Lecture 19: Interdependence & Coordination

130 likes | 279 Vues

Lecture 19: Interdependence & Coordination. International Interdependence Theory: interdependence results from capital mobility, even with floating rates. Empirical estimates of cross-country effects. International Coordination The institutions of international cooperation

Lecture 19: Interdependence & Coordination

E N D

Presentation Transcript

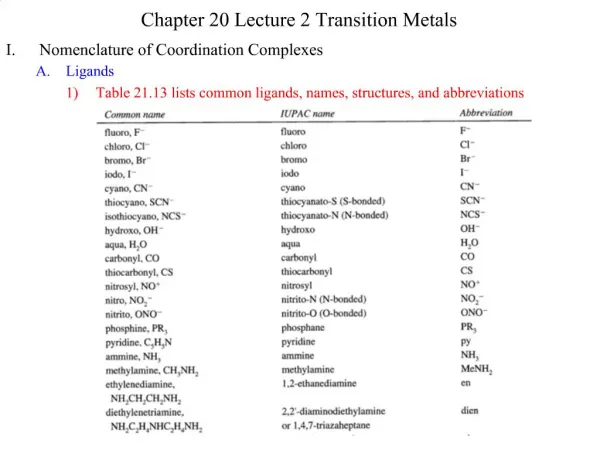

Lecture 19: Interdependence & Coordination • International Interdependence • Theory:interdependence results from capital mobility, even with floating rates. • Empirical estimates of cross-country effects. • International Coordination • The institutions of international cooperation • Theory: Prisoners’ dilemma

Interdependence under floating exchange rates, • revisited • Two of the results derived previously in the course were too strong to be literally true: • When we first looked at the question, floating rates completely insulated countries from each other’s economies. But that was when KA=0 (=> TB=0). • Since then, we have seen, capital mobility changes things. • Indeed, US, euroland, Japan, UK, etc., are still correlated. • Under κ=, we found G leaked abroad 100%, through offsetting TD. No effect remained at home. • This overly strong result was a consequence of the assumption i = .

The restriction i = is in reality too strong, even for modern conditions of low barriers to international capital flows . • Reasons: • i i*, when investors are aware of likelihood of future exchange rate changes, • and • (2) i* is not exogenous, if domestic country is large in world financial markets (as are US & EU). • => Two-country model. • Implication: Effects of AD expansion are partly felt in domestic country, partly transmitted abroad through TD. • Why don’t floating rates insulate? Capital flows.

Two-country model with perfect capital mobility • For now, retain i=i*, but drop i* =<= domestic country is big enough to affect i* . • Fiscal expansion, shifting ISUS out, • thereby appreciating $ and worsening TB, • now also depreciates € and raises TB*. • So Y rises (crowding out < than 100% ), despite κ=∞, • Y* rises (international transmission), despite floating, • as i and i* rise in tandem. API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

US expansion drives up interest rates worldwide, because US is large in world financial markets. $↑ €↓ => Expansion is transmitted from US to Europe. API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

Transmission in practice. • In 12 large econometric models, on average: • US fiscal expansion -> • Multiplier 1.5 in US 1/ • and ½ in EU & Japan. • US 4% monetary expansion -> • Effect on GDP 1% in US • and 0 in EU & Japan. • 1/presumably lower under full employmentor default risk(developing countries); Most relevant in recession with liquidity trap(US 2009-12).

The econometric models agree that US fiscal expansion,via TBUS<0 and TB* >0, is transmitted positively to the rest of the world. API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

Similarly, a fiscal expansion in the rest of the OECD countriesvia TBRoW<0 and TBUS>0,is transmitted positively to the US. API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

More disagreement regarding international effects of monetary policy. A US monetary expansion, domestically, raises output & inflation. But the models divide regarding the effects on TB, TBRoWand YRoW. Reason: two effects go opposite directions. Y ↑ => TB ↓ , but $↓ => TB ↑ API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

Disagreement regarding international effects of monetary policy. A foreign monetary expansion raises output & inflation there. But the models divide regarding cross-border transmission. Reason: 2 effects go opposite directions. YRoW↑ => TBRoW↓, but €↓ => TBRoW↑ API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

International macroeconomic policy coordination • Institutions of coordination: • G8 Leaders Summit & G7 Finance Ministers • 1975 Rambouillet: ratified floating • 1978 Bonn: locomotive theory • 1985 Plaza: intervention to depreciate $ • 1998 Cologne: reform of the international financial architecture • BIS & Basel Committee on Banking Supervision • 1988 Basel Accord: set capital adequacy rules for intl. banks • 2007 Basel II: Gov.t bonds should not necessarily get 0 risk weight. ValueatRisk measure. • 2011 Basel III: Higher capital requirements • G20 includes big emerging markets; • April 2009: G20 replaced G7/G8 at London Summit, responded to global recession with simultaneous stimulus • OECD for industrialized countries • IMF for everyone (“Surveillance.”)

International policy coordination is an application of game theory. In one game, the players choose their overall level of demand. In another game, the players choose the monetary/fiscal mix. API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University

Theories of Coordination API-120 - Macroeconomic Policy Analysis IProfessor Jeffrey Frankel, Kennedy School of Government, Harvard University