Gun-Jumping Rules

220 likes | 571 Vues

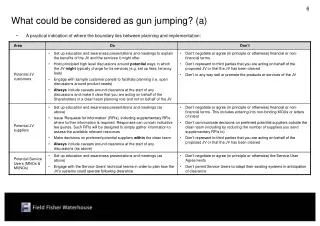

Gun-Jumping Rules . Pre-filing period Meaning of “offer”. (last updated 05 Feb 13). What is objective of regulation of public offerings?. Gun-Jumping (controlled disclosure during registration). Filing date. Effective date. Gun-Jumping (controlled disclosure during registration).

Gun-Jumping Rules

E N D

Presentation Transcript

Gun-Jumping Rules Pre-filing period Meaning of “offer” (last updated 05 Feb 13)

Gun-Jumping(controlled disclosure during registration) Filing date Effective date

Gun-Jumping(controlled disclosure during registration) Filing date Effective date No sales [§ 5(a)(1)] No deliveries [§ 5(a)(2)] No prospectus, unless comply § 10[§ 5(b)(1)] No delivery w/o §10 prospectus [§ 5(b)(2)] No offers [§ 5(c)] No offers - §8 proceeding / stop order [§ 5(c)] Pre-filing period Waiting period Post-effective period

Issuer categories • Non-reporting companies • Non-reporting issuer • No periodic reports • IPOs • Reporting companies • Unseasoned issuer • Reporting, but not eligible for S-3 • Small or less than 1 year • Seasoned issuer • S-3 eligible for primary offerings • $75 million float + 1 year • Well-known seasoned issuers (WKSI) • S-3 eligible AND • Either: • $700 MM worldwide float OR • $1 B in debt offerings in last 3 years Why are there different rules for different Issuers?

Public Offering Reforms (2005) * Only issuer, not UW/dealers

Hypothetical #1 Smartway Inc (an online marketer of last-minute airline tickets) decides to go public. Bob, Smartway’s VP of marketing, places an ad to run in the upcoming 9 issues of Business Week. It's the same ad as Smartway used to run in college newspapers: “Smartway is the leader for buying last-minute tickets online. We have more airlines and more destinations than any other online seller – and at better prices. In fact, last year our business grew 50%, as more and more flyers relied on our great service.” Any gun-jumping?

Securities Act Section 5(c) Necessity of filing registration statementIt shall be unlawful for any person, directly or indirectly, to make use of any means or instruments of transportation or communication in interstate commerce or of the mails to offer to sell or offer to buy through the use or medium of any prospectus or otherwise any security, unless a registration statement has been filed as to such security, or while the registration statement is the subject of a refusal order or stop order or (prior to the effective date of the registration statement) any public proceeding or examination under section 8.

Securities Act Section 2(a)(3) Definitions …The term "sale" or "sell" shall include every contract of sale or disposition of a security or interest in a security, for value. The term "offer to sell", "offer for sale", or "offer" shall include every attempt or offer to dispose of, or solicitation of an offer to buy, a security or interest in a security, for value. … ********************* • In re Loeb, Rhodes & Co (SEC 1959) • ’33 Act Rel No 3844 (1957) • ’33 Act Rel No 5180 (1971)

Rule 163A - defines “in registration” as 30 days before filing RSRule 168 – permits reporting issuers to continue regular info during registration Rule 169 – permits non-reporting issuers to continue regular info, but no FLI, issue-related info

Hypothetical #2 Smartway listens to your advice “go quiet, to go public.” It removes anything on its website that gives forward-looking information – nothing about profitability, growth prospects, and so on. But it does leave some links for customers interested in learning about the “last minute discount air tickets” industry. One link is to fool.com – where there is an analysis of the industry and Smartway’s upcoming IPO. Any gun-jumping?

“Use of Electronic Media” - Securities Act Rel No 7856 (2000)

Hypothetical #3 Smartway cuts the link to fool.com. CEO Sherry then begins talks with her friend Harold, an investment banker at Sparrow Securities. They phone each other and talk prices, size of offering, timing. Harold calls back and assures her that Sparrow can do the deal. He mails her a letter of intent for her signature. Any gun-jumping?

Securities Act Section 5(c) Necessity of filing registration statementIt shall be unlawful for any person, directly or indirectly, to make use of any means or instruments of transportation or communication in interstate commerce or of the mails to offer to sell or offer to buy … any security, unless a registration statement has been filed as to such security, …

Securities Act Section 2(a)(3) Definitions …The term "sale" or "sell" shall include every contract of sale or disposition of a security or interest in a security, for value. The term "offer to sell", "offer for sale", or "offer" shall include every attempt or offer to dispose of, or solicitation of an offer to buy, a security or interest in a security, for value. …The terms defined in this paragraph and the term "offer to buy" as used in subsection (c) of section 5 shall not include preliminary negotiations or agreements between an issuer (or any person directly or indirectly controlling or controlled by an issuer, or under direct or indirect common control with an issuer) and any underwriter or among underwriters who are or are to be in privity of contract with an issuer (or any person directly or indirectly controlling or controlled by an issuer, or under direct or indirect common control with an issuer).

Hypothetical #4 Excited about going public, CEO Sherry plans the following press release: “Smartway Inc announced today its plans for an initial public offering of common stock in the next few months. Smartway hopes to raise $200 million to expand its online last-minute airline ticketing business through a national advertising campaign.” “Smartway has reached an agreement in principle for a firm commitment offering with a well-known national investment bank to act as its managing underwriter.” Your advice?

Rule 135Notice of Proposed Registered Offering(only by issuer and limited to very basic information about offering)

Hypothetical #5 CEO Sherry changes the press release as you suggest. When Robert, a securities broker at First Lynch hears about the offering he figures that Sparrow Securities must be the managing underwriter. Robert calls Harold and says his firm is interested in participating in the offering as a retailer and will purchase 25% of Sparrow’s allotment. First Lynch will earn no more than the standard dealer’s commission. Harold agrees. Any gun-jumping?

Securities Act Section 5(c) Necessity of filing registration statementIt shall be unlawful for any person, directly or indirectly, to make use of any means or instruments of transportation or communication in interstate commerce or of the mails to offer to sell or offer to buy … any security, unless a registration statement has been filed as to such security, …

Securities Act Section 2(a)(3) Definitions …The terms defined in this paragraph and the term "offer to buy" as used in subsection (c) of section 5 shall not include preliminary negotiations or agreements between an issuer (or any person directly or indirectly controlling or controlled by an issuer, or under direct or indirect common control with an issuer) and any underwriter or among underwriters who are or are to be in privity of contract with an issuer (or any person directly or indirectly controlling or controlled by an issuer, or under direct or indirect common control with an issuer).

Securities industry demographics(Feb 2009) • Stock exchanges • Eleven exchanges • Clearing agencies • Five • Nationally recognized statistical rating organizations • Ten • Outstanding asset-backed securities • $2.5 trillion (in 2007, up from $1 trillion in 2000 • Today worth .. Public companies: • 12,000 (securities registered with SEC) Investment advisers: • 11,300 (includes hedge fund managers, up from 7,546 in 2002) Broker-dealers: • 5,500 (including 173,000 branch offices, up from 75,000 in 2001) • 665,000 registered representatives Fund complexes: • 950 (4,600 registered funds)