Example Exam Question

80 likes | 254 Vues

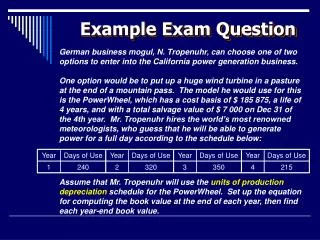

Year. Days of Use. Year. Days of Use. Year. Days of Use. Year. Days of Use. 1. 240. 2. 320. 3. 350. 4. 215. Example Exam Question. German business mogul, N. Tropenuhr, can choose one of two options to enter into the California power generation business.

Example Exam Question

E N D

Presentation Transcript

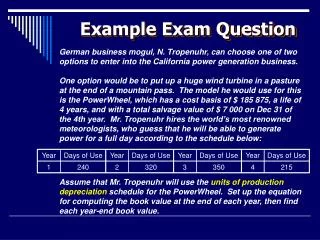

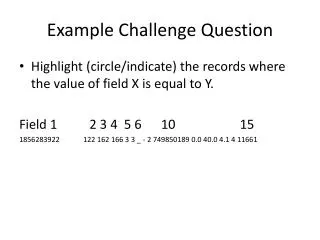

Year Days of Use Year Days of Use Year Days of Use Year Days of Use 1 240 2 320 3 350 4 215 Example Exam Question • German business mogul, N. Tropenuhr, can choose one of two options to enter into the California power generation business. • One option would be to put up a huge wind turbine in a pasture at the end of a mountain pass. The model he would use for this is the PowerWheel, which has a cost basis of $ 185 875, a life of 4 years, and with a total salvage value of $ 7 000 on Dec 31 of the 4th year. Mr. Tropenuhr hires the world’s most renowned meteorologists, who guess that he will be able to generate power for a full day according to the schedule below: • Assume that Mr. Tropenuhr will use the units of production depreciation schedule for the PowerWheel. Set up the equation for computing the book value at the end of each year, then find each year-end book value.

Year Days of Use Year Days of Use Year Days of Use Year Days of Use 1 240 2 320 3 350 4 215 Example Exam Question Total Service Units = 240days + 320days + 350days + 215days = 1125 days of generation capability Dn = Total Units Consumed (I – S) = TUC ($ 185 875 – $ 7 000) = $159(TUC) Total Service Units 1125 Bn = Bn –1– Dn

Example Exam Question The second option would be to construct an electric generation facility fueled by natural gas, and designed by an old, but famous Olympic decathlete. Mr. Tropenuhr can install the eighth revision of the plant design for a total cost basis of $ 12 800 000. The Jenner-8R model plant will run at full capacity until his underground natural gas field runs out in 5 years. He will then scrap the plant for a $ 4 000 000 salvage value at the end of the 5th year. Assume that for his U.S. investors, Mr. Tropenuhr will use straight line depreciation for the Jenner 8R. Set up the equation for computing the book value at the end of each year, then compute the book value at the end of each year. However for his E.U. investors, Mr. Tropenuhr will use the sum of year’s digits depreciation method for the system. Again, set up the equation for computing the book value at the end of each year, then compute the end-of-year book value.

Example Exam Question Straight Line Depreciation: Dn = (I – S) = ($ 12 800 000 – $ 4 000 000) = $1 760 000 / yr N 5 yrs Bn = I – Dn(n)= $ 12 800 000 – $ 1 760 000 (n)

Example Exam Question Sum Of Year’s Digits Depreciation: SOYD = N(N+1) = 5(5+1) = 15 2 2 Dn = (N–N + 1)(I – S) = (5 – n + 1)($ 12 800 000 – $ 4 000 000) SOYD 15 = (5 – n + 1)($ 8 800 000) = (5 – n + 1)($ 586 667) 15 Bn = Bn –1 – Dn

Example Exam Question Madoff Monet was an investment banker in subprime mortgage derivatives before his recent setback. Now he has taken his final bonus and put it into a similar bundled risk investment. He will invest in hog operations that have contracted swine flu (but to distribute the risk, he and his buddies will invest in a lot of diseased livestock operations, instead of only one farmer). Assume that, despite his brilliant plan, $25 000 000 of the Monet money becomes worth only $2 500 at the end of the 3 year quarantine period. Construct an algebraic equation that calculates the average yearly rate at which his investment deflates. Then compute that deflation rate. Take the viewpoint of the former farmer’s that Mr. Monet buys out, and compute what their total original investment was worth 26 years ago (using a 4% rate of inflation, and only using table factors) to be worth the $25 million in today’s dollars.

Example Exam Question Deriving Equation for Deflation: Computing: - or - 95.36% / yr

Example Exam Question Computing Initial Price Using 4% Inflation Rate: $C = $A (1 + f ) – n = $A (P/F, f, n) = $25 000 000 (P/F, 4%, 26) = $25 000 000 (P/F, 4%, 25)(P/F, 4%, 1) = $25 000 000 (.3751)(.9615) = $ 9 016 466