Free Response Question Practice

330 likes | 548 Vues

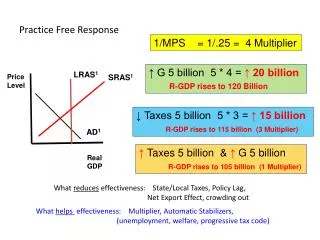

Free Response Question Practice. Loanable Funds Market [*Use this graph if there is a chg in savings by consumers or chg in fiscal policy] [* Use the Money Market graph when there is a change in MS ]. D 2. S. Use the “real interest rate” with LFM , because it is long-term .

Free Response Question Practice

E N D

Presentation Transcript

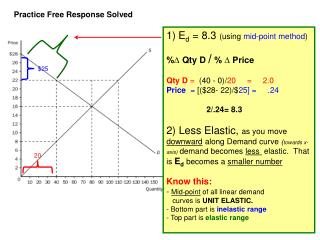

Loanable Funds Market [*Use this graph if there is a chg in savings by consumers or chg in fiscal policy] [*Use theMoney Market graphwhen there is achange in MS] D2 S Use the “real interest rate” with LFM, because it is long-term. Use “nominal interest rate” with money market, as it isshort-term. D1 Borrowers Lenders Starting from abalanced budget, if the G incr spendingordecr Tto get out of arecession, theywould now be running adeficitand have to borrow,pushing up demand in the LFMandincreasing the interest rate. r=8% Real Interest Rate, (percent) E2 r=6% E1 $2.2 tril. $2 tril. $2 tril. T G F1 F2 Quantity of Loanable Funds Balanced Budget[G&T=$2 Tr.]

Expansionary Fiscal Policy Loanable Funds Market D2 S [Incr G;Decr T] Real In. Rate D1 r=8% SRAS PL AD2 r=6% Start from a Balanced Budget G & T = $2 Trillion LRAS AD1 F1 F2 “Now, this is better.” $2.2 tril. “I can’t get a job.” PL2 $2 tril. $2 tril. PL1 E2 GT E1 YR YF Real GDP $2.2 $2.2 G G I.R. AD Y/Empl./PL; LFM $1.8 $1.8 T Y/Emp./PL; DI C AD T LFM IR

Contractionary Fiscal Policy Loanable Funds Market D1 [Decr G; Incr T] Real In. Rate D2 S r=6% PL r=3% SRAS Start from a Balanced Budget G & T = $2 Trillion LRAS AD2 F2 F1 PL1 $2.2 Ttril. E1 $2 tril. $2 Ttril. $1.8tril.. PL2 GT AD1 E2 YI YF [like we have “money trees”] Real GDP $1.8 $1.8 G G I.R. AD Y/Empl./PL; LFM $2.2 $2.2 T Y/Emp/PL; DI C AD T LFM IR

AP Macro FRQ Practice 1 • Government cuts defense spending by $75 billion. • As a result the following occur: • - Unemployment increases from 6% to 9% • - GDP drops 3% • - Inflation drops from 3% to 1% • Based on this info, draw AD1 to AD2on the graph. • ……………………………………………………………… • A. Now “G” decreases taxes, which (incr/decr) DI, • which (incr/decr) C, which (incr/decr) AD. [starting • a balanced budget] The result is an (incr/decr) in GDP, • employment & PL. With the increase of government’s • demand for loanable funds, because they now have • less tax revenue, the interest rate (increase/decrease). • Draw the new AD1 to AD2 curves on the graph. • B. Due to the change in interest rates, the dollar • (appreciates/depreciates) and our exports (incr/decr). SRAS LRAS PL AD2 AD1 E1 PL1 PL2 E2 YR 9% Y* Real Y LRAS SRAS PL AD2 AD1 PL2 E2 PL1 E1 YR 9% Y*

AP Macro FRQ Practice 2 2. Net exports increase by $50 billion due to a depreciated dollar, resulting in the following: - Unemployment stays at 3% - GDP stays the same - Inflation increases from 8% to 10% Based on this info, draw AD1 to AD2 on the graph. ……………………………………………………………… A. Now government decreases spendingby $100 bil. which leads to an (increase/decrease) in AD. The result is an (incr/decr) in GDP, employment, and PL. With the reduction of “G”’s demand for dollars in the LFM, because of the decrease in “G”, the interest rate (increases/decreases). Draw the new AD1 to AD2 curves on the graph. B. Due to the change in price level, the dollar (apprec/deprec) and our imports (increase/decrease). LRAS PL AD2 SRAS AD1 PL2 E2 E1 PL1 Y* YI 3% LRAS PL AD2 SRAS AD1 PL1 E1 PL2 E2 Real GDP Y* YI 3%

AP Macro FRQ Practice 3 3. Government spends $99 billionon a war with Cuba. As a result the following occur: - Unemployment decreases from 14% to 10% - GDP increases 10% - Inflation is 0% Based on this info, draw AD1 to AD2 on the graph. ……………………………………………………………… A. Now government decreases taxes by $150 billion which (incr/decr) DI, which (incr/decr) C, which (incr/decr) AD. The result is an (incr/decr) in GDP, employment, & PL. With the increase of government’s demand for LF, because they now have less tax revenue, the interest rate (increases/decreases). B. Due to the increase in the growth rate, the dollar (apprec/deprec) and our imports (increase/decrease). SRAS PL LRAS AD2 AD1 PL E2 E1 Real GDP YR 14% YR 10% Y* LRAS PL SRAS AD2 AD1 PL2 E2 PL1 E1 YR 10% Y* Real GDP

AP Macro FRQ Practice 4 4. Government spends $100 billion on the infrastructure. As a result the following occur: - Unemployment decreases from 6% to 3% - GDP increases 5% - Inflation increases from 2% to 6% Based on this info, draw AD1 to AD2 on the graph. ……………………………………………………………… A. Now government increases taxes by $100 billion, which (incr/decr) DI, which (incr/decr) C, which (incr/decr) AD. The result is an (incr/decr) in GDP employment, and PL. With the decrease of “G”’s demand for dollars in the LFM, because of the increase in “T”, the interest rate (incr/decr). Draw the new AD1 to AD2 curves on the graph. B. Due to the change in interest rate, the dollar (apprec/deprec) and our exports (increase/decrease). LRAS PL SRAS AD2 AD1 PL2 E2 PL1 E1 Y* YI 3% LRAS PL AD2 AD1 SRAS PL1 E1 PL2 E2 Real GDP Y* YI 3% The economy is guilty of breaking the “FE 4% Speed Limit.” We are going to have to raise interest rates. Wait a minute – this is monetary policy. We’ll attack this on the next test. Let’s look again at fiscal policy.

AP Macro FRQ Practice 5 5. Net exports decrease by $60 billion due to an appreciated dollar, resulting in the following: - Unemployment stays at 3% - GDP stays the same - Inflation drops from 10% to 6% Based on this info, draw AD1 to AD2 ……………………………………………………………. A. Now government decreases spending by $90 billion which leads to an (incr/decr) in AD. The result is an (incr/decr) in GDP, employment, & PL. With the reduction of “G”’s demand for LF, because of the decrease in “G”, the interest rate (increases/decreases). Draw the new AD1 to AD2 curves on the graph. B. Due to the change in PL, the dollar (apprec/deprec) and our imports (incr/decr). LRAS PL AD1 SRAS AD2 PL1 E1 PL2 E2 Y* YI 3% LRAS SRAS AD1 PL AD2 PL1 E1 PL2 E2 Y* YI 3%

AP Macro FRQ Practice 6 6. Rising U.S. tariffs cause Xn to drop by $30 billion. As a result the following occur: - Unemployment increases from 10% to 12% - GDP decreases 8% - Inflation is 0% Based on this info, draw AD1 to AD2 on the graph. ………………………………………………………………. A. Now government decreases taxes by $125 billionwhich (incr/decr) DI, which (incr/decr) C, which (incr/decr) AD. The result is an (incr/decr) in GDP, employment, and PL. With the increase of government’s demand for LF, because they now have less tax revenue,theinterest rate (incr/decr). Draw the new AD1 to AD2 on the graph. B. Due to the increase in the growth rate, the dollar (apprec/deprec) and our exports (increase/decrease). LRAS PL SRAS AD1 AD2 PL YR 10% Y* YR 12% LRAS PL SRAS AD2 AD1 PL2 E2 PL1 E1 YR 12% Y*

Fiscal Policy FRQ Practice Question 1 1. Suppose the following conditions describe the current state of the economy. -The unemployment rate is 3.5% -Real GDP is growing at the rate of 5% -The inflation rate is 9% (a) Identify the main problem this economy faces [inflation] (b) Now Congress votes to increase personal income taxes. Using AD/AS analysis [graph this], explain what effect this policy will have on each of the following. (i) AD, & thus output & employment (ii) The price level (iii) The interest rate Answers: (i) The increase in personal taxes will decrease DI, which will decrease C, which will decrease AD, which will decrease output and employment. (ii) The decrease in AD will result in a lower equilibrium [AD1 to AD2 & E1 to E2] and a lower price level. (iii) The increase in personal taxes results in more tax revenue v. government spending, which decreases the demand for money in the LFM & a decrease in interest rates.

Fiscal Policy FRQ Practice Question 2 2. Assume that in the U.S., nominal wage rates rise faster than labor productivity. UsingAD/AS analysis [graph this], analyze the short- run effects of this situation on each of the following. [Base your (b) answer on what the price level does] (a)The general price level (b) The international value of the dollar [based on PL] (c) The level of exports Answers: (a) As shown (graph), nominal wage rates rising faster than labor productivity would decrease the AS curve from AS1 to AS2. The decrease in AS would change equilibrium from E1 to E2, which would result in a higher general price level. (b) The higher price level would make our exports more expensive relative to foreign goods, thus decreasing demand for the U.S. dollar and depreciating the dollar. (c) The depreciated dollar would make our goods cheaper than the previous period and increase our exports.

Easy (Expansionary) Monetary Policy MS1 DI MS2 Investment Demand 8% 6% 4% 0 8 4 0 nominal Interest Rate 6% DM Buy If there is a RECESSION MS will be increased. Money Market QID1 QID2 AS AD1 AD2 I want a job as a Rockette PL2 Price level E2 PL1 E1 YR Y* Real GDP Buy Bonds I.R. QID MS Y/Emp/PL AD

Tight [Contractionary] Monetary Policy DI “It’s cheaper to burn money than wood.” Dm MS1 MS2 Investment Demand 10% 8% 6% 0 10 8 6 0 Nominal Interest Rate Sell If there is INFLATION, MS will be decreased. Money Market QID1 QID2 AS like “money trees” AD2 AD1 E1 PL1 Price level PL2 E2 YI Y* Sell Bonds MS I.R. AD Y/Empl./PL QID

Free Response 2005 1. [13 total pts] Assume that the U.S. economy is currently in equilibrium at the full-employment level of real GDP. (a) [3 pts] Draw a correctly labeled graph of AD/AS showing each of the following in the U.S. (i) Output level (ii) Price level SRAS LRAS AD1 AD2 PL1 E1 PL2 E2 Y* YR Real GDP (b) [3 pts] Japan is a major importer of U.S. products. Assume that the Japanese economy goes into arecession. (i) Explain the impact of the Japanese recession on the U.S. equilibrium output and price levels. (ii) Show these effectson your graph in part (a). Answer (b)(i) & (ii): The Japanese recession would cause job losses in Japan, lowering prices and incomes there, which would reduce U.S. exports to Japan. This would decrease aggregate demand in the U.S, which would decrease PL, output, and employment.

(c) [5 pts] Assume that the Fed takes action to curb the effects of the Japanese recession on the U.S. economy. (i) What open-market operation would the Fed undertake? FR 2005 Answer (c) (i): The Fed would buy bonds which would increase the MS and decrease interest rates. (ii) Use a correctly labeled graph of the money market to show how the Fed policy action will affect the nominal interest rate. Answer (c) (ii): The Fed buying bonds would mean a bigger MS, which would lead to lower nominal interest rates. (iii) Explain how the change in the nominal interest rate in part (c) (ii) will affect AD, price level, and real output in the U.S. Answer (c) (iii): As seen in the graphs above, the decrease in the nominal interest rate would increase investment, which would increase AD. The increase in AD would increase price level and real output in the U.S.

FR 2005 (d) [1 pt] Define the real interest rate. Answer 1 (d): The real interest rate is the nominal interest rate less the expected rate of inflation. (e) [1 pt] Indicate the effect of the open-market operation you identified in part (c) on the real interest rate in the U.S. Answer (e): The buying of bonds by the Fed would increase the MS, which would decrease the interest rate, which would increase Ig and increase AD and price level. The increase in PL would be subtracted from the nominal interest rate, which would decrease the real interest rate.

Loanable Funds Market FR 2005 D2 S D1 upply of Funds r=10% E2 Real Interest Rate E1 r=8% Demand for Funds F2 F1 Quantity of Funds 2. [8 total pts] The graph above shows the loanable funds market for a country. (a) [2 pts] Assume that now the country’sgovernment increases deficit spending. Explain how theincrease in deficit spending will affect the real interest rate. Answer 2. (a):The increase in deficit spending means the government has to borrow more in the LFM. The increase in demand in the LFM increases the real interest rate. (b) [1 pt] Indicate how the real interest rate change you identified in part (a) will affect the investmentin plant and equipment. Answer 2. (b): The increase in the real interest rate will make plant & equipment projects less profitable and will decrease investment in those projects. That is, there is “crowding-out” of investment, due to the higher interest rate.

FR 2005 (c) [2 pts] Explain how the real interest rate change you identified in part (a) will affect long-term economic growth. Answer 2. (c): Because the real interest rate increased in part (a), there will be lower investment in plant & equipment that make up that country’s national factory, therefore making its citizens less productive. This will result in slower long-term economic growth and shift the LRAS curve left. However, unless there is negative net investment, there could still be economic growth. (d) [3 pts] Explain how the real interest rate change you identified in part (a) will affect each of the following in the foreign exchange market. (i) The demand for the country’s currency (ii) The value of the country’s currency Answer 2. (d), (i) & (ii): With real interest rates increasing in part (a), the demand for financial capital (CDs, bonds, etc.) in that country will increase because of the greater relative return on them. (i) This will result in more demand for its currency. (ii) The increase in demand, caused by better return on its financial capital, will increase the value of that nation’s currency, appreciating it.

FR 2005 3. [4 total pts] Assume that thetable below shows theunemployment and inflation data in Country X as a result of a shift in AD. Period Unemployment RateInflation Rate Last Year 2%8% This Year 5%4% (a)[2 pts] Draw a correctly labeled graph of a short-run Phillips curve for Country X, showing theactual unemployment and inflation rates for both years. Label the Phillips curve as SRPC. (b) [2 pts] Now assume that the SRAS curve has shifted to the left. (i) Identify one factor that could cause the AS curve to shift to the left. SRPC* SRPC 8% Answer 3 (b) (i): An increase in input cost could shift the AS curve left. [Other OK answers would be increase in bus. regs., increase in business taxes, decrease in subsidies, or an increase in expected inflation.] Inflation 4% 2% Unemployment 5% (ii) On the graph, show how this shift would affect the short-run Phillips curve.

FR 2005 (c) [1 pt] Assume that the natural rate of unemployment in Country X is 5%. Draw acorrectly labeled graph of the long-run Phillips curve and label it asLRPC. LRPC SRPC 8% Inflation 4% 2% Unemployment 5% (d) [1 pt] What is the relationship between the unemployment rate and the inflation rate in the long run? Answer 2. (d): There is no relationshipbetween the unemployment rate and inflation in the long run. As can be seen in the graph above. If there is unanticipated inflation or disinflation, although PL increases or decreases, unemployment ends up at the natural rate.

2004 Macro Free Response • Assume our economy is operating at less than full employment. • (a) Using a correctly labeled AD & AS graph, show the following. • (i) Full-employment output • (ii) Current output • (iii) Current price level Need Job My InfoTech job was outsourced to India. YRYF Real GDP (b) Identify an open-market operation that could restore full employment in the short run. Answer: An open-market operation to increase AD would be the Fed buying bonds.

2004 Nominal Interest Rates MS2 This job is more like it. AD2 PL2 IR2 E2 IR2 Money Market QID2 YR YF Quantity of Investment (c) Using a correctly labeled graph of the money market, show how the open market operation you identified in part (b) affects the I.R. in the SR. Answer: See the above graph. The increase in MS decreases the I.R. in the SR. (d) Explain how the change in the interest rateyou identified in part (c) will affect AD. Answer: The decrease in the interest rate will increase QID and consumption which will increase AD. (It will also increase Xn because it depreciates the dollar, making our products cheaper.) (e) Show on the graph in part (a) how the change in the IR you identified in part (c) will affect output and price level. Answer: The lower IR will increase QID, which will increase AD which will increase output and price level as shown by the movement fromAD1 to AD2.

(f) Instead of the open-market in part (b), suppose that no policy actions are takento address the unemployment problem. With flexible prices & wages, explain how each of the following will eventually change. (i) Short-run AS (ii) Output and price level LRAS SRAS1 AD1 PL FRQ 2004 AD SRAS2 Surplus -20% $10 $8 YR RGDP Y* Answer: As price level drops, workers will accept lower wages. With cheaper resource cost, firms will hire more workersshifting the SRAS curve to the right, decreasing price level and increasing output.

2. (a) Assume that national saving in the U.S. increases. Explain the effect of this increase on the real interest rate in the U.S. Answer: If national savings increase, then banks have more loanable funds. More LF would lead to adecrease in the real interest rate. LFMor Money Market? Use the “Money Market”model, with the vertical MS,when theFed changesthe MS. Use the “LFM” model, with the upward sloping supply curve, if there is a “change in savings” or “change in demand for loanable funds”, such as expansionary or contractionary fiscal policy. (b) Suppose that real interest rates in the rest of the world remain unchanged. (i) Explain the effect of the real interest rate change in the U.S. that you identified in part (a) on the demand for the U.S. dollar in the foreign exchange market. Answer: Because the U.S. real interest rate is going down and they are unchanged in the rest of the world, foreign investors would decrease their demand for U.S. financialassetsbecause of less return on the lowerreal I.Rates. (ii) As a result of the effect you identified in (i), what will happen to the international value of the U.S.dollar? Answer:The decrease in foreign demand for U.S. financial assets because of the decreasing interest rate would depreciate the dollar. (c) Given your answer in part (b), indicate how each of the following will change. (i) U.S. imports (ii) U.S. exports Answer:U.S. importswoulddecrease because the depreciated dollar would make imports more expensive. U.S. exports would increase because the depreciated dollar would make U.S. exports cheaper.

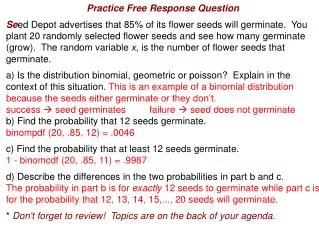

3. The Fed buys $5,000 in bondsfrom Clark Consulting Services, which then deposits the money in a checking account at First Generation Bank. (a) As a result of the Fed’s action, what is the change in MS if RR is 100%? Answer: The change in MS would be the $5,000DD. (b) If the RR is reduced to 10%, calculate the following. (i) The maximum amount this bank could lendfrom this deposit. Answer: With 10% or $500 in RR, the bank could loan out $4,500. (ii) The maximum increase in the total MS from the Fed’s bond purchase. Answer: Potential money creation in the banking system could be as much as $45,000 [10x$4,500=$45,000]. Clark Consulting has a DD of $5,000. Adding these two together gives a TMS of $50,000. (c) If banks keep some of the deposit as ER, how will this influence the change in the MS that was determined in part (b)(II)? Explain. Answer: If the bank doesn’t loan out all of the $4,500 ER, then the 1st loan would not be as much as $4,500, therefore reducing PMC. (d) If the public decides to hold some money in the form of currency rather than in demand deposits, how will this influence the change in the money supply that was determined in part (b)(ii)? Explain. Answer: If the public gets the loan and holds part of it as currency, then this is a leakage in the PMC of the banking system. If the person who takes the $4,500 loan from First Generation Bank takes $500 in cash, then only $4,000 gets deposited in the next bank, thus reducing the PMCof the system.

MACROECONOMICS FRQ 2008 Question 1: 11 pts [2+2+3+2+2] Question 2: 6 pts [2+2+2] Question 3: 6 pts [1+2+2+1]

FRQ 2008 Question 1: 11 pts [2+2+3+2+2] • Assume the U.S. economy is operating at full-employment output and the government has a balanced budget. A drop in consumer confidence reduces consumption spending, causing the economy to enter into a recession. • (a) Using a correctly labeled graph of the short-run Phillips curve, show the effect • of the decrease in consumption spending. Label the initial position “A” and the • new position “B”. • (b) What is the impact of the recession on the federal budget? Explain. SRPC 2 pts – 1 pt for correctly labeled SRPC graph. 1 pt for initial & new pt on SRPC graph. Inflation A 4% B 2% A. W. Phillips 1914-1975 7% Unemployment 5% Answer to 1. (b): The decrease in consumption would result in a decrease in AD and a decrease in GDP. This would result in an increase in unemployment and an increase in transfer payments. Due to the job losses, there would be a decrease in tax revenues, resulting in an increase in government red ink for the federal budget. So a federal budget deficit would increase or a federal budget surplus would decrease. 2 pts - 1 pt for budget deficit and 1 pt for explanation.

FRQ 2008 (c) Assume current real GDP falls short of full-employment output by $500 billion and the MPC is 0.8. (i) Calculate the minimum increase in government spending that could bring about full employment. Answer to 1. (c) (i): The expenditure multiplier [ME] would be 5 [1/.2 = ME of 5]. Because current output falls short by $500 billion, it would take a minimum increase in government spending of $100 billion to get to full employment. [5 X $100 = $500] (ii) Assume that instead of increasing government spending, the government decides to reduce personal income taxes. Will the reduction in personal income taxes required to achieve full employment be larger than or smaller than the government spending change you calculated in part (c) (i)? Explain why. Answer to 1. (c) (ii): Because the tax multiplier [MT] is smaller, or [MPC/MPS = .8/.2 = 4], it will take a larger tax cut then the increase in government spending. Because current output is $500 bil. short of FE Y, and the MT is 4, it would take a tax cut of $125 billion. [4 X $125 = $500] 3 pts – 1 pt – $100; 1 pt – larger Tax reduction; 1 pt – smaller MT or not all increased Y spent.

(d) Using a correctly labeled graph of the loanable funds market, show the impact of the increased government spending on the real interest rate in the economy. Answer to 1. (d) As can be seen on the LF graph, the RIR would increase as the government has to borrow more than previously, increasing demand in the LFM, which pushes up the RIR. D2 S D1 2 pts – 1 pt – correctly labeled LFM graph; 1 pt – rightward shift of D curve or leftward supply shift. Borrowers Lenders (e) How will the real interest rate change in part (d) affect the growth rate of the U.S. economy? Explain. rir=8% Real Interest Rate, (percent) E2 Answer to 1. (e): The increase in RIR will decrease real Ig, decreasing capital stock. This will decrease AD and decrease GDP or growth rate in the U.S. economy. rir=6% E1 2 pts – 1 pt – growth rate falls; 1 pt – Igdecreases, slowing capital formation. $2.1 Tril. after $100 B increase $2 T $2 T T G F1 F2 Quantity of Loanable Funds Balanced Budget [G&T=$2 Tr.]

Question 2: 6 pts [2+2+2] FRQ 2008 • 2. Balance of payments accounts record all of a country’s international transactions during a year. • Two major subaccounts in the balance of payments accounts are the current account and the • capital account. • In which of these subaccounts will each of the following transactions be recorded? • (i) A United States resident buys chocolate from Belgium. Answer to 2. (a) (i): Chocolate from Belgium would go in the current account as it includes the import of goods. 1 pt – current account (ii) A United States manufacturer buys computer equipment from Japan. Answer to 2. (a) (ii): Computer equipment by a U.S. manufacturer would also be classified as an import so it would also go on the current account. 1 pt – current account (b) How would an increase in the real income in the United States affect the United States current account balance? Explain. Answer to 2. (b): An increase in real income would make U.S. citizens richer. We would buy more imports, decreasing net exports, and increasing the deficit on the current account. 2 pts - 1 pt – imports increase or Xn decrease. 1 pt – current account balance decreases or current account balance goes into deficit.

FRQ 2008 D1$ S1$ Price R looking for $’s $’s looking for R R100 S2$ R50 Rupee Price ofDollar E1 Rupee appreciates A R25 E2 Quantity of Dollars D (c) Using a correctly labeled graph of the foreign exchange market for the U.S. dollar, show how an increase in U.S. firms’ direct investment in India will affect the value of the U.S. dollar relative to the Indian currency (the rupee). Answer to 2. (c): The increase in investment in India will increase demand for the rupee & appreciate that currency. This would result in an increase in supply of the U.S. dollar for more rupees, depreciating the dollar. 2 pts - 1 pt – correctly labeled foreign exchange graph for the dollar. 1 pt – rightward shift in supply and depreciation of the dollar.

Question 3: 6 pts [1+2+2+1] FRQ 2008 • 3. The PPCs for Artland & Rayland are shown. Using equal • amounts of resources, Artland can produce 600 hats or 300 • bicycles, & Rayland can produce1,200 hats or 300 bicycles. • Calculate the opportunity cost of a bicycle in Artland. • (b) If the two countries specialize and trade, which country • will import bicycles? Explain. • (c) If the terms of trade are 5 hats for 1 bicycle, would trade • be advantageous for each of the following? • (i) Artland • (ii) Rayland • (d) If productivity in Artland triples, which country has the comparative advantage in the production of hats? Answer to 3. (a): The Domestic Comparative (opportunity cost) of a bicycle in Artland is 2 units of hats. [1 bicycle = 2 hats or 600/300=2] 1 pt for “1 B = 2 H” DCC: Rayland DCC: Artland 1 B = 4 H 1 B = 2 H ¼ B= 1 H ½ B= 1 H Terms of Trade 1 B = 3 H 1/3 B = 1 H Answer to 3. (b): Rayland will import bicycles. Domestically, they have to give up 4 hats to get a bicycle but with trade they have to give up only 3 hats. 2 pts for “Rayland will import bicycles” 1 pt for “Yes, 5 H is better than 2 H” Answer to 3. (c) (i): Yes, 5 hats is better than 2 hats they are getting domestically. Answer to 3. (c) (ii): No, Rayland is going to export hats so opportunity cost is ¼ bicycle. So 1/5 of a bicycle would not benefit them. 1 pt for “No” Answer to 3. (d): 300 bicycles would become 900 and 600 hats would become 1,800, so the DCC would still be 1 bicycle = 2 hats, same as before. Rayland still has a C.A. in hats. 1 pt for “No change, so Rayland still has a comparative advantage in hats”