Inventories and CGS

250 likes | 544 Vues

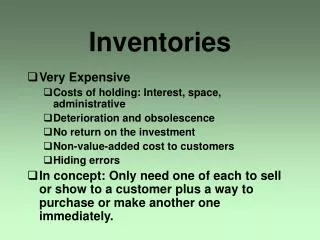

Inventories and CGS. RCJ Chapter 9. Key Issues. Effect of LIFO on financial statements LIFO layers LIFO reserve Change in LIFO reserve Price vs. quantity effects LIFO and earnings management LIFO footnote LIFO tax savings LIFO FIFO switch Dollar Value LIFO. Cost Flow Assumptions.

Inventories and CGS

E N D

Presentation Transcript

Inventories and CGS RCJ Chapter 9

Key Issues • Effect of LIFO on financial statements • LIFO layers • LIFO reserve • Change in LIFO reserve • Price vs. quantity effects • LIFO and earnings management • LIFO footnote • LIFO tax savings • LIFO FIFO switch • Dollar Value LIFO Paul Zarowin

Cost Flow Assumptions BI + Pur = Cost of Goods Available for Sale • GAAP does not require specific identification of the cost of each unit sold to its acquired cost. • Allocation of the “Cost of Goods Available for Sale” between EI and CGS based on assumptions like FIFO & LIFO. Cost of Goods Sold (CGS) Ending Inventory (EI) + Paul Zarowin

Illustrative Example • Use of FIFO vs. LIFO makes a difference when prices change. Paul Zarowin

Illustrative Example (cont’d) Paul Zarowin

Reporting Trade-offs • FIFO vs. LIFO: • Inventories closer to replacement (current) cost under FIFO – reliable B/S • CoGS closer to replacement cost under LIFO – High quality of earnings operating margin (economic profit) Independent of inventory method Holding gain(influences only accounting earnings) Dependent on use of LIFO or FIFO Paul Zarowin

Reporting Trade-offs (cont’d) • I/S perspective (CoGS): LIFO vs. FIFO Example continued: • 400 units were sold. • At replacement cost ((i.e., the 4th quarter unit cost of $14) the CoGS equals 400 x $14 = $5,600 FIFO $4,300 LIFO $5,150 replacement cost $5,600 < < EX. P. 93 W/O LR Paul Zarowin

Reporting Trade-offs (cont’d) • B/S perspective (Inventory): FISH vs. LISH • Ending inventory 300 units • At replacement cost ($14 per unit) inventory has carrying value of: 300 x $14 = $4,200 Replacement cost $4,200 FIFO/LISH $3,950 LIFO/FISH $3,100 > > Ex. P. 93 w/o LR Paul Zarowin

LIFO Reserve (LR) B/S perspective: LIFO layers: LR =LQL*(RC - HCL) L=layer Q=quantity (# of units) RC=replacement cost (current price per unit) HC=historical cost per unit Approximates replacement cost Paul Zarowin

LIFO Layers $350 Dip $125 $75 $25 $25 Paul Zarowin

LIFO Reserve (cont’d) I/S perspective: (pre-tax earnings) i.e. cumulative difference in CGS. Why? Paul Zarowin

Why do we care about in LIFO Reserve? • Note: FIFO CGS can be > LIFO CGS • Key assumption: same purchases. Reasonable? Incentives? • Do LIFO vs. FIFO firms differ in inventory management? Ex. P9-3; P9-8; P9-13 • Adjust B/S by LR • Adjust I/S by LR Paul Zarowin

Why do we care about in LIFO Reserve? (cont’d) Remember: LR =LQL*(RC - HCL) So LR means Q and/or RC (HC is fixed) Example: • LRB=100($1.5 - $1) = $50 Consider there 2 alternative scenarios: • Q 100 150 : LRE=150($1.5 - $1) =$75 • RC $1.5 $2 : LRE=100($2 - $1) =$100 In general, both Q and RC may change. Paul Zarowin

LR: Price Effect and Quantity Effect • What makes LIFO CGS > or < FIFO CGS? • i.e., What makes LR + or - ? • LIFO disclosures: must disclose quantity effect if material. Why? Ex. ARAL CO, pg. 454-462, P.9-15 Paul Zarowin

LIFO and Earnings Management • What is under management’s control? Q? RCE ? HC? QB ? RCB? • LIFO liquidations • What about FIFO firms? P9-5 Paul Zarowin

LIFO Tax Savings (conservative: assumes 0% interest) Remember: LR = cumulative difference in LIFO CGS vs. FIFO CGS C 9-2, 3 Paul Zarowin

Switch FIFO LIFO • Switch from FIFO to LIFO: just go forward, since can’t replicate layers (i.e., don’t know cumulative effect) • Switch from LIFO to FIFO: DR Inventory (LR) CR Cash/taxes payable (LR*tax rate) CR R/E LR* (1-tax rate) Remember: cumulative effect accounting change Note: pay no interest on tax savings Paul Zarowin C 9-5 Weldotron

DVL: Dollar Value LIFO • How firms do LIFO • Keep records FIFO (replacement cost) • Convert to LIFO using annual price index • Ease of record keeping Paul Zarowin

DVL Example • Firm begins at 1-1-1992 • FIFO CGS = 100,000 every year DVL = LIFO @ BOY + (Q * Price) Qty = RC ÷ Price 1993: • DVL: 86,800 = 70,000 BI + 16,000*1.05 new layer • LR: 13,500 = 90,300 - 86,800 • P effect: 70,000 units * (1.05 - 1.00) • Q effect: zero, because RC = HC for new units • LIFO CGS = FIFO CGS + LR Paul Zarowin

LIFO Correction J.E. Put LIFO firm on FIFO: DR Inventory (LR) CR Cash or taxes/payable (LR*tax rate%)CR R/E (LR* 1-T%) [same as slide #17] Paul Zarowin