Comprehensive Insurance Plan with Savings and Critical Illness Rider Options

110 likes | 251 Vues

This most popular insurance plan offers high liquidity and better returns, suitable for individuals aged 12 to 65 years, with maturity age up to 75 years. With premium payment terms ranging from 5 to 55 years, the policy ensures death cover and maturity benefits, including bonuses, as long as the policy is in force. Optional riders for term assurance and critical illness enhance coverage, providing additional benefits for specific health conditions. Flexible premium payment modes (monthly, quarterly, half-yearly, annually) are available for convenience.

Comprehensive Insurance Plan with Savings and Critical Illness Rider Options

E N D

Presentation Transcript

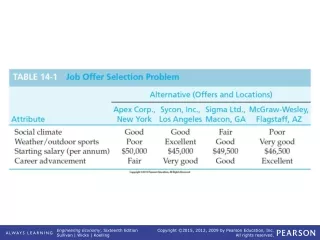

Table No.14 Most preferred plan Popularity Meter : 76,11,104 policies sold in 2003-04

Simplest of plans • Savings Oriented • Wide range of terms: 5 to 55 • Most popular plan • High liquidity • Better returns Attractions !!! • Loan available • Options available for term • rider and critical illness rider

Who can avail of the plan ? Those aged between age 12 years (completed) and 65 years (nearer birthday). The maximum age at maturity is 75 years. For how many years is premium payable ? Premium is payable over the entire term in monthly, quarterly, half-yearly and yearly modes over premium payment terms of 5 to 55 years. For how many years is risk cover available ? Choice of policy term from 5 to 55 years is available subject to maximum maturity age of 75 years. eligibility

Death Cover : On unfortunate death during the term of the policy, an amount equal to sum assured plus vested bonus plus final additional bonus, if any, is payable, provided policy is in full force. Term rider, if availed, benefits will be additional. Maturity benefit : On survival upto date of maturity, an amount equal to sum assured plus vested bonus plus final additional bonus, if any, is payable, provided policy is in full force benefits

What are the benefits of the term assurance rider ? On death of the Life Assured during the term of cover under the rider, an amount equal to the Term Assurance Sum Assured is payable. The rider can be availed of by payment of a small additional premium. Who can avail of the rider ? Those aged between age 18 years (completed) and 50 years (nearer birthday). The maximum age at maturity is 60 years. What is the minimum and maximum sum assured allowed ? The minimum Sum Assured for the Term Rider is Rs. 1,00,000 and maximum sum assured is an amount equal to the Basic Sum Assured, subject to a maximum overall limit of Rs. 25,00,000. Optional Term Assurance Rider

What are the terms allowed ? The policy terms allowed are 10 to 35 years under regular premium policies; 5 to 35 years under Single premium policies and 15, 20 and 25 years under limited premium paying term policies. This rider is allowed only if the age at maturity under the main policy is less than or equal to 60 years. The policy term and premium paying term of the rider should match with the policy term and premium paying term under the main policy Optional Term Assurance Rider

(A) Minimum entry age : 18 yrs (completed) (B) Maximum entry age : 50 yrs (nearer birthday) (C) Maximum maturity age : 60 years (D) Minimum Sum Assured for the Critical illness Rider : Rs.50,000/= (E) Minimum Sum Assured of the Main plan on which the Critical illness Rider can be given: Rs.50,000 (F) Maximum Sum Assured : An amount equal to the Basic Sum for the Critical Illness Rider Assured, subject to a maximum of Rs. 5,00,000. (G) Term : 10 to 35 years under regular premium 5 to 35 years under Single premium and 15, 20 & 25 years under limited premium paying term policies. This rider is allowed only if the maturity age under main policy is not greater than 60 years. The policy term and premium paying term of the rider should match with the policy term and premium paying term under the main policy. Optional Critical Illness Rider : Eligibility

Critical Illness Sum Assured is payable on life assured surviving for a period of 28 days from date of occurrence of any of the following critical illnesses- • Heart Attack (Myocardial Infarction) • Stroke (Cerebro-vascular Accident) • Cancer • Kidney Failure • Major Organ transplant • Paralysis • 3rd Degree Burns • Blindness • Coronary Artery By-pass Surgery • Heart Valve Replacement or Repair • Aorta Graft Surgery • Premium Waiver Benefit: • A policyholder has option to avail of a premium waiver benefit whereby premiums falling due on or after the date of diagnosis of critical illness are waived till maturity date of the main plan or earlier death of the life assured. Optional Critical Illness Rider - Benefits

Age at entry: 35 years Policy Term: 25 years Premium paying term: 25 years Mode of premium payment: Yearly Sum Assured: Rs.1,00,000/- Annual Premium : 4047/- Illustration

This illustration is applicable to a non-smoker • male/female standard (from medical, life style • and occupation point of view) life. • ii) The non-guaranteed benefits (1) and (2) in above • illustration are calculated so that they are • consistent with the Projected Investment Rate of • Return assumption of 6% p.a.(Scenario 1) and 10% • p.a. (Scenario 2) respectively. In other words, in • preparing this benefit illustration, it is assumed • that the Projected Investment Rate of Return that • LICI will be able to earn throughout the term of the • policy will be 6% p.a. or 10% p.a., as the case may • be. The Projected Investment Rate of Return is not • guaranteed. • iii) The main objective of the illustration is that the • client is able to appreciate the features of the • product and the flow of benefits in different • circumstances with some level of quantification. • iv) Future bonus will depend on future profits and as • such is not guaranteed. However, once bonus is • declared in any year and added to the policy, the • bonus so added is guaranteed. • v) The maturity benefit is amount shown at the end • of policy term. Illustration Assumptions And Disclaimer