Mastering Customer Objections: 4-Step Approach for Overcoming Sales Hurdles

310 likes | 329 Vues

Learn how to effectively handle common sales objections with a 4-step approach, including listening, acknowledging, restating, and answering objections tactfully. Discover valuable techniques and closing sales techniques to close deals successfully and achieve desired outcomes.

Mastering Customer Objections: 4-Step Approach for Overcoming Sales Hurdles

E N D

Presentation Transcript

COMMON EXCUSES • I’m not interested in insurance; God is my protector. • I am going to live a long time. I won’t die soon • I ‘ve already had enough insurance. • I can’t afford it.

COMMON EXCUSES • I want to talk it over with my spouse • I have my own savings • I’m too young to die • I join a welfare association that caters for things like this

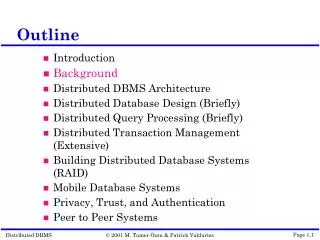

4-Step Approach 1. LISTEN CAREFULLY Be attentive, Maintain eye contact and allow the customer talk 2. ACKNOWLEDGE OBJECTIONS Demonstrate that you understand and care about customer’s concerns raised 3. RESTATE OBJECTIONS Paraphrase the objection but do not change the meaning 4. ANSWER OBJECTIONS Answer tactfully and redefine customer needs

Handling Customer Objections 1. QUESTION • Objections are always an opportunity ask further questions to clarify customer’s viewpoint • Question the customer – but never in abrupt manner – to know more about the objection

Handling Customer Objections 2. SUPERIOR POINT • Admit disadvantages in certain products but then present superior points to offset or compensate for them. • This technique puts the customer in a position to decide between the different features and see additional reasons for buying.

Handling Customer Objections 3. DENIAL • When a customer's objection is based on misinformation, provide proof and accurate information to answer the objection.

Handling Customer Objections 4. THIRD PARTY • Use a testimonial from a previous customer or another neutral person.

What you SHOULD NOT do • 1. Don’t interrupt the client – allow him/her to finish • 2. Don’targue – control your body language: avoid • shaking your head, tapping your feet, etc • 3. Don’ttry to prove them wrong • 4. Don’tcriticize – if you know yours is better or • accuse client of bad judgment • 5. Don’tpromise when you can’t deliver

VALUE-BASED SELLING

Before the Sales Presentation: • Realize you are selling yourself and your expertise • Know the strengths and weaknesses of your competitors • Survey your existing customers and know what they value most

During the Sales Presentation: • Know why they should choose to do business with you • Don’t get derailed by price objections

After the Sales Presentation: • Identify the need and fill it • Align their objectives with your solutions

How prospects will value life insurance • Strike at the right time • If you find prospects based on their current life situation you don’t have to work as hard at selling the value of insurance. • Think about creative ways to find people who: • Just got married or engaged. • Just had a baby • Just bought a house • Just lost a friend or loved one • Just had a significant birthday 40,50,70… • Just changed jobs.

How prospects will value life insurance 2. Talk about surprising deaths Talking with your prospects about a recent death in the news or in your local community is a good non-confrontational way to remind your prospect that “hey, you never know”

How prospects will value life insurance 3. Don’t call it Life insurance People have a typical reaction to hearing the word life insurance, and if you want to get their attention you need to use words they’re not as familiar with. Call it income protection (FIPP) , family coverage (FFP), tuition guarantees (EduCare)

How prospects will value life insurance 4. Let the Maths tell the story Have prospects figure out how much money their family would have to live off each month if they didn’t have life insurance. Could the bills be paid? Could your family stay in the same house? Eat the same food? Drive the same car?

Features Versus Benefits Features are defined as surface statements about your product, such as what it can do, its dimensions specifications and so on. Benefits show the end results of what a product or service can actually accomplish Features tell – Benefits sell

Features Versus Benefits Example: On FFP: Waiver of premium is a feature hence the benefit is that in the absence of the main life, other lives are still covered and do not pay premiums while the policy remains active – this is the value to the customer

Features Versus Benefits PARTICIPANTS’ DISCUSSION & PRESENTATION: Bring out the value sale in our products: Funeral Finance Family Income Protection Policy Lady Care Life Time Needs Edu Care

Closing Sales In sales, CLOSING is achieving the desired outcome - getting the customer to purchase the service and signing off

Closing Sales - Conclusion These techniques are best applied when the salesperson identifies buying signals from the prospect early in the sales process. They may show interest (having a copy of your forms, asking you relevant questions, etc) Pay attention to these signals and apply a suitable closing technique sooner rather than later