Financing College: The Path to Higher Education and Financial Success

140 likes | 164 Vues

Discover the importance of college education, the cost of attendance, types of student aid available, and the long-term benefits of federal loans. Learn how university endowments and personal budgeting can help pay for college. Watch Ted Talks for insights on the exploitative nature of student loans.

Financing College: The Path to Higher Education and Financial Success

E N D

Presentation Transcript

What is “College?” • What are you paying for? • What do you hope to gain from the experience? • What is this product?

Paying for College: Your Role • You have the primary responsibility to pay for higher education. • Alternatives? • The role of financial aid is to offer assistance to families who need help paying for college • Who? • Main players: • Students • ~ Parents

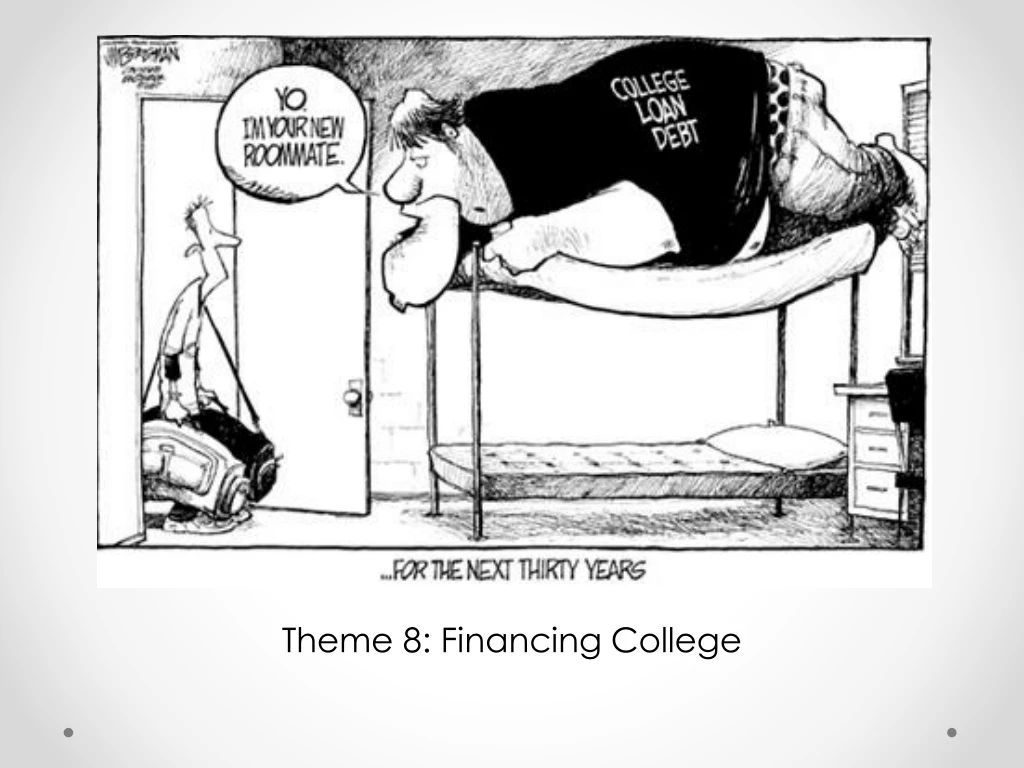

Consider • No one knows better than recent grads how expensive college is. The college class of 2016 graduated with an avg. of $37,172 in student loans says Mark Kantowitz, a higher-education expert. They were the most indebted class ever- up 6% from the year before. • With debt totals climbing each year, it’s easy to picture today’s high school seniors owing more than $40,000 when they finish college.

So how do people do it?? Sallie Mae- 2012

5 Types of Student Aid • Gift aid, such as grants and scholarships: free money that does not need to be repaid. • Scholarships and grants can be academic, athletic, income-based or sociocultural • Work-study jobs: Part-time student employment jobs which let you earn as you learn. • Work study is based on your family’s income and is filled on a 1st come 1st serve basis • Student loans: Money that is repaid over several years, usually with interest. • Student loans may be taken out by the student or the parent • Education tax benefits: such as the Hope Scholarship tax credit, which is money you get by filing a federal income tax return, even if you don’t owe any taxes. • Military student aid: such as ROTC and the GI Bill, where you earn money for your education in exchange for service in the United States Armed Forces.

So which is the best type of student aid? • Grants and scholarships are better than student loans because you don’t have to pay them back! • Need Based: Some funds are awarded based on financial need (the difference between the costs and ability to pay) • Merit Based: Some funds are based on academic, artistic or athletic merit or other skills and activities • GPA/ACT or SAT score/Class rank/extracurriculars • Some funds are based on unusual criteria • Creating a prom costume out of duct tape • A scholarship for left-handed students

Federal v. Private Loans • Benefits of Federal loans: • Federal student loans come with a number of benefits typically unavailable with private options. Once they enter repayment, federal student loans let you base payments on your income, pause repayment if you’re unemployed or facing a financial hardship, and potentially forgive your balance if you meet certain criteria. - (US News and World Reports)

Loan Comparison- $30,000 Federal Student Repayment v. $30 Private Student Repayment • Interest Rate: 3.75% • $300.33 (monthly payment) X 120 months= $36,099.04 • How much in interest? • Interest rate: 8.5% • 371.96 (monthly payment) X 120 months = $44,634.85 • How much in interest? • What’s the difference?

University Endowments • Endowments represent money or other financial assets that are donated to universities or colleges. • The sole intention of the endowment is to invest it and further invest in the institution. • They often follow very strict guidelines about how much can invested back into the institution each year and for what reasons. • One reason is to cover tuition of future students. • Less than $60,000 and you are accepted, you may not have to take out loans.

Paying for College- The Bottom Line Cost of Attendance/Budget • Billable (Tuition, Room and Board, Fees) • Non Billable (Books, Personal Expenses, Travel Expenses) Cost (Billable and Non-Billable)- financial aid you receive = What you will need to pay

Ted Talks: How Student Loans Exploit Students for Profit- Sanjay Samuel