Lecture 4: Section 1

280 likes | 474 Vues

Lecture 4: Section 1. Generic Currency Signals. Momentum or Trend: bet on continuation of directional moves. Many ways to calculate the autoregressive nature of currency returns BofA: use past month and Deutsche Bank: use last 12-month returns and buy top-3 and sell bottom-3

Lecture 4: Section 1

E N D

Presentation Transcript

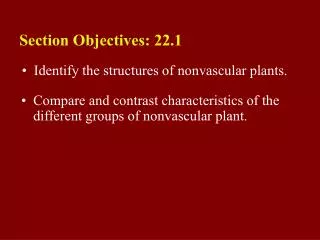

Lecture 4: Section 1 Generic Currency Signals

Momentum or Trend: bet on continuation of directional moves Many ways to calculate the autoregressive nature of currency returns • BofA: use past month and • Deutsche Bank: use last 12-month returns and buy top-3 and sell bottom-3 • Could use MA cross-over rules (like 20-day & 200 day) Why (and when) should momentum strategies work?

Carry: long high interest rate, short low interest rate What interest rate differential? • BofA: use 1 month LIBOR • Deutsche Bank uses 3 month LIBOR & buy top-3 & sell bottom 3 • Rebalance every 3 months How can you manage the risk of carry unwinds?

Fundamental Value: bet on reversion to long-term equilibrium value Purchasing Power Parity (PPP) is most common measure • BofA: compare PPP, adjusted by return to carry, to current spot rate • Deutsche Bank: buy top-3 undervalued currencies and sell top-3 overvalued currencies • Valuation determined by OECD PPP versus current spot rate When will PPP be most likely to add value?

Lecture 4: Section 2 Liquidity Considerations

What do you do about liquidity differences? BofA has a “most liquid” portfolio: • USD, EUR, JPY, GBP, CHF And a less liquid portfolio: • AUD, CAD, NOK, NZD, SEK Can impose position caps that reflect liquidity tiers • Depends upon size of portfolio Could use IC weighting to alter alphas

Modeling transaction costs Liquidity will determine market impact of trades • If you have large portfolio will have “backlog” where actual positions differ from desired positions • Tcosts affected by inventory risk to broker (G&K, Ch. 16) • Estimated time for opposing trades to match a trade of size V: • Trade 1 day’s volume, expect it to take a day for counterparties to clear risk • Inventory risk facing liquidity provider depends on volatility: • Convert annual vol to vol over relevant horizon for inventory management • Measure in units of days, with 250 trading days in year

Modeling transaction costs • ADV varies across currencies • Use BIS survey data • Vol varies across currencies • Calculate trailing vol or use implied vols • Smooth some to avoid vol spikes distorting relative costs • Beyond market impact costs, have fixed costs of commissions and spreads

Modeling transaction costs Objective function: • Tcost amortization factor • Higher to trade patiently • Lower to trade faster • Could simulate model to find “optimal” TCAF • Experience with backlog will guide • How often to rebalance? • Could use calendar interval or backlog risk trade trigger rule • Only trade when risk >threshold

Lecture 4: Section 3 Risk Modeling

Risk modeling: drawdown risk Clients often want to think about extreme value risk • What is maximum drawdown? • Duration and magnitude • Experience for fund with history • Simulation for start-up • Could make part of every proposed signal diagnostic • Investment officers have different horizon than fund might suggest • Insurance companies or pension funds have very long-run horizon? • Investment officer bonus paid annually • A major drawdown can get you fired

Risk modeling: covariance model Fast or slow, historic or forward-looking? • Speed of COV should match rate of model alpha decay • Do you want “normal” correlations across assets? • Do you want to capture short-term shifts in correlations? • Do you want slowly-evolving correlation matrix? • Exponentially smoothed with long HL • Just update once-a-month? • Impose priors in a “shrinkage” matrix to help capture important relations • Look at “hedge bundles” implied by construction: AUD & NZD; NOK & SEK; EUR & CHF; ……… • Regional funding; commodity currencies; “flight to quality” currencies;….. • A fast model would require a faster COV matrix • Update daily • Use implied vol only or in a blend with historic

Realized Volatility: the most accurate predictor • Compute daily vol from the sum of squared intradaily returns • Motivated by approaching limit of Brownian motion • Consider a continuous-time log process for the quote q: • The corresponding discretely-sampled returns are: • The variance of the h-period returns is: • While that variance is unobservable, a measure of realized vol that is consistent (in m) for the integrated vol is summing the high-frequency squared returns:

Realized Volatility: the most accurate predictor • Don’t sample at very highest frequency as get “microstructure noise” • Non-synchronous prices • Data holes • Can treat volatility as observable rather than latent • See Melvin & Melvin (Review of Economics & Statistics, 2003) for FX example • Use daily vol estimates to construct cov matrix • Better for fast models than implied vol, which contains risk premium

Lecture 4: Section 4 Model Building Tips

Follow SPCA Method for signal development Sensible • First step is to convince yourself (and others) that the idea makes sense • No data mining allowed! • If it conflicts with finance theory, why? Predictive • The proposed signal is useful for predicting returns Consistent • Performance occurs through time (not in 1 episode) • May like signal that is not very consistent, but in certain market conditions adds good diversification • For instance, a value signal that only has positive performance when carry unwinds Additive • Does it add value beyond existing model?

Useful Diagnostics for Signal Development • IR for whole backtest sample and subsamples • Cumulative return plot • Drop one asset at a time to determine dependence across assets • Lead-lag plots of IR around implementation day • Determine speed of alpha decay • Inform trading process: what do you lose by trading patiently? • Tilt-timing analysis • Tilt: what if we held a constant portfolio • Timing: residual of actual returns - tilt

Lecture 4: Section 5 Pojarliev & Levich, Do Professional Currency Managers Beat the Benchmark?

Currency Benchmark • There is no accepted practice • There is no “market portfolio” • All positions long/short • Zero assumption from random-walk findings of academic literature • Cash: if you can’t beat that, why invest? • P&L create currency indexes off of generic signals • Are these benchmarks? • More like style betas

Estimate factor model • Returns from Barclay Currency Trader Index (BCTI) • 1 month LIBID for risk-free returns

Style Factors • Carry • Citi G10 Carry Index: equally-weighted basket of 13 pairs • Trend • AFX index: equally-weighted portfolio of 3 MA rules • 32, 61, 117 days over 7 pairs weighted by turnover • Value • Citi Beta1 G10 PPP Index: long currencies <20% undervalued & short currencies >20% overvalued • OECD PPP for 13 pairs compared to spot • Volatility • Avg of implied vol for EURUSD & USDJPY • This is relevant for vol strategies rather than directional bets • But will capture carry unwinds so would want to be long JPY & short high-yielders

All manager index results • Trend is useful factor; carry & PPP not useful • Alpha insignificant when factors are accounted for • Short sample results • Carry sigificant 2001-2006 but Trend dominates • Vol significant in both periods, but more significant in latter period • They say currency derivatives trading increased after 2001 • In the low vol period, selling vol was a successful strategy • Vol quite low until 2007, I kept saying “just wait”

Individual Manager Results • 34 have data over 2001-2006 period (survivors) • Alpha positive on avg with big range • Reflects different risk levels of funds • IR puts on equal footing • Mean=0.47; median=0.45 • Estimate IR from 4-factor model • Only 8 firms have sig & positive alpha • So returns are combination of beta & alpha • With similar returns, find some managers generative beta while others generate alpha • Trend sig for 15 firms; Carry for 8; Vol for 7; Value for 5 • Firms have different approaches

Timing Ability, Alpha & R-square • A passive portfolio has asset weights uncorrelated with returns • Regress returns on factors and factors squared • Some evidence of timing ability for about ½ of firms • Finally, the more a firm loads on 4 factors, the smaller alpha

Critique • Don’t believe that it is cheap & easy to get active manager performance by just betting on generic strategies • Active managers adjust portfolio to changing market conditions • Putting a generic strategy on cruise control is very dangerous • 2007 was good lesson for carry indexers • Paper has small sample of active managers & conclusions are too sweeping from this limited universe