK TO AN INVESTOR HOLDING 100 SHARES WHEN THE DIVIDEND IS DECLARED

COMMON STOCK STOCK DIVIDENDS • LESS DESIRABLE THAN CASH BUT MAY BE MORE DESIRABLE THAN NO DIVIDEND AT ALL, PARTICULARLY IF THE MARKET DOES NOT DROP THE PRICE OF THE COMMON STOCK IN RESPONSE TO THE DIVIDEND

COMMON STOCK PROPERTY DIVIDENDS • THESE ARE VERY RARE BUT MAY RESULT IN THE DISTRIBUTION OF BONDS, PREFERRED STOCK, STOCK OF OTHER COMPANIES, OTHER SECURITIES OR MERCHANDISE EXAMPLE: A MERCHANDISE DIVIDEND MIGHT BE THE DISTRIBUTION OF SMALL BOTTLES OF PERFUME BY THE CO MANUFACTURING PERUM

FINANCIAL MARKETS & INSTITUTIONS • WHEN A FIRM IS MAKING ITS FINANCING DECISION IT HAS THE CHOICE OF OBTAINING FINANCE DIRECTLY FROM INVESTORS THROUGH THE FINANCIAL MARKETS OR INDIRECTLY THROUGH FINANCIAL INSTITUTIONS

FINANCIAL MARKETS & INSTITUTIONS • TWO MAIN TYPES OF FINANCIAL MARKETS ARE: • MONEY MARKET • CAPITAL MARKET

FINANCIAL MARKETS & INSTITUTIONS MONEY MARKET • IS USED BY PARTICIPANTS AS A MEANS OF BORROWING AND LENDING IN THE SHORT TERM FROM SEVERAL DAYS TO JUST UNDER A YEAR

FINANCIAL MARKETS & INSTITUTIONS MONEY MARKET IF A COMPANY OR GOVERNMENT NEEDS TO RAISE FUNDS FOR THE SHORT-TERM, THEY CAN ACCESS THE MONEY MARKET AND ISSUE: • TREASURY BILLS (ISSUED BY GOVT) • CERTIFICATES OF DEPOSIT (ISSUED BY FIRMS) • COMMERCIAL PAPER (ISSUED BY FIRMS WITH HIGH CREDIT RATING) • BILL OF EXCHANGE (ISSUED BY FIRM IOU SIGNED BY CUSTOMER)

FINANCIAL MARKETS & INSTITUTIONS MONEY MARKET TREASURY BILL A NEGOTIABLE DEBT OBLIGATION ISSUED BY THE GOVT AND BACKED BY ITS FULL FAITH AND CREDIT, HAVING A MATURITY OF ONE YEAR OR LESS EXEMPT FROM GOVT AND LOCAL TAXES

FINANCIAL MARKETS & INSTITUTIONS MONEY MARKET BILL OF EXCHANGE • AN UNCONDITIONAL ORDER ISSUED BY A PERSON OR BUSINESS WHICH DIRECTS THE RECIPIENT TO PAY A FIXED SUM OF MONEY TO A THIRD PARTY AT A FUTURE DATE. • THE FUTURE DATE MAY BE EITHER FIXED OR NEGOTIABLE • A BILL OF EXCHANGE MUST BE IN WRITING AND SIGNED AND DATED ALSO CALLED DRAFT