The Aggregate Expenditures Model

600 likes | 798 Vues

9. The Aggregate Expenditures Model. Keynesian Theory. Chapter Objectives. Economists Combine Consumption and Investment to Depict an Aggregate Expenditures Schedule for a Private Closed Economy Three Characteristics of the Equilibrium Level of Real GDP in a Private Closed Economy

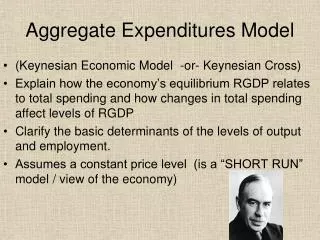

The Aggregate Expenditures Model

E N D

Presentation Transcript

9 The Aggregate Expenditures Model

Chapter Objectives • Economists Combine Consumption and Investment to Depict an Aggregate Expenditures Schedule for a Private Closed Economy • Three Characteristics of the Equilibrium Level of Real GDP in a Private Closed Economy • AE = Output • Saving = Investment • No Unplanned Changes in Inventories • How Changes in Equilibrium Real GDP Occur and Relate to Multiplier • Integrate Government and Foreign Sectors into AE • Recessionary and Expansionary Expenditure Gaps

Consumer Spending The consumption function is an equation showing how an individual household’s consumer spending varies with the household’s current disposable income.

Disposable Income and Consumer Spending for American Households in 2003

For each income group, average disposable income in 2003 is plotted versus average consumer spending in 2003. For example, point A shows that among the group with an annual income of $40,000 to $49,999, average disposable income was $42,842 and average consumer spending was $39,757. The data show a positive relationship between disposable income and consumer spending: higher disposable income leads to higher consumer spending.

The consumption function relates a household’s current disposable income to its consumer spending. The vertical intercept, a, is individual household autonomous spending: the amount of a household’s consumer spending if its current disposable income is zero. The slope of the consumption function line, cf, is the marginal propensity to consume, or MPC: of every additional $1 of current disposable income, MPC × $1 of it is spent.

If we graph the data for American households in 2003, the best estimate of a is $14,184 and the best estimate of MPC is 0.597, or approximately 0.6. • Again: HOW DO WE KNOW????

The effect of an increase in expected future disposable income. Consumers will spend more at every given level of current disposable income, YD. As a result, the initial aggregate consumption function CF1, with aggregate autonomous spending A1, shifts up to a new position at CF2 and aggregate autonomous spending A2. An increase in aggregate wealth will also shift the aggregate consumption up.

An Upwards Shift of the Aggregate Consumption Function The aggregate consumption function shifts in response to changes in expected future income and changes in aggregate wealth.

The effect of a reduction in expected future disposable income. Consumers will spend less at every given level of current disposable income, YD. Consequently, the initial aggregate consumption function CF1, with aggregate autonomous spending A1, shifts down to a new position at CF2 and aggregate autonomous spending A2. A reduction in aggregate wealth will have the same effect.

Income-Expenditure Equilibrium The economy is in income–expenditure equilibrium when GDP is equal to planned aggregate spending. Income–expenditure equilibrium GDP is the level of GDP at which GDP equals planned aggregate spending.

Income-Expenditure Equilibrium When planned aggregate spending is larger thanY*, unplanned inventory investment is negative; there is an unanticipated reduction in inventories and firms increase production. When planned aggregate spending is less thanY*, unplanned inventory investment is positive; there is an unanticipated increase in inventories and firms reduce production.

Income-Expenditure Equilibrium The Keynesian cross is a diagram that identifies income–expenditure equilibrium as the point where a planned aggregate spending line crosses the 45-degree line.

Income–expenditure equilibrium occurs at E, the point where the planned aggregate spending line, AEPlanned , crosses the 45-degree line. At E, the economy produces GDP* of $2,000 billion, the only point at which GDP equals planned aggregate spending, AEPlanned , and unplanned inventory investment, IUnplanned , is zero. At any level of GDP less than GDP*, AEPlanned exceeds GDP. As a result, unplanned inventory spending, IUnplanned , is negative and firms respond by increasing reduction. At any level of GDP greater than GDP*, GDP exceeds AEPlanned. Unplanned inventory investment, IUnplanned , is positive and firms respond by reducing production.

Panel (a) illustrates the change in GDP* caused by an autonomous increase in planned spending. The economy is initially at equilibrium point E1 with an equilibrium GDP1* equal to 2,000. AEPlannedincreases by 400 and shifts the planned aggregate spending line upward by 400. The economy is no longer in income–expenditure equilibrium: GDP is equal to 2,000, but AEPlanned, is now 2,400, represented by point X. The vertical distance between the two planned aggregate spending lines, equal to 400, represents IUnplanned= − 400—the negative inventory investment that the economy now experiences. Firms respond by increasing production, and the economy eventually reaches a new income–expenditure equilibrium at E2 with a higher level of equilibrium GDP, GDP2*, equal to 3,000. The increase in GDP* is several times larger than the autonomous increased in planned spending, reflecting the effects of the multiplier on the economy.

Panel (b) shows the corresponding rightward shift of the AD curve generated by the increase in AEPlanned. The change in GDP*, from GDP1* to GDP2*, corresponds to the increase in quantity demanded of aggregate output at any given aggregate price level.

The Paradox of Thrift • In the Paradox of Thrift, households and producers cut their spending in anticipation of future tough economic times. • These actions depress the economy, leaving households and producers worse off than if they hadn’t acted virtuously to prepare for tough times. • It is called a paradox because what’s usually “good” (saving to provide for your family in hard times) is “bad” (because it can make everyone worse off).

Model Simplifications • Private closed economy • Consumption and investment only • Prices are fixed • Excess capacity exists • Unemployed labor exists • Disposable income = real GDP • No taxes

Consumption and Investment Investment demand vs. schedule Investment Demand Curve Investment Schedule Investment Demand Curve Investment Schedule Ig 20 Investment (billions of dollars) r and i (percent) 8 20 20 ID 20 Investment (billions of dollars) Real GDP (billions of dollars)

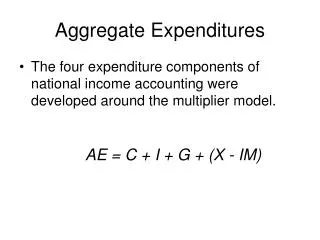

Consumption and Investment • Equilibrium GDP: C + Ig = GDP • Real Domestic Output • Aggregate expenditures • Equal to C + Ig • Aggregate expenditures schedule • Quantity goods produced = quantity goods purchased • Disequilibrium • Only 1 equilibrium level of GDP

(2) Real Domestic Output (and Income) (GDP=DI) (3) Con- sump- tion (C) (7) Unplanned Changes in Inventories (+ or -) (8) Tendency of Employment Output and Income (5) Investment (Ig) (6) Aggregate Expenditures (C+Ig) (1) Employ- ment (4) Saving (S) (1-2) Consumption and Investment …in Billions of Dollars • 40 • 45 • 50 • 55 • 60 • 65 • 70 • 75 • 80 • 85 $370 390 410 430 450 470 490 510 530 550 $375 390 405 420 435 450 465 480 495 510 $-5 0 5 10 15 20 25 30 35 40 20 20 20 20 20 20 20 20 20 20 $395 410 425 440 455 470 485 500 515 530 $-25 -20 -15 -10 -5 0 +5 +10 +15 +20 Increase Increase Increase Increase Increase Equilibrium Decrease Decrease Decrease Decrease Graphically…

530 510 490 470 450 430 410 390 370 Consumption (billions of dollars) 45° • 390 410 430 450 470 490 510 530 550 Disposable Income (billions of dollars) Consumption and Investment Equilibrium GDP C + Ig (C + Ig = GDP) C Equilibrium Point Aggregate Expenditures Ig = $20 Billion C = $450 Billion

Equilibrium GDP • Other Features… • Saving Equals Planned Investment • Leakage • Injection • No Unplanned Changes in Inventories

510 490 470 450 430 Aggregate Expenditures (billions of dollars) 45° 430 450 470 490 510 Real GDP (billions of dollars) Changes in Equilibrium GDP …and the Multiplier (C + Ig)1 (C + Ig)0 (C + Ig)2 Increase in Investment Decrease in Investment

International Trade • Net Exports and Aggregate Expenditures • Net Exports Schedule • Net Exports and Equilibrium GDP • Positive Net Exports • Negative Net Exports • International Economic Linkages • Prosperity Abroad • Tariffs • Exchange Rates

510 490 470 450 430 Aggregate Expenditures (billions of dollars) 45° 430 450 470 490 510 Real GDP (billions of dollars) +5 0 -5 Net Exports Xn (billions of Dollars) Real GDP International Trade Net Exports and Equilibrium GDP C + Ig+Xn1 C + Ig Aggregate Expenditures with Positive Net Exports C + Ig+Xn2 Aggregate Expenditures with Negative Net Exports Positive Net Exports Xn1 450 470 490 Xn2 Negative Net Exports

GLOBAL PERSPECTIVE -700 200 150 100 50 0 50 100 150 200 250 International Trade Net Exports of Goods - Select Nations, 2006 Negative Net Exports Positive Net Exports +31 Canada -45 France Germany +203 Italy -27 Japan -19 -171 United Kingdom -881 United States Source: World Trade Organization

Adding the Public Sector • GDP = Cd + Ig + Xn + G • Lump sum taxes • Taxes affect disposable income • Consumption and the MPC • Leakages = Sd + M + T • Injections = Ig + X + G • Sd + M + T = Ig + X + G • No Planned Inventory Changes 11-36

(1) Level of Output and Income (GDP=DI) (5) Net Exports (Xn) (7) Aggregate Expenditures (C+Ig+Xn+G) (2)+(4)+(5)+(6) (2) Consump- tion (C) (4) Investment (Ig) (6) Government (G) Exports (X) Imports (M) (3) Saving (S) Adding the Public Sector Government Purchases and GDP …in Billions of Dollars • $370 • 390 • 410 • 430 • 450 • 470 • 490 • 510 • 530 • 550 $375 390 405 420 435 450 465 480 495 510 $-5 0 5 10 15 20 25 30 35 40 $20 20 20 20 20 20 20 20 20 20 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 10 20 20 20 20 20 20 20 20 20 20 $415 430 445 460 475 490 505 520 535 550

Aggregate Expenditures (billions of dollars) 45° 470 550 Real GDP (billions of dollars) Adding the Public Sector Government Spending and GDP C + Ig + Xn + G C + Ig + Xn C Government Spending of $20 Billion $20 Billion Increase in Government Spending Yields an $80 Billion Increase In GDP

Aggregate Expenditures (billions of dollars) 45° 490 550 Real GDP (billions of dollars) Adding the Public Sector Lump-Sum Tax Increase and GDP C + Ig + Xn + G Cd + Ig + Xn + G $15 Billion Decrease In Consumption From a $20 Billion (MPC=.75) Increase in Taxes $20 Billion Increase in Taxes Yields a $60 Billion Decrease In GDP

550 530 510 490 470 Aggregate Expenditures (billions of dollars) 45° 490 510 530 Real GDP (billions of dollars) Equilibrium Versus Full-Employment GDP Recessionary Expenditure Gap AE0 $5 Billion Gap Yields $20 Billion GDP Change AE1 Recessionary Expenditure Gap = $5 Billion Full Employment

550 530 510 490 470 Aggregate Expenditures (billions of dollars) 45° 490 510 530 Real GDP (billions of dollars) Equilibrium Versus Full-Employment GDP Inflationary Expenditure Gap AE2 AE0 Inflationary Expenditure Gap = $5 Billion $5 Billion Gap Yields $20 Billion GDP Change Full Employment

Equilibrium Versus Full-Employment GDP • Application: • U.S. Recession of 2001 • Inflationary Expenditure Gap • U.S. Inflation in the Late 1980s • Full-Employment Output with Large Negative Net Exports • Negative Net Exports

Equilibrium Versus Full-Employment GDP • Limitations of the Model • Does Not Show Price Level Changes • Ignores Premature Demand-Pull Inflation • Limits Real GDP to the Full-Employment Level of Output • Does Not Deal with Cost-Push Inflation • Does Not Allow for “Self-Correction”

GIVEN: C = 100 + 0.8Y I = 50 G = 60; T = 0 Yfe = 1300 STUDY PROBLEM IN KEYNESIAN MACROECONOMICS What is the value of the MPC? MPC = b = 0.8 What is the value of the MPS? MPS = 1 - b = 0.2 Note that the two marginal propensities sum to one.

What is the significance of the “100” in the equation C = 100 + 0.8Y? C People spend “100” on consumption goods even when their income is temporarily zero. Where does the b = 0.8 show up on this graph? b 1 a = 100 The coefficient of Y (symbolized by “b” and always less than one) is the slope of the consumption equation. Y

Calculate the investment multiplier and the government spending multiplier. C The spending multipliers are given by the expression 1/(1 – b). b 1 a = 100 1/(1 – b) = 1/(1 – 0.8) = 1/ 0.2 = 5 Y

Write the saving equation that corresponds to the given consumption equation. C C = a + bY S = -a + (1 – b)Y C = 100 + 0.8Y b 1 S = -100 + 0.2Y a = 100 1-b 1 Y

At what income does saving equal zero? C S = -100 + 0.2Y = 0 -100 = - 0.2Y Y = 100/0.2 Y = 500 C = 100 + 0.8Y b 1 S = -100 + 0.2Y a = 100 1-b 1 Y 500

How much is aggregate demand when income is equal to 1100? E C + I + G C = 100 + 0.8Y C = 100 + 0.8(1100) C = 100 + 880 C = 980 C + I C C = 980 I = 50 G = 60 C + I + G = 1090 a = 100 Y 500

How much is aggregate demand when income is equal to 1100? E C + I + G When Y = 1100 C + I + G = 1090 Y > C + I + G C + I C Is the economy in equilibrium when income is 1100? a = 100 No. There are excess inventories in the amount of 1100 – 1090 = 10. Y 500