Endowment With Profit Plan - Simple and Preferred

80 likes | 135 Vues

A savings-oriented plan with a wide range of terms, offering better returns and high liquidity. Eligible for those aged 12 to 65 years with a maximum maturity age of 75 years. Premium payable for the entire term and risk cover available for 5 to 55 years. Benefits include death cover, maturity benefit, loan facility, and double accident benefits.

Endowment With Profit Plan - Simple and Preferred

E N D

Presentation Transcript

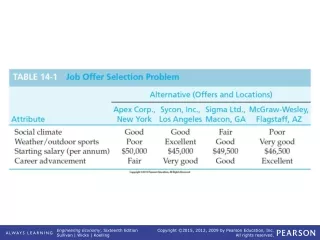

Table No.14 Endowment With Profit Most preferred plan

Attractions !!! Simplest of plans Savings Oriented Wide range of terms: 5 to 55 Most popular plan Better returns High liquidity

Eligibility Who can avail of the plan ? Those aged between age 12 years (completed) and 65 years (nearer birthday) The maximum age at maturity is 75 years For how many years is premium payable ? Premium is payable over the entire term in monthly, quarterly, half-yearly and yearly modes over premium payment terms of 5 to 55 years For how many years is risk cover available ? Choice of policy term from 5 to 55 years is available subject to maximum maturity age of 75 years

Benefits Death Cover : On unfortunate death during the term of the policy, an amount equal to sum assured plus vested bonus plus final additional bonus if any is payable provided policy is in full force Term rider if availed, benefits will be additional Maturity benefit : On survival upto date of maturity, an amount equal to sum assured plus vested bonus plus final additional bonus if any is payable provided policy is in full force

Other Benefits Available • Loan Facility : • Loan facility is available after payments of three full premium • Double Accident Benefits: • On death of Life Assured in accidental condition during the term amount equal to Double Accident sum assured is payable. The rider can be availed of by payment of a small additional premium • For example if Basic S.A. is Rs.100000/- and Double Accident S.A. is Rs.100000/- on accidental death nominee of policy holder will get Basic S.A. + Double Accident S.A. i.e. Rs.100000 + Rs.100000 =Rs. 200000 • Maximum DAB limit is allowed upto Rs. 50,00,000/- for all policies held by one person

Riders Available • Term Rider : • On death of the Life Assured during the term of cover under the rider, an amount equal to the Term Assurance Sum Assured is payable The rider can be availed of by payment of a small additional premium • For example if Basic S.A. is Rs.100000/- and Term Rider S.A. is Rs.100000/- on death nominee of policy holder will get Basic S.A. + Term Rider S.A. i.e. Rs.100000 + Rs.100000 = Rs. 200000 • Maximum Term Rider is allowed upto basic S.A.

Riders Available • Critical illness Rider • This Rider is available for any eligible disease prescribed by LIC • Amount equaling to S.A. of critical illness rider will be payable to policy holder • Premium wavier Benefit • This rider is available only if customer is having critical illness rider • By availing this rider in case of occurrence of any disease mentioned in critical illness rider all future premium will be waived off